Falcon Finance presents itself as a next-generation protocol, aiming to evolve into a full-fledged financial institution that bridges traditional banking, centralized crypto platforms, and decentralized finance.

DWF Labs co-founder Andrei Grachev first introduced the project in October 2024, describing it as a yield-generating synthetic stablecoin.

At the start of 2025, the Falcon Finance team launched a beta version of the product.

What Are USDf and sUSDf?

USDf is Falcon Finance’s U.S. dollar–pegged stablecoin, maintained at a 1:1 ratio with the dollar. It is issued by locking supported assets as collateral.

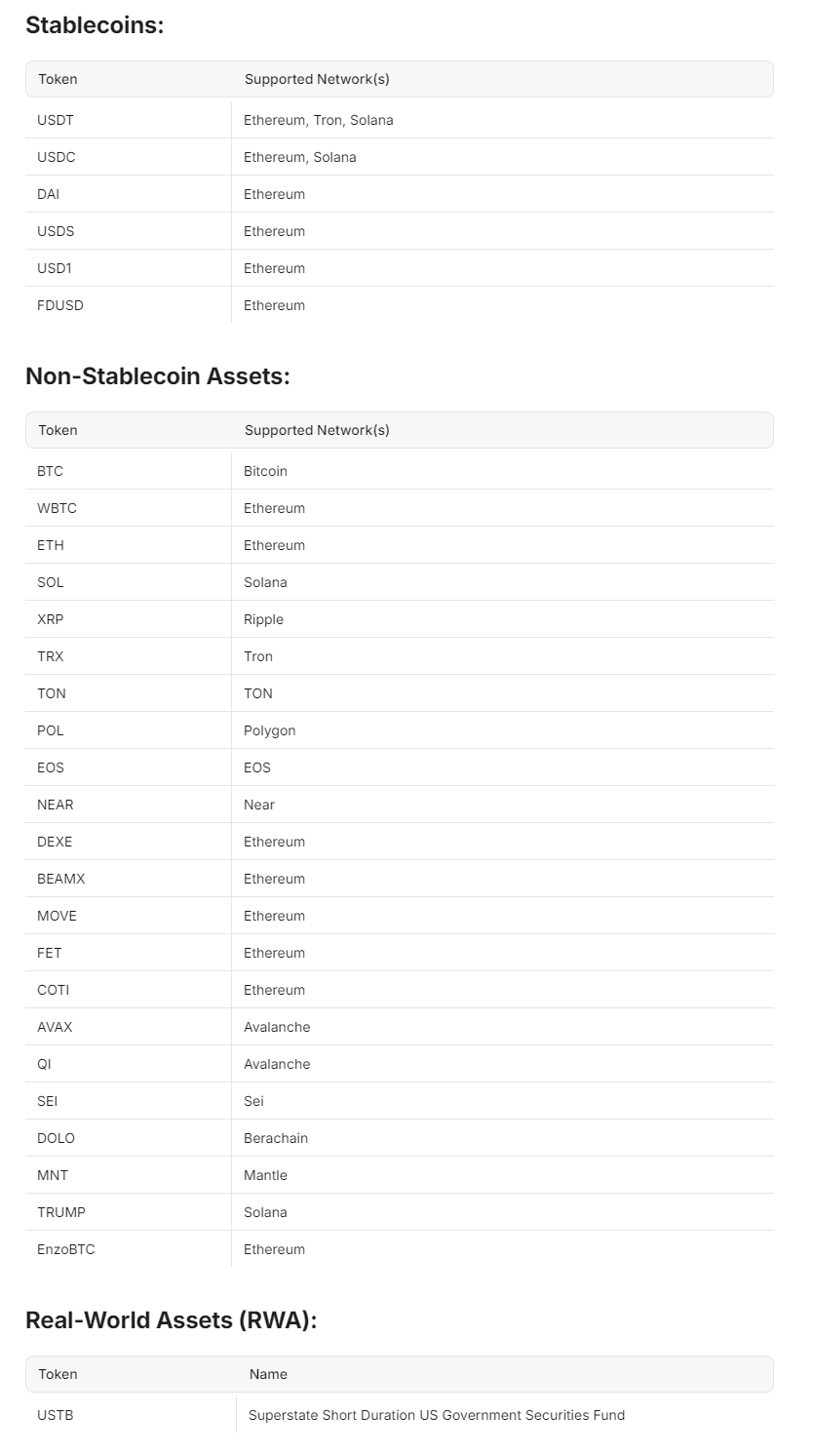

Assets Supported by Falcon Finance. Source: Falcon Finance.

