Expert Says LINK Should Focus on Flipping Cardano Rather Than XRP

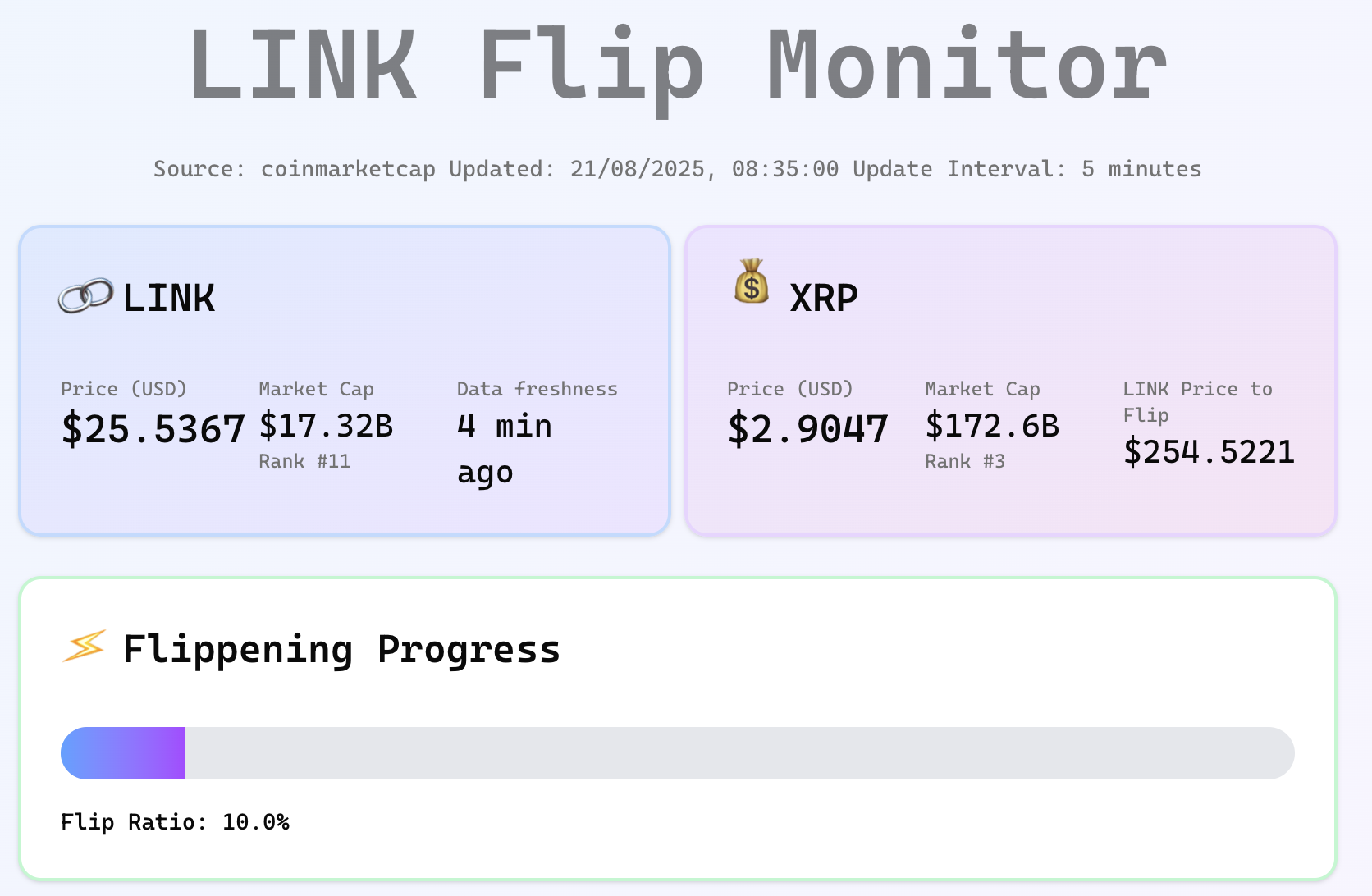

The rivalry between the XRP and Chainlink (LINK) crypto communities shows no signs of subsiding anytime soon. It has centered around LINK flipping XRP, both in terms of crypto market ranking and adoption scale. The discussion intensified following a viral post suggesting that LINK’s progress toward overtaking XRP has reached the 10% milestone. X user "Chainlink Revolution" triggered the conversation. In his tweet, he urged traders to “save their XRP gains” and rotate into LINK before the “flippening” occurs, sharing a dashboard screenshot to emphasize the momentum. The latest data on the dashboard shows that at a price of $25.59, LINK has reached a 10% ratio in its journey to overtake XRP. While the journey remains long, a growing voice in the Chainlink community believes it’s becoming a reality. They view LINK’s retail and institutional adoption as justification for a potential valuation shift.  Chainlink XRP Flip monitor "Focus on Flipping Cardano Rather Than XRP" However, pro-XRP attorney Bill Morgan poured cold water on the growing enthusiasm. He noted that sophisticated institutional players, such as Tidal Trust II, are already applying for XRP ETFs — including leveraged strategies that invest directly in other XRP-based exchange-traded products. Morgan argued that instead of targeting XRP, Chainlink should set its sights on Cardano (ADA), which currently sits only about $14 billion ahead of LINK in market capitalization. Notably, ADA has a market cap of $31.11 billion at press time, while LINK trails behind at $17.32 billion. Meanwhile, XRP holds a much larger valuation of $172.5 billion. In other words, XRP’s market cap remains 10 times larger than Chainlink’s, making the path to an XRP flippening significantly more challenging. XRP vs Chainlink The discussion about LINK flipping XRP comes as Chainlink enjoys renewed optimism, highlighted by dominance in Google Trends. LINK recently overtook XRP in global search interest, achieving a perfect score of 100 versus XRP’s score of only 11, as of July 2025.

