Saylor Reverses Course on Stock Sales as Strategy’s Premium to Bitcoin Holdings Falls

Michael Saylor’s Strategy Inc has quietly abandoned its self-imposed restrictions on stock sales just weeks after implementing them.

The company announced it will now allow equity issuance below its previously established 2.5x mNAV threshold “when otherwise deemed advantageous to the company,” according to Bloomberg.

Strategy’s trading premium to its massive Bitcoin holdings continues to compress amid growing market pressures and slowing institutional demand.

The reversal is a retreat from July’s more stringent financing guidelines that pledged to avoid selling new shares below the 2.5x premium except for covering debt interest or preferred equity dividends.

The policy shift comes as Strategy’s Bitcoin purchases have notably slowed, with the company acquiring just 430 Bitcoin worth $51.4 million in the seven days ended August 17, and 115 BTC in the week before.

This pause marks a deceleration from the aggressive accumulation patterns seen earlier this year, during which Strategy regularly purchased thousands of Bitcoin weekly through various financing mechanisms.

Short sellers led by Jim Chanos have intensified their scrutiny of the company’s financing model, questioning whether demand for Strategy’s four series of preferred stock offerings can adequately replace revenue from traditional share sales.

Strategy’s common shares have since declined 22% since reaching an all-time high on November 20, while Bitcoin has surged approximately 23% during the same timeframe.

Currently, Strategy is holding 629,376 BTC worth approximately $72 billion. The company’s reduced purchasing pace indicates a potential constraint in the capital-raising machinery that has powered years of aggressive accumulation.

Brian Dobson from Clear Street believes “the additional language in the guidance gives them more leeway with issuing common stock” and “should allow the company to be more opportunistic in its Bitcoin purchases.”

Adding to the company’s challenges, multiple class-action lawsuits targeting Strategy’s business practices and risk disclosures have emerged, with Pomerantz LLP representing shareholders who purchased stock between April 30, 2024, and April 4, 2025.

Strategy’s financing adjustment is part of a growing competitive pressure as corporate treasury strategies expand beyond Bitcoin into a multi-asset race for diversification.

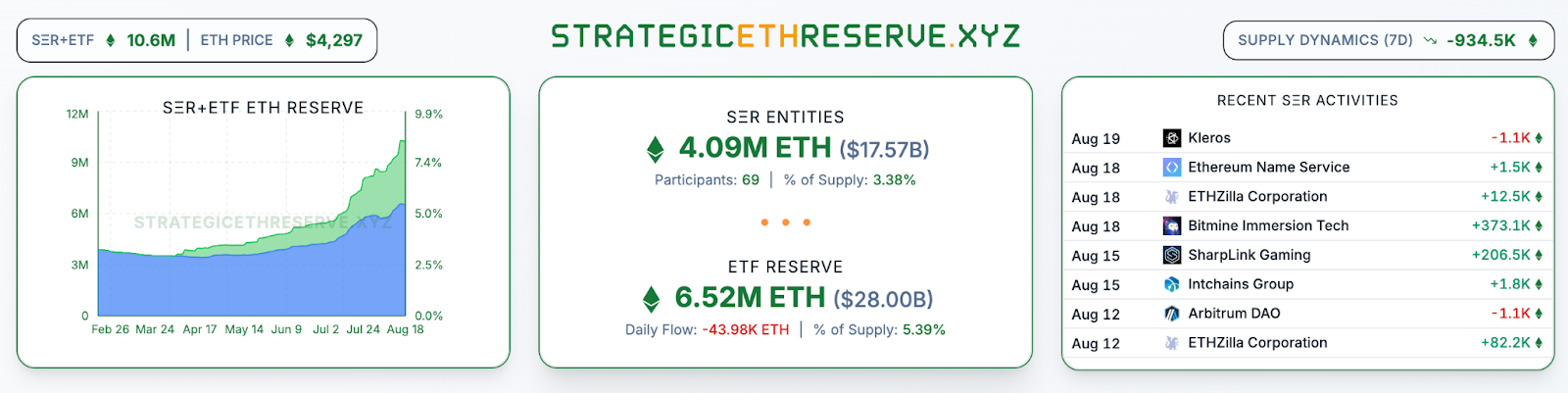

Major Ethereum treasury companies recently gathered in Manhattan to pitch Wall Street on over $22 billion worth of corporate Ether holdings, with BitMine targeting 5% of Ethereum’s total supply and SharpLink Gaming raising $2.6 billion for more ETH accumulation.

Corporate treasuries now control over $28 billion worth of Ether across multiple public companies, creating a parallel accumulation race that mirrors Bitcoin’s corporate adoption but with yield-generating staking capabilities.

Source: Strategic ETH Reserve

Source: Strategic ETH Reserve

Unlike Bitcoin’s yield-free model, Ethereum treasury companies can stake their holdings for returns, with SharpLink taking nearly 100% of its ETH and generating approximately 1,326 ETH in cumulative rewards.

Meanwhile, the broader $215 billion corporate Bitcoin movement spanning 213 entities faces warnings from Sentora research that most participants “won’t survive credit cycle” due to structural vulnerabilities in rising-rate environments.

The study identifies what it calls a critical flaw in corporate Bitcoin strategies. The research noted that “idle Bitcoin on a corporate balance sheet is not a scalable strategy in a rising-rate world” because most companies are either unprofitable or heavily reliant on mark-to-market gains.

Vincent Maliepaard from Sentora acknowledges that “balance sheet diversification with a hard asset like Bitcoin is the right framing,” but warns the strategy remains “fundamentally limited” without Bitcoin evolving to generate yield.

This critique has found support from established investment firms, with Kerrisdale Capital arguing that Strategy’s $100 billion market capitalization trading above its $60 billion Bitcoin holdings creates an “unjustifiable” premium that sophisticated investors are beginning to arbitrage.

Despite these headwinds, Strategy’s shares have gained over 3,000% since initiating Bitcoin purchases in mid-2020, vastly outperforming both Bitcoin’s 1,000% gain and the S&P 500’s 115% rise during the same period.

You May Also Like

WLFI Bank Charter Faces Urgent Halt as Warren Exposes Trump’s Alarming Conflict of Interest

UNI Price Prediction: Targets $5.85-$6.29 by Late January 2026