Google Bets Big on Bitcoin Miner TeraWulf with $3.2 Billion AI Infrastructure Deal

TLDR

- Google becomes TeraWulf’s largest shareholder with 14% stake through warrant agreement

- Tech giant provides $3.2 billion backstop for TeraWulf-Fluidstack AI infrastructure deal

- Fluidstack expands at TeraWulf’s Lake Mariner data center with new 160 MW facility

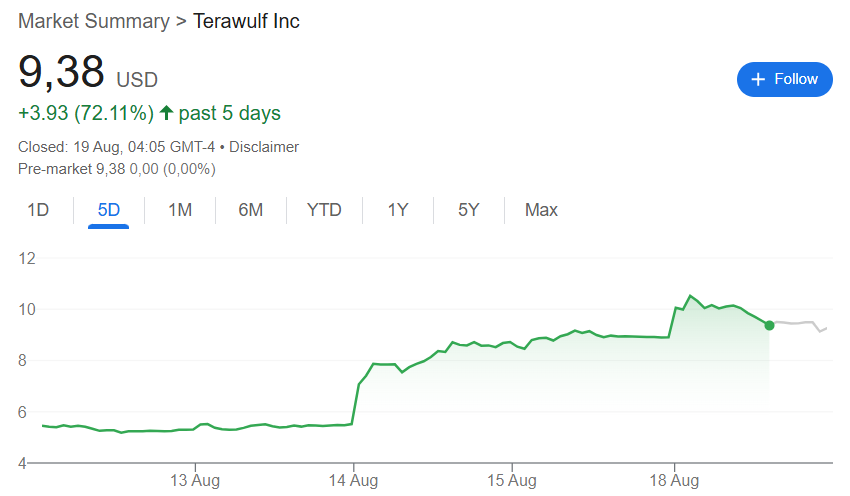

- TeraWulf stock surged over 70% in five days following the announcement

- Deal represents shift from Bitcoin mining to AI and high-performance computing services

Google has become the largest shareholder in Bitcoin mining company TeraWulf after increasing its financial commitment to a major AI infrastructure project. The tech giant now holds a 14% stake in the company through warrant agreements tied to a colocation lease deal.

The partnership involves AI infrastructure provider Fluidstack, which has signed a 10-year lease agreement with TeraWulf for data center space. Google supports this arrangement through a financial guarantee called a backstop, which has grown to $3.2 billion total.

In exchange for this financial backing, Google receives warrants to purchase over 73 million shares in TeraWulf. This stake makes Google the company’s largest shareholder, surpassing previous investors.

Kerri Langlais, TeraWulf’s chief strategy officer, said Google’s investment provides “powerful validation” from a leading technology company. She emphasized that the backstop highlights the strength of TeraWulf’s zero-carbon infrastructure.

The financial guarantee specifically protects Fluidstack’s lease commitments at TeraWulf’s Lake Mariner data center campus in New York. If Fluidstack cannot meet its obligations, Google would step in with the guaranteed funds.

Expansion Plans Take Shape

Fluidstack has exercised an option to expand its presence at the Lake Mariner facility. The expansion includes a new purpose-built data center called CB-5, which will provide 160 MW of critical IT load capacity.

Operations at the new facility are expected to begin in the second half of 2026. This expansion increases the contracted capacity between TeraWulf and Fluidstack under their existing agreement.

TeraWulf CEO Paul Prager said the expansion demonstrates the scale and capabilities of the Lake Mariner campus. He noted that adding CB-5 deepens the strategic alignment with Google as a financial partner.

The backstop arrangement is tied exclusively to AI and high-performance computing lease revenues. Langlais clarified that it does not guarantee TeraWulf’s corporate debt and remains separate from Bitcoin mining operations.

Mining Strategy Shifts

TeraWulf plans to maintain its current Bitcoin mining platform at Lake Mariner but will not expand these operations. The company is focusing on execution and delivery for partners and shareholders.

Mining currently generates cash flow and provides grid stability through flexible load management. However, the company sees greater long-term value in transitioning capacity to AI and high-performance computing workloads.

This shift reflects broader industry trends following the April 2024 Bitcoin halving event. The halving reduced mining rewards to 3.125 Bitcoin, affecting overall profitability for mining companies.

Asset manager VanEck estimated that publicly traded Bitcoin mining companies could increase profits by $13.9 billion over 13 years. This projection assumes companies shift 20% of energy capacity to AI and HPC by 2027.

Market Response

TeraWulf’s stock price has responded strongly to the Google partnership announcement. Shares rallied to $10.57 during Monday trading, representing a 17% increase from the previous close of $8.97.

Source: Google Finance

Source: Google Finance

The stock settled at $9.38 by the end of the trading session and lost an additional 1.28% in after-hours trading. Despite this pullback, the stock has gained more than 72% over five trading days since the initial announcement.

The partnership agreement with Fluidstack is projected to generate $6.7 billion in revenue for TeraWulf. This figure could reach $16 billion through potential lease extensions over the contract period.

The post Google Bets Big on Bitcoin Miner TeraWulf with $3.2 Billion AI Infrastructure Deal appeared first on CoinCentral.

You May Also Like

Philippines jobless rate jumps to over three-year high of 5.8% in January

Supply Shock Sparks Unprecedented Price Strength Through 2025 – Commerzbank Analysis