XRP price down 16% in 30 days, deeper correction coming?

XRP’s price has slumped over the past month amid a decline in network activity and weakening demand from investors. Will the token continue to see more corrections ahead?

- XRP price has fallen 16.8% in the past month.

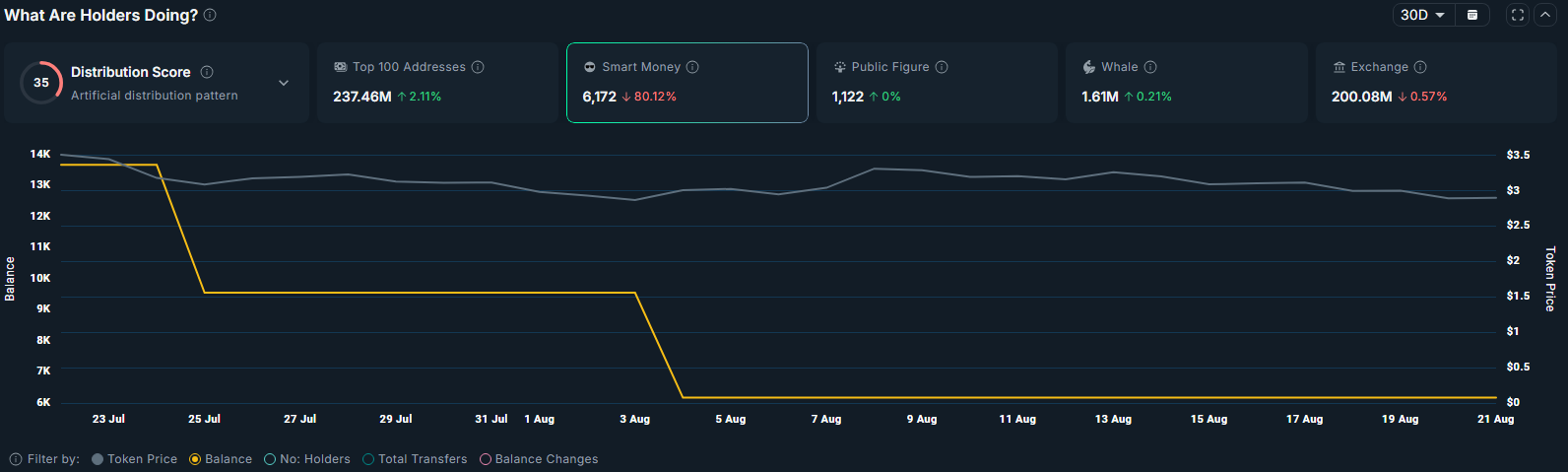

- The amount of XRP held across smart money wallets has dropped nearly 80%.

- XRP is trading below key moving averages and risks further correction.

According to data from crypto.news, XRP (XRP) was trading at $2.93, up 19% over the last 3 months and 63% higher than its year-to-date low. The third-largest cryptocurrency by market cap stood at $173.8 billion, with a daily trading volume of $6.4 billion.

Much of these gains came amid investor hype after Ripple, the company behind XRP, secured a decisive win in its years-long legal battle with the U.S. Securities and Exchange Commission.

Part of the gains also came as investors anticipate the launch of a spot XRP ETF soon, which could unlock fresh institutional demand for the token.

Despite XRP’s notable performance this year, there are signs the token could be poised for a correction. The token has already dropped 16.8% over the past month after hitting its year-to-date high last month.

Current data from Nansen shows that the balance of XRP held by smart money investors has dropped 80% over the past 30 days. This presents a risk, as such investors often reduce exposure ahead of market weakness. Retail investors tend to follow these moves, which can amplify price corrections for the token.

Additional data from CoinGlass shows that futures traders have also turned bearish. Open interest for XRP had fallen from $10.94 billion in July to $7.56 billion at press time, a sign of reduced speculation from investors.

Furthermore, the long/short ratio was below 1, which means more traders were positioned for a potential downside.

All of this has been unraveling as the network has been witnessing subdued activity on the XRP Ledger. Data from Dune show that weekly transactions have slumped 14.8% to 12.4 million, while weekly active addresses dropped 2.1% to 107,340. Investors view the slowdown as a sign of weakening network demand, adding to bearish sentiment around the token.

XRP price analysis

On the daily chart, XRP has fallen below the 20-day and 50-day moving averages, indicating that bearish momentum currently dominates.

The Relative Strength Index has also formed a bearish divergence with price action. Such a divergence typically reflects weakness in the prevailing uptrend, as rising RSI values fail to confirm higher price levels. This dynamic often leads traders to take profits, signaling declining investor interest and the onset of buyer exhaustion.

In addition, the Aroon Down indicator stands at 92.86% while the Aroon Up remains at 7.14%, reinforcing the strength of the bearish trend.

Given these signals, XRP is positioned for a potential correction toward $2.70, a level that previously acted as key support during its August decline.

A decisive break below this threshold could open the way for a further drop toward $2.30, which coincides with the 23.6% Fibonacci retracement level.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

The United Nations launches the "Global Dialogue on Artificial Intelligence Governance" mechanism