Assets Supported by Falcon Finance. Source: Falcon Finance.

Falcon Finance offers two minting mechanisms: the classic and the “innovative” model.

Classic Mint

The minimum collateral requirement is $10,000 in supported stablecoins or volatile assets.

When using volatile assets, an overcollateralization ratio is applied, varying depending on the risk profile of the asset.

When collateralized with stablecoins, users receive USDf at a 1:1 ratio.

“Innovative” Mint

The minimum collateral requirement is $50,000 in supported volatile assets.

This mechanism provides partial exposure to upside price movement. Funds are locked for a fixed term ranging from 3 to 12 months. During issuance, users must specify parameters such as:

- lock-up period,

- capital efficiency level,

- strike price multiplier.

These parameters determine the amount of USDf issued, the liquidation price, and the strike price.

Collateral is monitored throughout the lock-up period, leading to three possible scenarios:

- If the collateral price falls below liquidation at any point: the user forfeits the collateral to protect the protocol, but keeps the issued USDf, which can be redeemed for supported stablecoins like USDT or USDC.

- If the collateral price stays between liquidation and strike until maturity: the user can reclaim the original collateral by returning the issued USDf — regaining the asset while still having had access to liquidity in USDf during the lock-up.

- If the collateral price rises above the strike before or at maturity: the user forfeits the collateral but receives an additional payout in USDf, calculated as:

(strike price × collateral amount) – issued USDf

sUSDf is a yield-bearing token (ERC-4626 standard) issued when USDf is locked. Its value increases over time as the protocol generates revenue through Falcon Finance’s institutional strategies.

The yield comes from a range of operations managed by the Falcon engine.

Revenue Strategies

Positive funding rate arbitrage. Falcon Finance generates income by holding spot positions while simultaneously opening shorts on corresponding perpetual futures. The spot assets are then staked, adding an extra layer of yield.

Negative funding rate arbitrage. In this case, the engine sells spot assets and opens long positions on futures contracts.

Cross-exchange arbitrage. Falcon Finance buys and sells assets across different markets, profiting from price discrepancies.

Altcoin staking. The protocol leverages staking opportunities for supported volatile assets, earning on-chain rewards.

Liquidity pools. A portion of assets is allocated to liquidity pools, generating returns through arbitrage and trading activity on decentralized exchanges.

Roadmap

On July 29, 2025, Falcon Finance unveiled its roadmap for the next 18 months. The plan outlines the creation of an efficient infrastructure that integrates cryptocurrencies, tokenized real-world assets (RWA), and capital markets into a unified system.

Priorities for 2025

In 2025, the Falcon Finance team is focused on bridging crypto liquidity with traditional financial infrastructure. Key initiatives include:

- Opening regulated fiat gateways in Latin America, Turkey, the Middle East, North Africa, and the Eurozone to ensure 24/7 liquidity for USDf.

- Introducing the option for physical gold redemption in the UAE.

- Expanding collateral options to include fiat currencies, RWA, and gold.

Initiatives for 2026

The 2026 roadmap emphasizes infrastructure expansion for deeper RWA integration and stronger institutional participation. Core initiatives include:

- Geographic expansion, with support for gold-backed collateral in the MENA region and Hong Kong.

Launching the Falcon RWA Tokenization Engine, a tool for tokenizing real-world assets. - Adding support for tokenized corporate bonds, equities, treasuries, and private credit as eligible collateral.

- Expanding USDf’s integration with traditional financial platforms.

- Issuing a securitized version of USDf through an SPV (special purpose vehicle), enabling institutional investors to adopt the asset within regulated infrastructure.

- Rolling out flexible investment products based on USDf, offering regulated infrastructure and institutional-grade reporting.

Total Issuance and Percentage of Locked USDf. Source: Dune Analytics

Total Issuance and Percentage of Locked USDf. Source: Dune Analytics

Number of First-Time USDf Addresses. Source: Dune Analytics.

Number of First-Time USDf Addresses. Source: Dune Analytics.

Daily USDf/USD Chart. Source: CoinMarketCap.

Daily USDf/USD Chart. Source: CoinMarketCap.