Tokenized Gold Is Getting Destroyed – Hyperliquid (HYPE) Perps Just Won the War

Tokenized gold was supposed to be one of crypto’s easiest wins. The pitch was bring real-world gold onto the blockchain, trade it anytime, and skip the traditional barriers.

Tokens like PAXG and XAUT were built to do exactly that, giving crypto users exposure to gold without leaving the ecosystem.

But the market just delivered a harsh reality check. Hyperliquid’s gold perpetual futures are now doing 5 to 10 times the combined volume of the biggest tokenized gold assets. That’s not a small shift. That’s traders making a clear decision about what they actually want.

This isn’t tokenization taking over. This is perps taking the crown.

Gold Tokenization Had the Story… But Not the Traders

On paper, tokenized gold makes perfect sense. Gold-backed assets should be an obvious bridge between traditional finance and crypto. The problem is that tokenization never fully escaped the same friction it was meant to replace.

Even though the asset lives on-chain, it still comes with questions about custody, redemption rules, and issuer trust. It feels closer to traditional finance wrapped in crypto packaging, and that’s not what most traders are looking for.

The truth is simple: most people weren’t chasing the idea of “owning gold.” They were chasing exposure to gold’s price movement.

Hyperliquid Perps Give Traders What They Actually Want

This is where Hyperliquid completely outplayed tokenization. Gold perps remove all the extra baggage. There’s no need to think about vaults or redemption mechanics. Traders just get instant price exposure, and that’s the only thing that matters in high-volume markets.

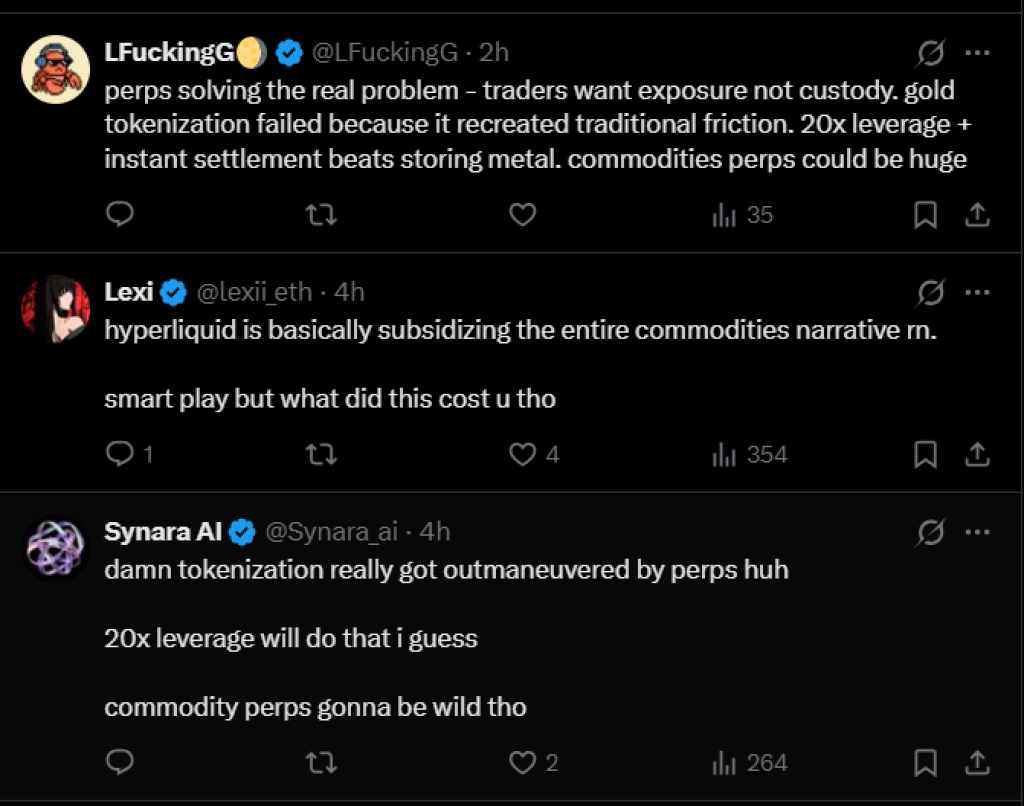

One reply said it perfectly: traders want exposure, not custody. That’s why liquidity moved so quickly. Hyperliquid (HYPE) isn’t selling a narrative about holding gold long-term. It’s offering a trading product built for speed.

And once leverage enters the equation, tokenized gold doesn’t even have a chance. Hyperliquid offers up to 20x leverage, which is exactly what speculative markets chase. Perps are built for action, not storage.

However, the brutal part is that tokenized gold was supposed to modernize commodities, but it ended up recreating the same traditional friction under a new label. It still feels like a financial product that comes with rules and limitations.

Perps don’t have that problem. They are simple, liquid, and fast. No custody worries, no extra steps, no delays. Just instant settlement and pure exposure.

That’s why the volume speaks louder than the narrative ever could.

Hyperliquid Is Taking Over the Commodities Lane

This shift isn’t only about gold. Commodities now make up around 20% of Hyperliquid’s platform volume, and that share is climbing. That’s a big deal because crypto trading has mostly lived inside its own bubble of memes, altcoins, and majors.

Hyperliquid is starting to pull macro markets into the on-chain derivatives world. Some traders even joked that Hyperliquid is subsidizing the entire commodities narrative right now, but that’s often how liquidity dominance gets built.

The exchange is positioning itself as the place where commodity trading goes next.

Another interesting detail from the tweet is the valuation comparison. HYPE trades around 45x price-to-fees, while dYdX sits closer to 186x. That’s a massive gap, and it suggests Hyperliquid may still be early in how the market is pricing its growth.

Multiples don’t guarantee upside, but they do highlight where attention starts shifting when a platform captures real usage. And right now, Hyperliquid is capturing it.

Read Also: Kaspa to Face Major Threat in 2026: Here’s How KAS Price Could React

Furthermore, the most eye-catching part might be what comes next. Oil perps are rumored for March, and that could take this story to another level. Oil is one of the largest trading markets on the planet, far bigger than gold in terms of global activity.

If Hyperliquid (HYPE) can replicate what it’s doing with gold, this stops being a niche crypto trend. It becomes a serious attempt to bring global commodity speculation fully on-chain. That’s the next real test.

However, tokenized gold was supposed to be crypto’s commodity breakthrough. But traders made the decision clear. They don’t want slow, custody-based products that recreate traditional finance rules. They want fast exposure, leverage, and liquidity.

Hyperliquid (HYPE) perps didn’t just beat tokenization. They exposed the truth of the market.

In crypto, ownership is optional. Exposure is everything.

And Hyperliquid is starting to look like the platform building the next phase of trading infrastructure.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post Tokenized Gold Is Getting Destroyed – Hyperliquid (HYPE) Perps Just Won the War appeared first on CaptainAltcoin.

You May Also Like

The Channel Factories We’ve Been Waiting For

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference