Since May 2025, the NFT market has been showing signs of recovery. At first, the momentum was shaky — likely fueled by the launch of giveaways on Telegram.

But by June the growth had continued, and in July it accelerated even further. According to CryptoSlam, total trading volume in July reached about $580 million — a 35% increase compared to June’s $389 million, and even surpassing the hype-driven May figure of $474 million. That makes July the strongest month for NFT growth in over a year.

NFT market trends: monthly trading volumes (black), along with the number of unique buyers (blue) and sellers (orange). Source: CryptoSlam.

NFT market trends: monthly trading volumes (black), along with the number of unique buyers (blue) and sellers (orange). Source: CryptoSlam.

According to CoinGecko, the total market capitalization of NFTs doubled in July — jumping from $3.4 billion to $6.8 billion.

Total NFT market capitalization. Source: CoinGecko.

Total NFT market capitalization. Source: CoinGecko.

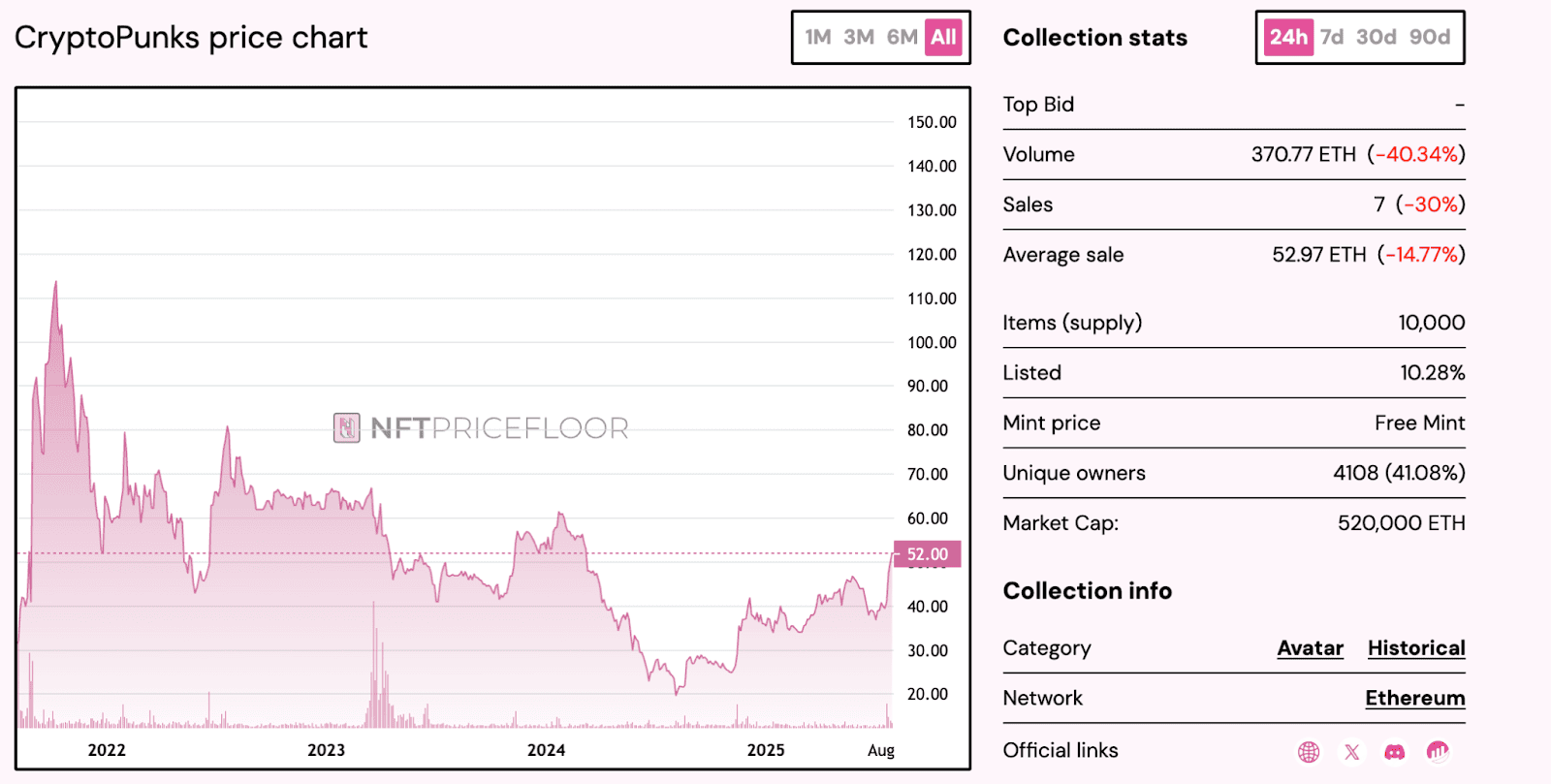

However, this growth isn’t uniform across the board. While “blue-chip” NFTs like CryptoPunks and Pudgy Penguins have seen explosive gains, the CryptoSlam 500 NFT Index remains near its lows and hasn’t even recovered to June levels.

Price trends of the most expensive NFT collections. Source: Coingecko

Price trends of the most expensive NFT collections. Source: Coingecko  CryptoSlam 500 NFT Index. Source: CryptoSlam.

CryptoSlam 500 NFT Index. Source: CryptoSlam.

Another feature of this cycle is Bitcoin’s contribution to the market’s growth. So-called “Bitcoin NFTs,” built on the Inscriptions protocol, helped the network climb to fourth place in terms of trading volume.

NFT trading volumes across different blockchains. Source: CryptoSlam.

NFT trading volumes across different blockchains. Source: CryptoSlam.

However, the number and value of transactions on the Bitcoin network remain an order of magnitude lower than its closest competitor, Polygon. Alongside TON and Ethereum, Polygon played a key role in driving the July rally.

