Tens of Millions Are Riding on the Fed’s September Decision — And the Odds Just Flipped

Following Federal Reserve Chair Jerome Powell’s dovish remarks at Jackson Hole, markets are bracing for a possible rate cut in September.

The Fed’s September Call Has Traders on Edge — And the Wager Pile Just Got Bigger

CME’s Fedwatch tool, along with bets placed on Polymarket and Kalshi, point to easing next month. Data from the Fedwatch tool on cmegroup.com shows a 75% probability of 25 basis points (bps), or quarter-point, cut as of Aug. 23, 2025. The odds still leave a 25% chance the Fed holds the federal funds rate steady.

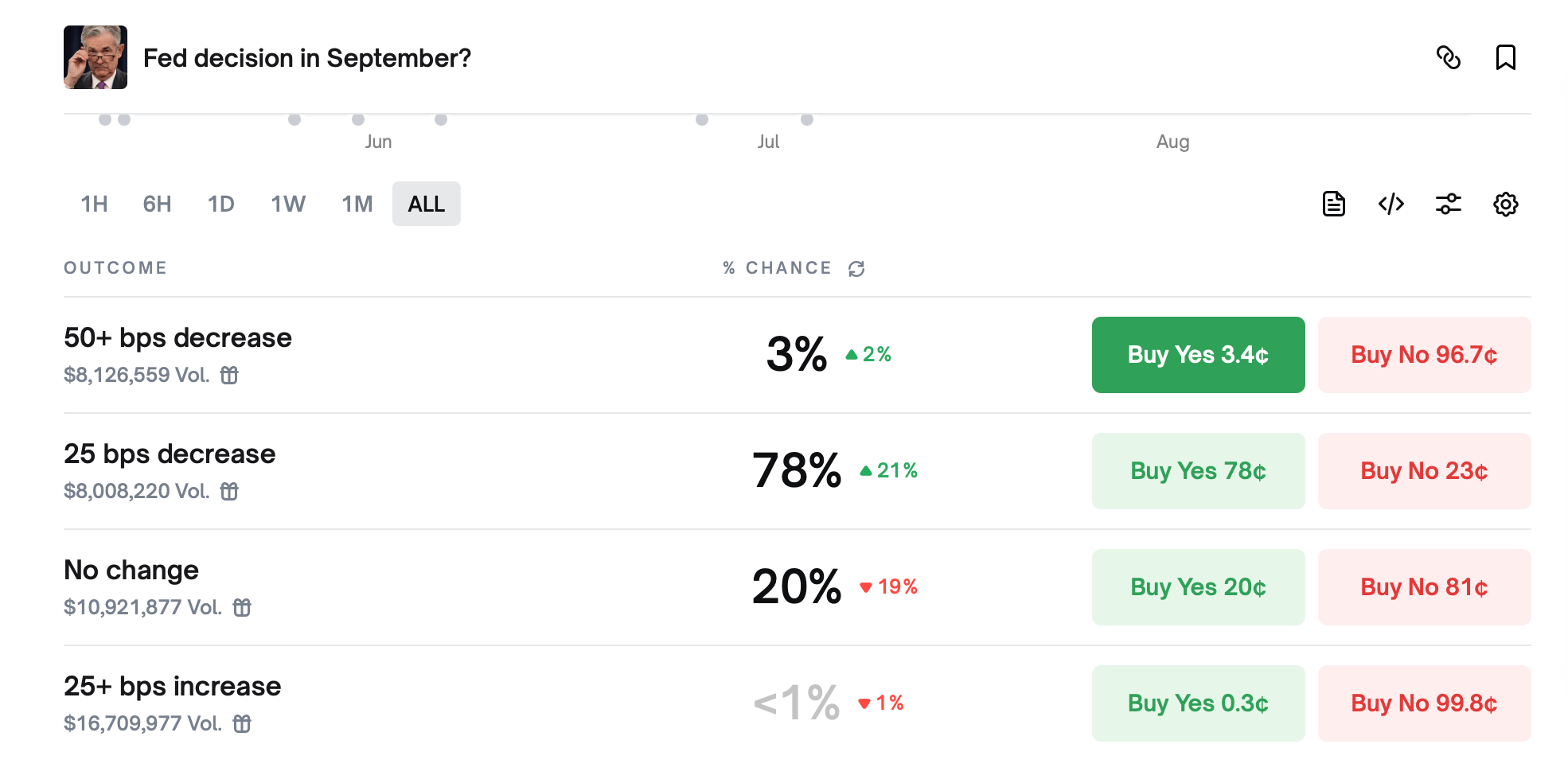

Prediction markets on Polymarket are leaning hard toward a September rate cut from the Federal Reserve, with traders nearly unified on the size of the move. Odds of a 25 basis point trim after the September 2025 meeting now stand at 78%, a jump of 21% in recent sessions.

Source Image: Polymarket Fed bet on Aug. 23, 2025, the day after Powell’s Jackson Hole talk.

Source Image: Polymarket Fed bet on Aug. 23, 2025, the day after Powell’s Jackson Hole talk.

