Bitcoin Nears Its Most Watched Weekly Signal as 200 EMA Comes Into Focus

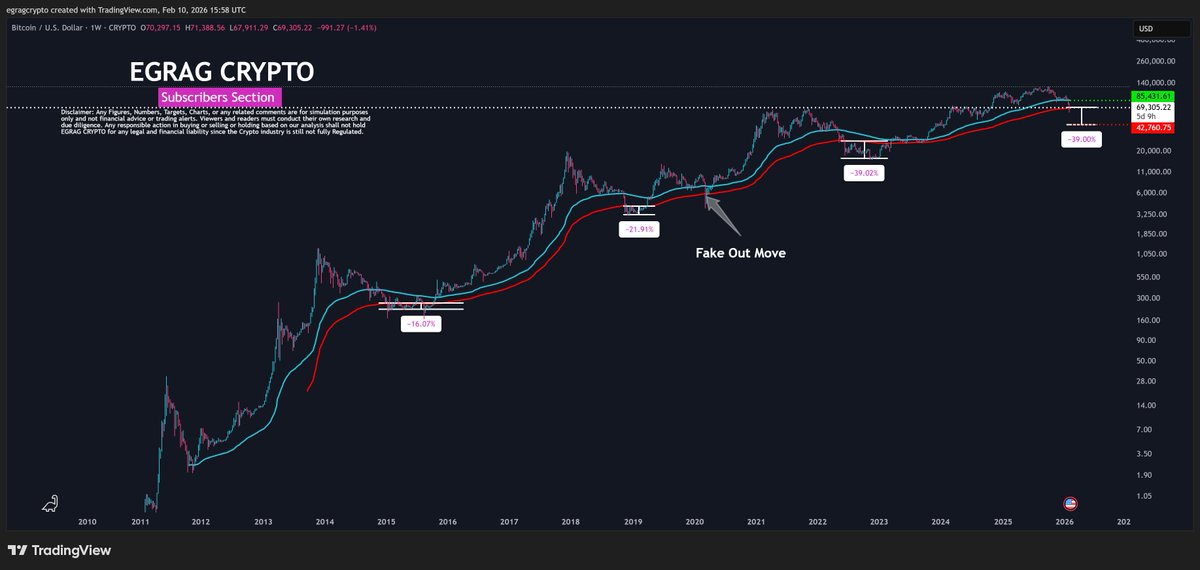

As Bitcoin trades closer to its long-term trend anchor, attention has shifted away from short-term volatility and toward the weekly 200 EMA, a level that has historically defined whether pullbacks remain corrective or turn structural.

According to analysis shared by EGRAG CRYPTO, the current setup should be viewed through probabilities and weekly confirmation rather than headline-driven fear.

Why the 200-Week EMA Matters

EGRAG Crypto notes that the 200-week EMA has played three distinct roles across Bitcoin’s history. In bull-market corrections, it has acted as dynamic support, catching downside moves before continuation.

In full bear markets, it has served as hard support, marking long-term bottoms. In several cycles, it has also functioned as a fake-out zone, briefly breaking before price reclaimed the level and resumed its broader trend.

Source: https://x.com/egragcrypto/status/2021255822529929657

Source: https://x.com/egragcrypto/status/2021255822529929657

What matters now is not the magnitude of any drawdown, but how price behaves around the EMA on a weekly closing basis.

The Most Likely Paths From Here

EGRAG outlines three scenarios, each grounded in historical behavior rather than prediction.

The base case, carrying roughly 45–50% probability, is a controlled pullback of around 15–25%. In this scenario, Bitcoin may briefly dip or wick into the 200-week EMA before reclaiming it on a weekly close. Historically, this type of move has marked mid-cycle resets rather than bearish regime shifts.

A fake-out scenario, assigned 30–35% probability, involves a sharper downside move designed to flush liquidity. This would likely include one to two weekly closes below the 200 EMA, followed by a fast reclaim and trend continuation. EGRAG frames this as consistent with past liquidity-hunt behavior, where acceptance below the level was short-lived.

The deep drop scenario, with a lower 15–20% probability, would resemble the 2022 drawdown, with losses in the 35–39% range. This outcome would require sustained weekly closes below the 200 EMA, accompanied by the EMA flattening or turning down. Crucially, EGRAG emphasizes that such a move would likely require a macro liquidity shock, which is not evident so far.

What Traders Should Actually Watch

Rather than focusing on percentage declines, the analysis stresses a short list of structural signals:

- Weekly close relative to the 200-week EMA

- Speed of any reclaim after a break

- Slope of the EMA, which remains rising in a bullish context

- Fast reclaims, which historically align with accumulation

- Acceptance below, which raises the risk of a deeper leg lower

From this perspective, intraday volatility is secondary. The weekly close is the signal.

Structure Over Speculation

EGRAG’s conclusion is deliberately restrained. Bitcoin is not at a point where outcomes are fixed, and the 200-week EMA is not a verdict in itself. The market is approaching a level where behavior matters more than price, and where patience outweighs prediction.

For now, the long-term structure remains intact unless the market proves otherwise. As EGRAG puts it, the weekly close will do the talking.

The post Bitcoin Nears Its Most Watched Weekly Signal as 200 EMA Comes Into Focus appeared first on ETHNews.

You May Also Like

Propel to Report Q4 and Full Year 2025 Financial Results and Announces Dividend Increase

UK crypto holders brace for FCA’s expanded regulatory reach