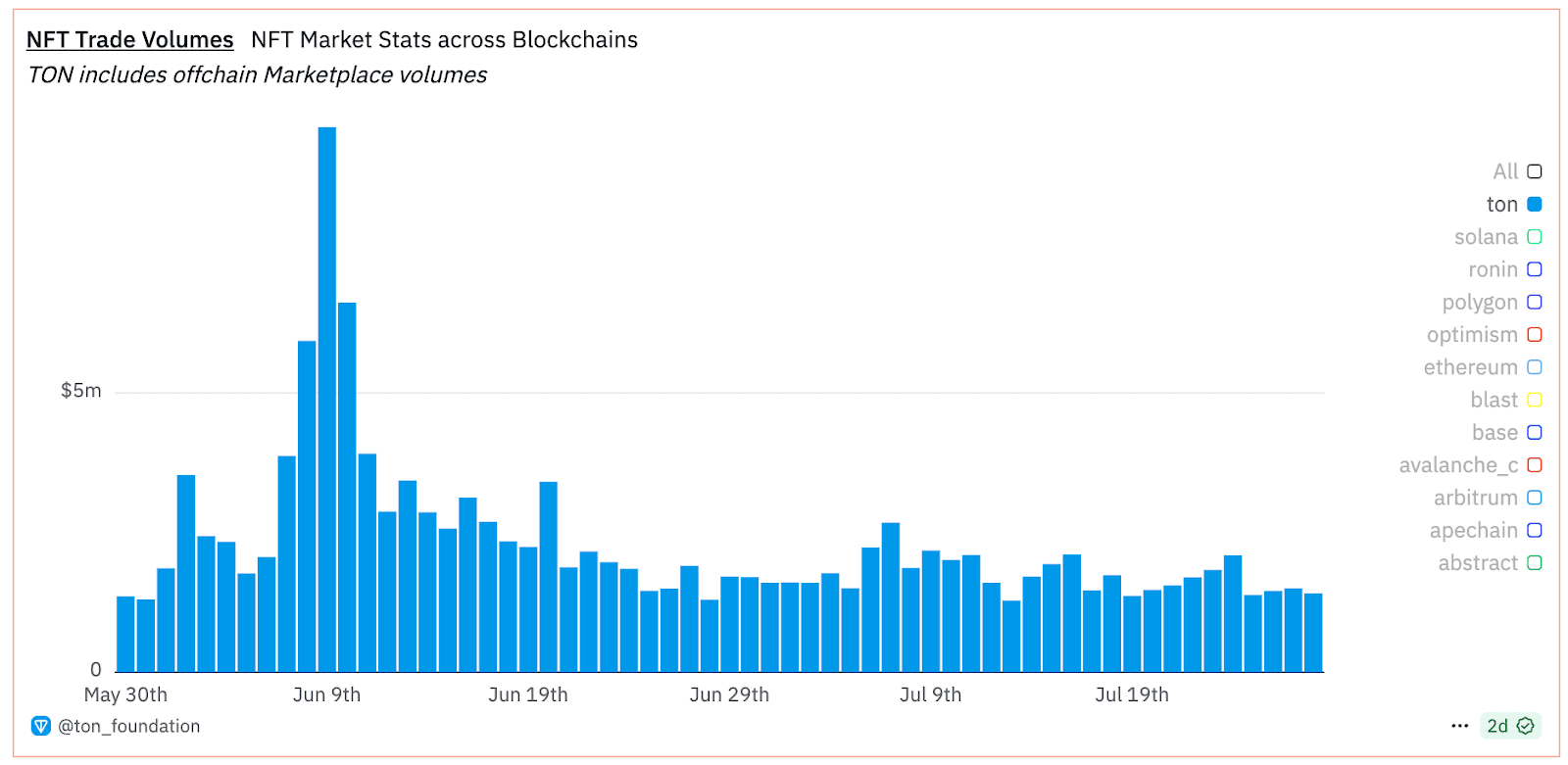

NFT trading volume on the TON network. Source: Dune.

NFT trading volume on the TON network. Source: Dune.  Trading volumes of Telegram gifts across different marketplaces. Source: Dune.

Trading volumes of Telegram gifts across different marketplaces. Source: Dune.