The outlook for a rate cut of any size by September is even firmer at 80%, while the probability of a cut sometime in 2025 has swelled to 93%. Breaking it down, only 3% of bets price in a larger 50 basis point move, and less than 1% wager on an increase—showing traders see virtually no chance of the Fed tightening.

Meanwhile, the odds of “no change” have tumbled to 20%, down 19 points as expectations shift toward easing. Millions of dollars are stacked behind the 25 basis point option, while bets on a pause or a surprise hike are thinning quickly. Kalshi’s markets tell the same story, showing a decisive lean toward a September cut that mirrors Polymarket’s momentum.

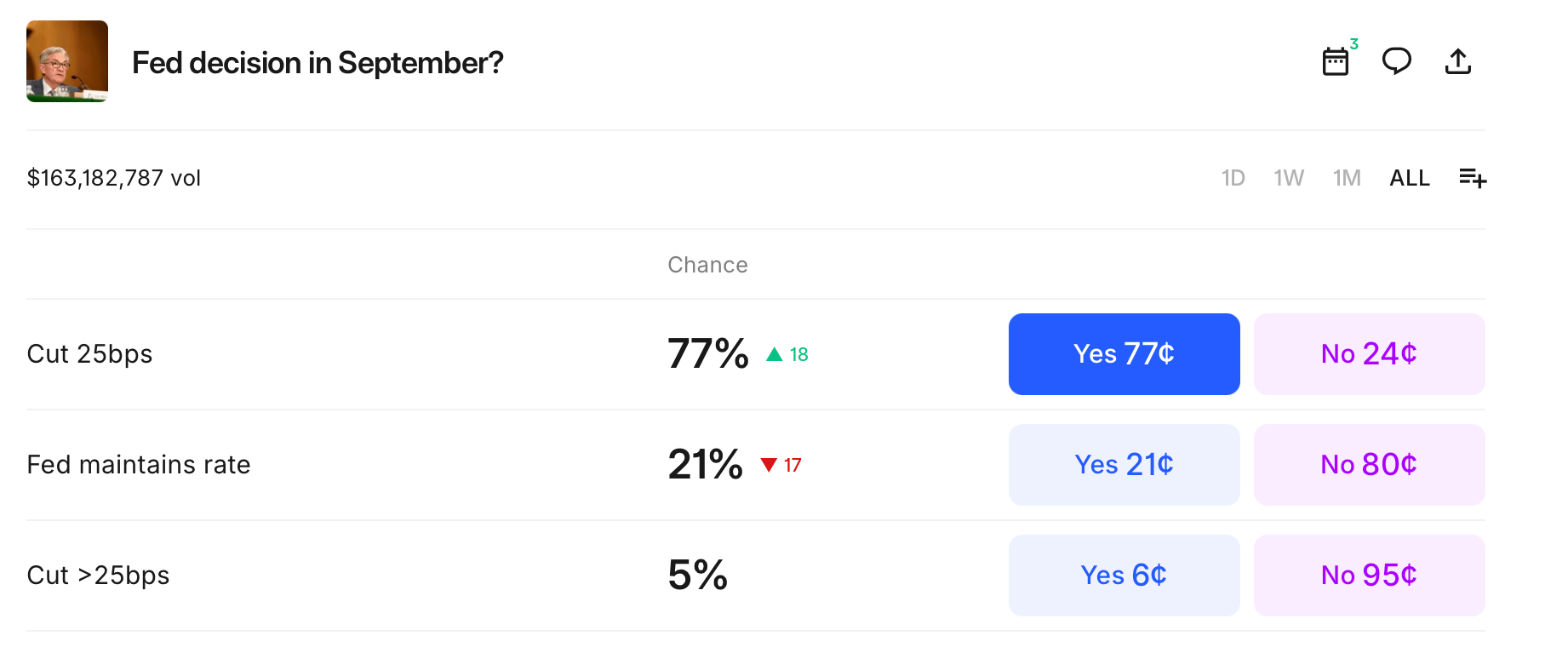

Source Image: Kalshi Fed bet on Aug. 23, 2025.

Source Image: Kalshi Fed bet on Aug. 23, 2025.

On Kalshi, traders are pricing a 77% chance the Fed trims rates by 25 basis points, up 18 points in recent activity. The probability of the central bank holding steady has slid to 21%, a 17-point drop, as sentiment swings in favor of easing.

There’s still a thin 5% priced in for something more aggressive than a quarter-point, but conviction is squarely behind the smallest possible move. With over $163 million in wagers shaping these odds, Kalshi reflects strong agreement that the Fed will favor a cautious 25 basis point cut over standing pat or attempting a bolder policy shift.

In short, CME futures, Polymarket, and Kalshi are aligned: September looks like the kickoff for Fed easing, with Powell’s team expected to deliver a measured quarter-point cut instead of a dramatic swing.

You May Also Like

Bitcoin ETFs Outpace Ethereum With $2.9B Weekly Surge

The earliest statute of limitations for retroactive taxation on overseas income is 2017.