ETH Spot ETFs Attract Record Net Inflows as Analysts Position Ethereum as Prime Macro Asset

Ethereum has reached its strongest weekly close in four years, supported by rising institutional demand and record ETF inflows. The latest figures show a growing shift toward Ethereum as investors search for long-term opportunities.

Record Inflows into Ethereum Spot ETFs

Last week, ETH spot ETFs recorded around 649,000 ETH in net inflows, according to Glassnode data. This marked the largest weekly inflow to date, with Ethereum closing near 4,500 dollars before briefly touching 4,740 dollars.

These ETF inflows reflect the increasing role of institutions in supporting Ethereum’s price trajectory. The demand is further driven by BlackRock’s ETHA product, which has become the largest holder among ETH ETFs with more than 3.4 million ETH.

Glassnode

Glassnode

CoinShares also reported that inflows into ETH investment products totaled 2.9 billion dollars last week. This strong appetite has placed Ethereum ahead of other digital assets in attracting institutional funds.

Analysts View Ethereum as a Macro Asset

Commentary from market analysts points to Ethereum’s positioning as a prime macro asset for the next decade. Ted, an investor, noted in a post on X that Ethereum has a wide moat, increasing adoption, and regulatory clarity. He compared its 500 billion dollar market capitalization with Bitcoin and gold, which are many times larger.

Ethereum’s performance is also being supported by corporate treasuries. Recent data shows 69 companies now hold 17.3 billion dollars in ETH, which represents about 3.4 percent of the supply. This adoption by corporations adds another layer of support for long-term investors.

Another factor is growing network usage, with daily transactions reaching 1.74 million on August 5. Stablecoin transfers, DeFi activity, and layer 2 scaling have been driving this activity higher.

Key Price Levels and Institutional Treasury Growth

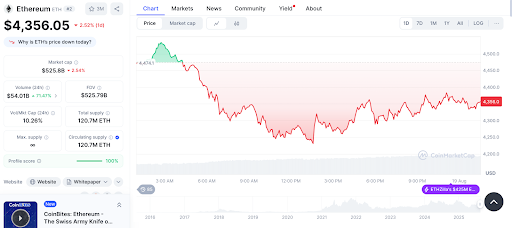

Ethereum closed last week at $4,475, its highest level since November 2021. Analysts are watching the $4,000-4,150 support range, as this level previously acted as strong resistance. If Ethereum maintains this zone, analysts expect further consolidation before the next rally.

CoinMarketCap

CoinMarketCap

On the upside, a close above $4,550 could open the way to new all-time highs between $5,000 and $5,800. This technical structure, combined with steady ETF inflows, keeps Ethereum in focus for traders and institutions alike.

Meanwhile, ETHZilla Corporation has entered the market with one of the largest public corporate Ethereum treasuries. The company, which recently rebranded from biotech firm 180 Life Sciences, now holds 94,675 ETH worth 419 million dollars. Backed by Polychain, Founders Fund, and DeFi leaders, ETHZilla plans to use staking and DeFi strategies to generate returns.

This move signals a shift toward Ethereum as a store of value and income-generating asset. With both ETFs and corporations adding exposure, Ethereum’s presence in traditional markets is growing steadily.

The post ETH Spot ETFs Attract Record Net Inflows as Analysts Position Ethereum as Prime Macro Asset appeared first on Live Bitcoin News.

You May Also Like

Husky Inu (HINU) Completes Move To $0.00020688

US Senate Releases Draft Crypto Bill Establishing Clear Regulatory Framework for Digital Assets