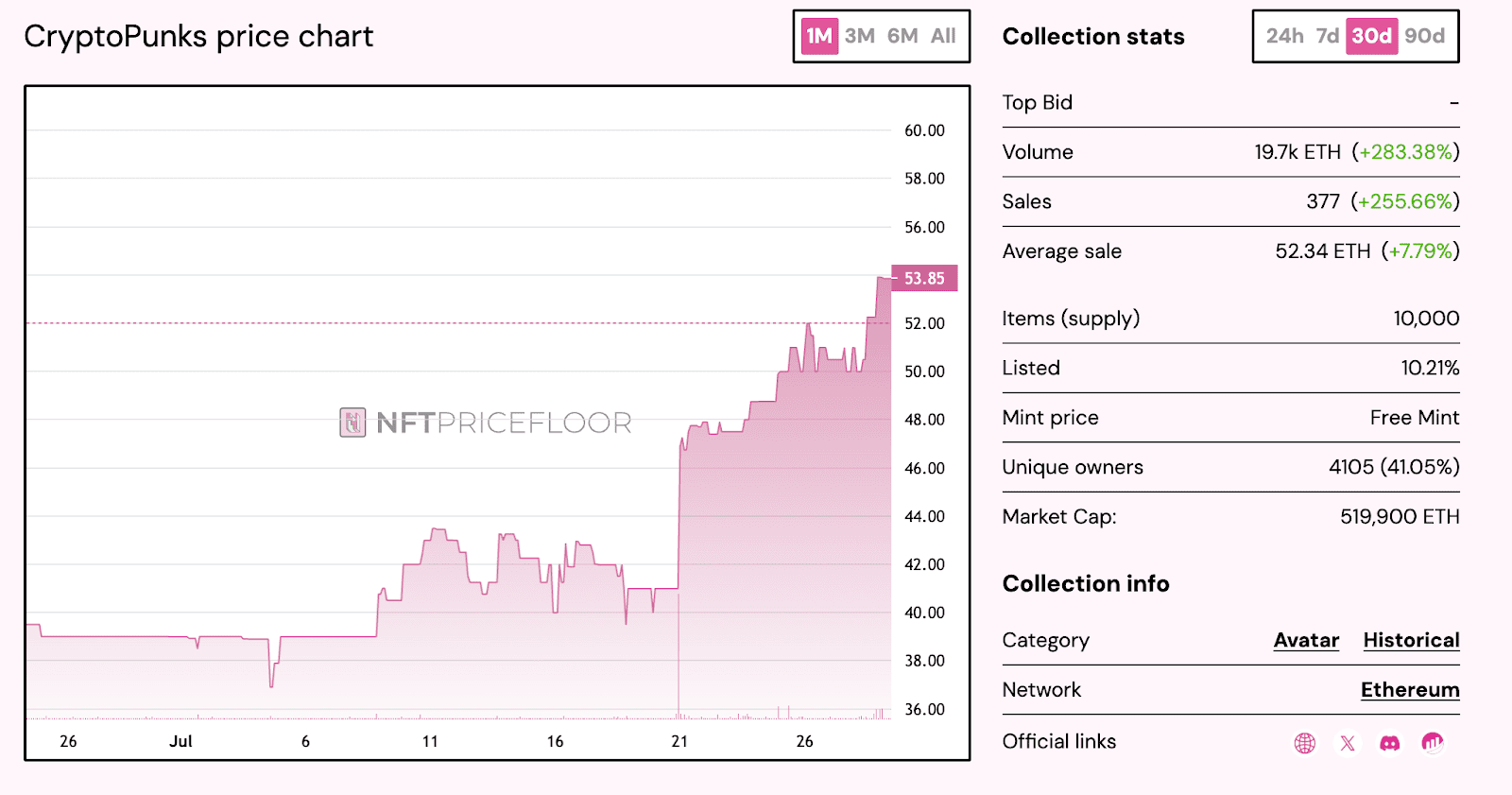

CryptoPunks NFT prices. Source: Nftpricefloor.

CryptoPunks NFT prices. Source: Nftpricefloor.

Daily NFT trading volumes across different networks. Source: Dune.

Daily NFT trading volumes across different networks. Source: Dune.

Number of transactions on Courtyard in July 2025. Source: CryptoSlam.

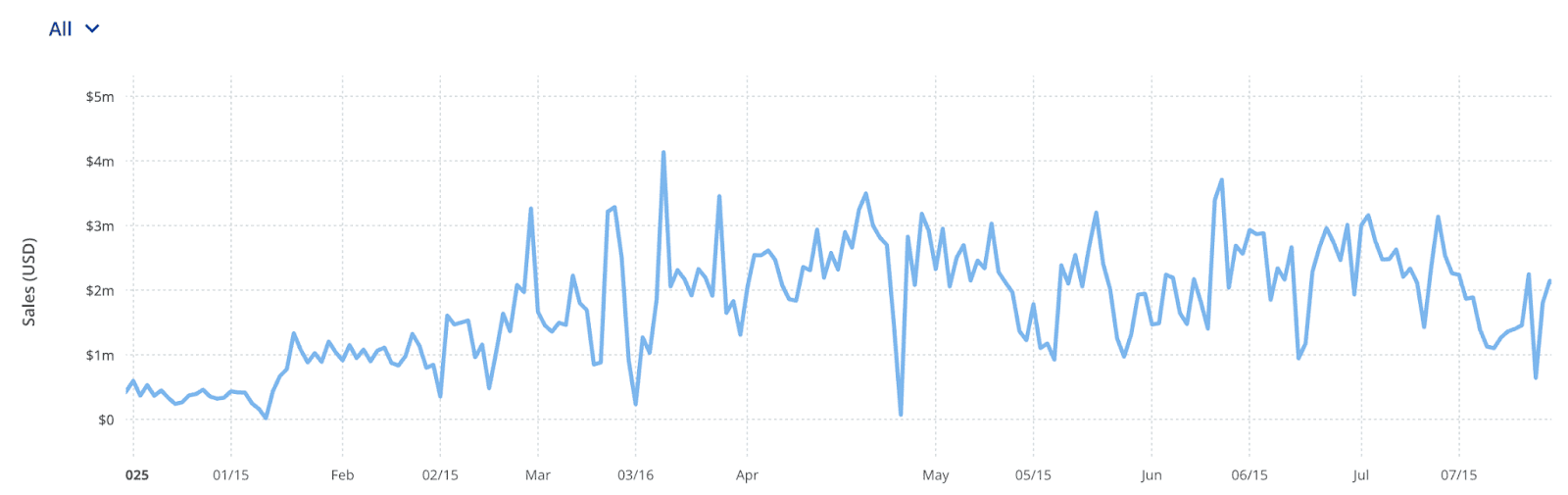

Number of transactions on Courtyard in July 2025. Source: CryptoSlam.  Trading volumes on Courtyard in 2025. Source: CryptoSlam.

Trading volumes on Courtyard in 2025. Source: CryptoSlam.

Ethereum price trends in July 2025. Source: TradingView.

Ethereum price trends in July 2025. Source: TradingView.

CryptoSlam ETH NFT Composite Index in July 2025. Source: CryptoSlam.

CryptoSlam ETH NFT Composite Index in July 2025. Source: CryptoSlam.

Total NFT market capitalization. Source: Coingecko.

Total NFT market capitalization. Source: Coingecko.  Ethereum price trends. Source: TradingView.

Ethereum price trends. Source: TradingView.