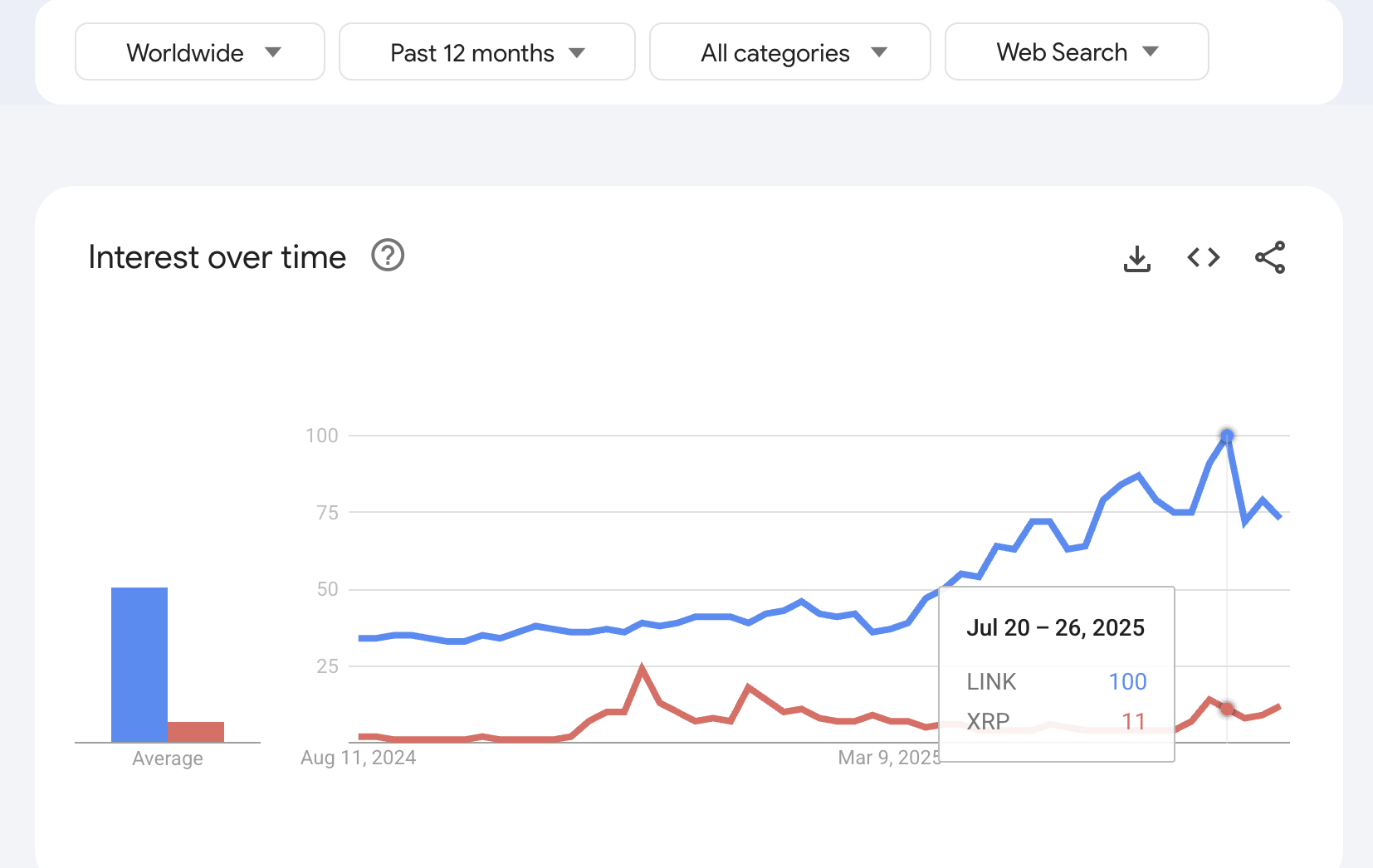

Chainlink XRP Flip monitor "Focus on Flipping Cardano Rather Than XRP" However, pro-XRP attorney Bill Morgan poured cold water on the growing enthusiasm. He noted that sophisticated institutional players, such as Tidal Trust II, are already applying for XRP ETFs — including leveraged strategies that invest directly in other XRP-based exchange-traded products. Morgan argued that instead of targeting XRP, Chainlink should set its sights on Cardano (ADA), which currently sits only about $14 billion ahead of LINK in market capitalization. Notably, ADA has a market cap of $31.11 billion at press time, while LINK trails behind at $17.32 billion. Meanwhile, XRP holds a much larger valuation of $172.5 billion. In other words, XRP’s market cap remains 10 times larger than Chainlink’s, making the path to an XRP flippening significantly more challenging. XRP vs Chainlink The discussion about LINK flipping XRP comes as Chainlink enjoys renewed optimism, highlighted by dominance in Google Trends. LINK recently overtook XRP in global search interest, achieving a perfect score of 100 versus XRP’s score of only 11, as of July 2025.  Google Trends data for XRP and LINK In terms of DeFi strength, LINK's total value secured (TVS) crossed $93 billion days back. When compared to XRP’s $85 million, the difference is clear. Still, XRP has maintained stronger long-term price performance. Over the last year, XRP has surged 386%, compared to LINK’s 145% despite the recent resurgence. The SWIFT Factor and Institutional Adoption Chainlink advocates argue that LINK has become what many once expected XRP to be — a bridge for global finance. Through its ongoing partnership with SWIFT, Chainlink has demonstrated cross-chain interoperability, tested