Bitcoin Accumulation Builds, But Hedge Status Still Unconfirmed

A decline in U.S. inflation to 2.4% year-over-year in January has reinforced the impact of quantitative tightening, which briefly ended on December 1, 2025.

Yet markets did not respond with broad risk-on enthusiasm, as quantitative easing failed to materialize. According to a recent report shared by CryptoQuant, capital flows remain defensive rather than euphoric.

The U.S. 10-year Treasury yield has retreated to 4.08%, signaling demand for safety. Some of that defensive positioning appears to be structurally migrating toward Bitcoin.

Accumulation Surges During Defensive Phase

On-chain data shows 387,930 BTC accumulated over the past 30 days by so-called accumulator addresses. That figure exceeds the monthly average and indicates large-scale holders are increasing exposure despite broader macro caution.

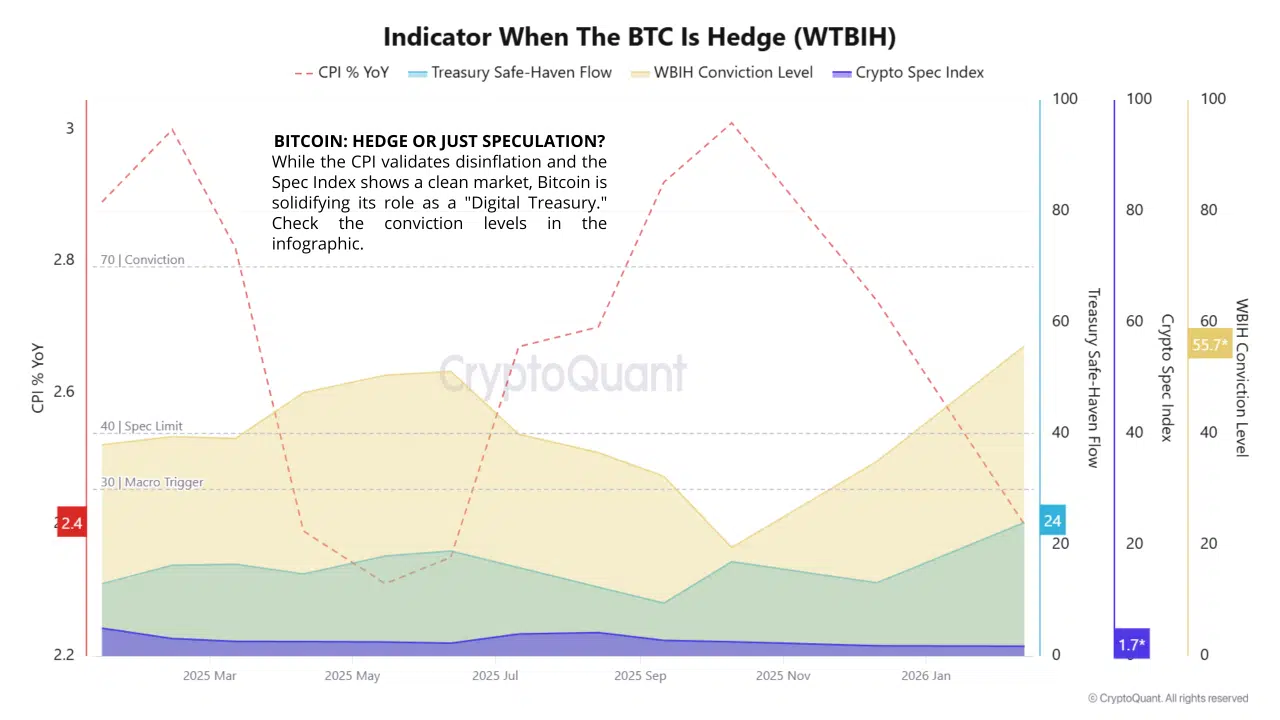

Historically, during bear markets, capital shifts toward strategic anchoring rather than short-term speculation. The report references the When The BTC Is Hedge (WTBIH) indicator to assess whether Bitcoin is currently functioning as a macro hedge rather than a speculative instrument.

Historically, during bear markets, capital shifts toward strategic anchoring rather than short-term speculation. The report references the When The BTC Is Hedge (WTBIH) indicator to assess whether Bitcoin is currently functioning as a macro hedge rather than a speculative instrument.

WTBIH Metrics: Accumulation, But Not Full Hedge Status

The WTBIH framework consolidates three key inputs: daily crypto speculation metrics, monthly CPI readings, and business-day Treasury flow data.

Current readings show:

- CPI YoY: 2.4%, validating disinflation and reducing inflation-driven uncertainty premiums.

- Treasury Safe-Haven Flow: 24, below the macro trigger level of 30, suggesting global defensive flows are still forming.

- Crypto Spec Index: 1.74, dramatically below the speculative threshold of 40, confirming exhaustion of euphoric positioning.

- WTBIH Conviction Level: 55.74, below the conviction zone threshold of 70.

These metrics suggest technical accumulation is underway, but Bitcoin has not yet reached full hedge classification within the framework.

Structural Interpretation

The combination of declining inflation, Treasury inflows, and subdued speculative activity reflects a market in transition. While leveraged shorts remain active within the downtrend, speculative excess appears largely cleared.

According to the WTBIH model, Bitcoin approaches “Digital Treasury” behavior when defensive capital flows intensify beyond the 30-point Treasury trigger and conviction levels exceed 70. Until that threshold is met, the asset remains in accumulation mode rather than confirmed hedge mode.

Professional Takeaway

Bitcoin is showing structural maturity through sustained accumulation and reduced speculative pressure. However, hedge status requires stronger macro-driven capital rotation.

For now, the data suggests positioning for protection is building, but the definitive global hedge signal has not yet been triggered.

The post Bitcoin Accumulation Builds, But Hedge Status Still Unconfirmed appeared first on ETHNews.

You May Also Like

Reboost Plans Reverse Takeover of Pyratzlabs to Build Profitable Blockchain Group

SOL Price Prediction: Targets $100 Breakout by March 2026