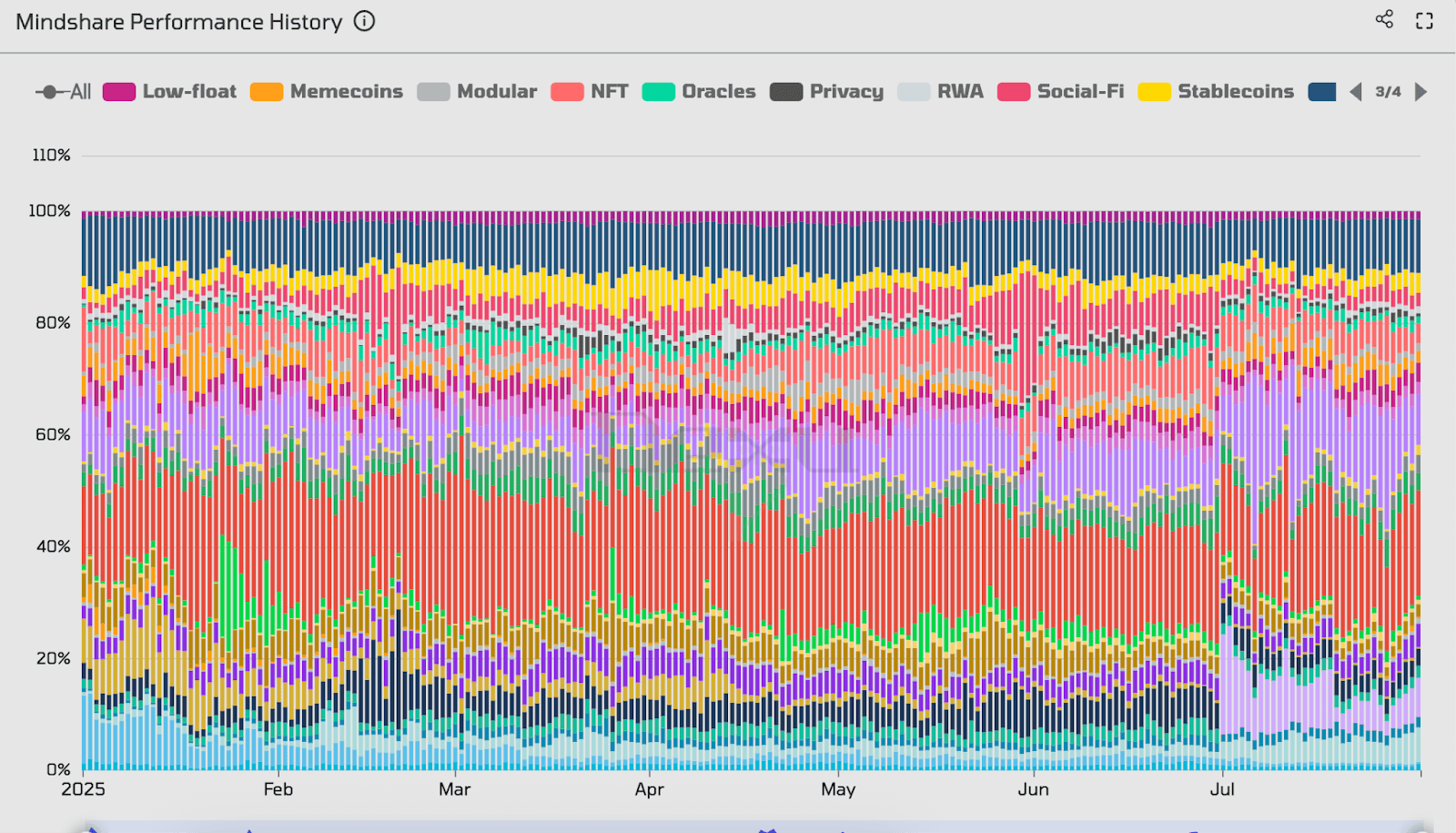

Social media attention trends for different crypto narratives. Source: Dexu.ai.

Social media attention trends for different crypto narratives. Source: Dexu.ai.

Price trends of crypto market narratives. Source: Dexu.ai.

Price trends of crypto market narratives. Source: Dexu.ai.