tokenized asset transfers with banks such as BNY, and run pilots with UBS Asset Management. These milestones strengthen LINK’s institutional adoption case. XRP has also seen institutional traction via treasury asset inclusion and Ripple partnerships. However, Chainlink proponents believe their project has been far more successful in this regard. Meanwhile, XRP supporters believe ETF investments and continued integration into financial markets may further extend XRP’s dominance in terms of valuation.

Google Trends data for XRP and LINK In terms of DeFi strength, LINK's total value secured (TVS) crossed $93 billion days back. When compared to XRP’s $85 million, the difference is clear. Still, XRP has maintained stronger long-term price performance. Over the last year, XRP has surged 386%, compared to LINK’s 145% despite the recent resurgence. The SWIFT Factor and Institutional Adoption Chainlink advocates argue that LINK has become what many once expected XRP to be — a bridge for global finance. Through its ongoing partnership with SWIFT, Chainlink has demonstrated cross-chain interoperability, tested tokenized asset transfers with banks such as BNY, and run pilots with UBS Asset Management. These milestones strengthen LINK’s institutional adoption case. XRP has also seen institutional traction via treasury asset inclusion and Ripple partnerships. However, Chainlink proponents believe their project has been far more successful in this regard. Meanwhile, XRP supporters believe ETF investments and continued integration into financial markets may further extend XRP’s dominance in terms of valuation.

You May Also Like

WLFI Bank Charter Faces Urgent Halt as Warren Exposes Trump’s Alarming Conflict of Interest

UNI Price Prediction: Targets $5.85-$6.29 by Late January 2026