Digital Asset Funds Bleed $173M as US Outflows Deepen

Digital asset investment products recorded a fourth consecutive week of outflows, with $173 million withdrawn, according to the latest data from CoinShares.

Over the past four weeks, cumulative outflows have now reached $3.74 billion, underscoring persistent institutional caution amid price volatility.

Volatility Drives Weekly Swings

The week started positively, with $575 million in inflows, before sentiment reversed sharply.

Subsequent price weakness triggered $853 million in outflows, erasing early gains.

However, weaker-than-expected CPI data toward the end of the week helped stabilize flows, leading to $105 million in inflows on Friday.

Meanwhile, ETP trading volumes dropped significantly to $27 billion, down from the prior week’s record $63 billion, signaling cooling activity.

Sharp Regional Divergence

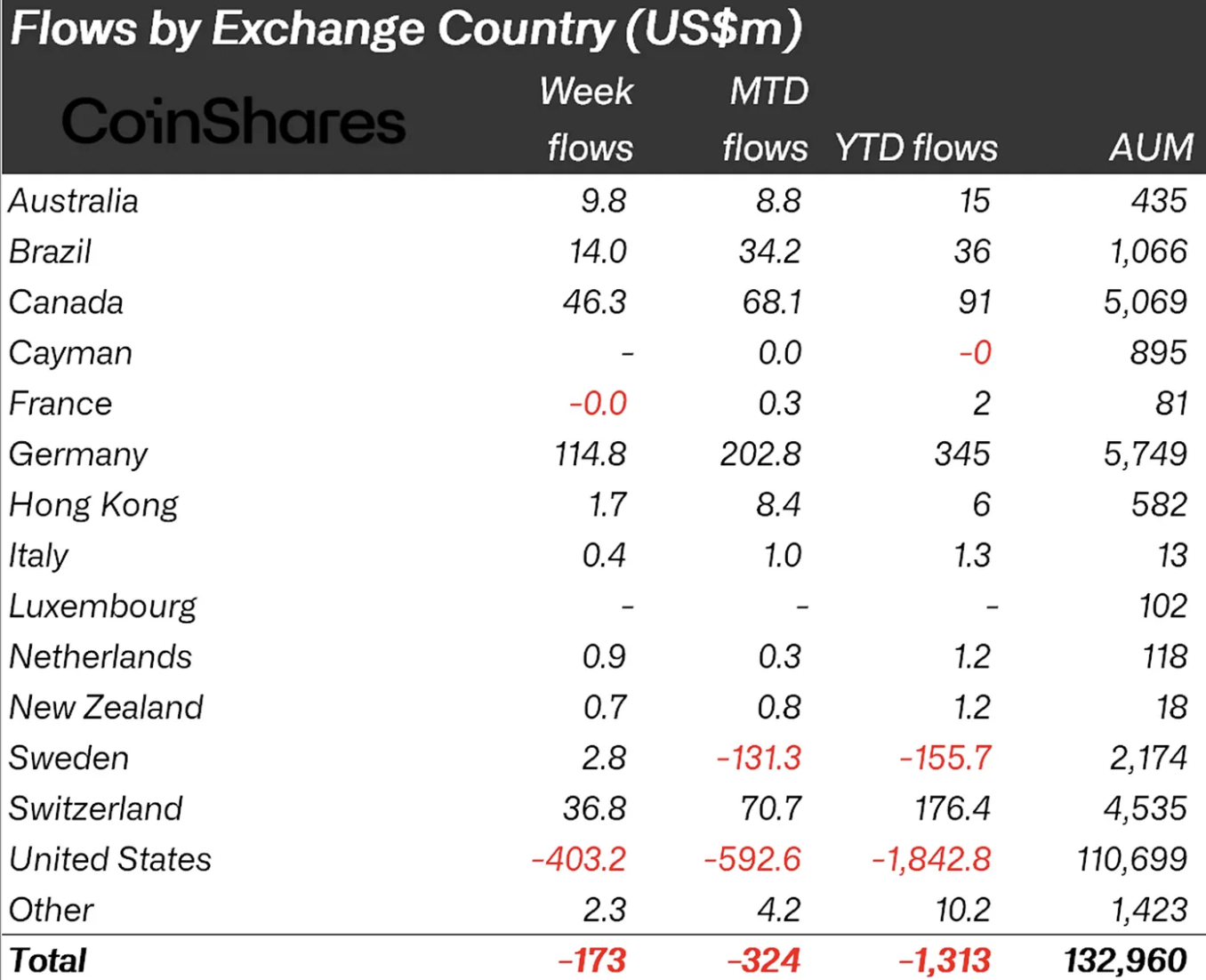

Flows revealed a clear split between the United States and other markets.

- United States: -$403.2 million

- Germany: +$114.8 million

- Canada: +$46.3 million

- Switzerland: +$36.8 million

While the US led global outflows, Europe and Canada collectively posted $230 million in inflows, suggesting regional differences in risk appetite.

Source: https://researchblog.coinshares.com/volume-273-digital-asset-fund-flows-weekly-report-619cd0f21653

Source: https://researchblog.coinshares.com/volume-273-digital-asset-fund-flows-weekly-report-619cd0f21653

The divergence highlights contrasting investor positioning rather than uniform global risk-off behavior.

Bitcoin and Ethereum Lead Outflows

By asset class:

- Bitcoin: -$133.3 million

- Ethereum: -$85.1 million

- Multi-asset products: -$14.6 million

- Short Bitcoin products: -$5.0 million

Interestingly, short Bitcoin products have now seen $15.5 million in outflows over the past two weeks, a pattern often observed near market bottoms, as bearish positioning unwinds.

Ethereum also experienced sustained weakness, while smaller assets showed mixed activity.

XRP and Solana Attract Fresh Capital

Despite broader pressure, select altcoins continued to draw inflows:

- XRP: +$33.4 million

- Solana: +$31.0 million

- Chainlink: +$1.1 million

This selective inflow pattern suggests capital rotation rather than wholesale risk reduction.

Total AUM Context

Total assets under management across digital asset investment products now stand at approximately $132.96 billion.

The structure of flows indicates that while macro uncertainty continues to weigh on US-based products, particularly Bitcoin, investors in Europe and Canada appear more willing to accumulate on weakness.

The coming weeks will likely hinge on macro data stability and whether US flows begin to converge with the more constructive tone seen outside the region.

The post Digital Asset Funds Bleed $173M as US Outflows Deepen appeared first on ETHNews.

You May Also Like

What’s driving the euro to outperform USD for 2nd year in a row?

Trump Family-Backed American Bitcoin Keeps Stacking Bitcoin, Holdings Pass 6,000 BTC