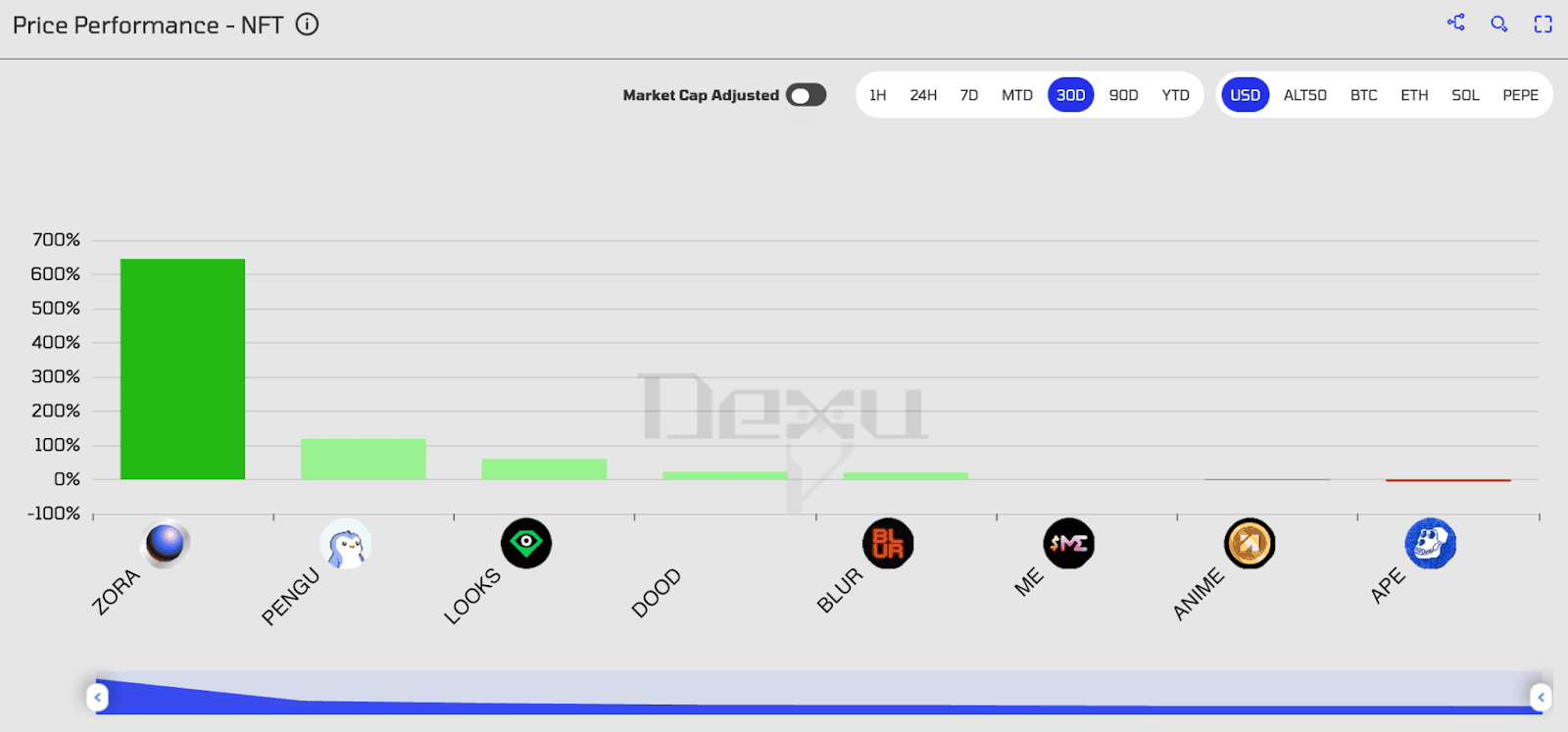

Price dynamics of the largest projects in the NFT sector. Data: Dexu.ai.

Price dynamics of the largest projects in the NFT sector. Data: Dexu.ai.

Total NFT market capitalization since November 2024. Source: Coingecko.

Total NFT market capitalization since November 2024. Source: Coingecko.

CryptoPunks NFT prices. Source: Nftpricefloor.

CryptoPunks NFT prices. Source: Nftpricefloor.

Search frequency for the term “NFT” in 2024–2025. Source: Google Trends.

Search frequency for the term “NFT” in 2024–2025. Source: Google Trends.

Total NFT market capitalization in June–July 2025. Source: Coingecko.

Total NFT market capitalization in June–July 2025. Source: Coingecko.  Market capitalization of the largest meme coins in June–July 2025. Source: Coingecko.

Market capitalization of the largest meme coins in June–July 2025. Source: Coingecko.