Crypto market annual review: Amidst depression and optimism, on the road to altcoin season

Author: Delphi Digital

Compiled by: Felix, PANews

In 2024, cryptocurrencies are at a crossroads: Bitcoin’s strong gains contrasted with overall market weakness, until a regulatory shift at the end of the year brightened the outlook.

The crypto narrative is being recalibrated, and 2025 will usher in a fresh start. This article aims to briefly review the market situation this year.

Many crypto people believe that with the launch of spot ETF products, the crypto market will rebound to all-time highs. But this is not entirely the case, at least not in the way many people expected.

In the first quarter of this year, with the launch of the ETF, Bitcoin rose by more than 50% to $73,000. Billions of dollars flowed directly into the market, and the market no longer had any concerns about institutional demand. For about 7 months, Bitcoin fluctuated mainly between $60,000 and $70,000.

Unfortunately, aside from a few outperforming tokens, most are struggling. These woes were exacerbated by the initial “failure” (or lack thereof) of spot ETH liquidity after its launch mid-year. Much of the story in 2024 is one of low sentiment and infighting.

However, the crypto industry finally saw the light of day after the presidential election in November. This is also reflected in the changes in market sentiment and risk appetite in the past few weeks.

Cycle strategy is on track

Delphi Digital outlined the reasons for the bear market bottoming out at the end of 2022, expressing its belief in the upcoming bull cycle more than 15 months ago. In last year's report, it predicted that Bitcoin would break new highs in the fourth quarter of 2024.

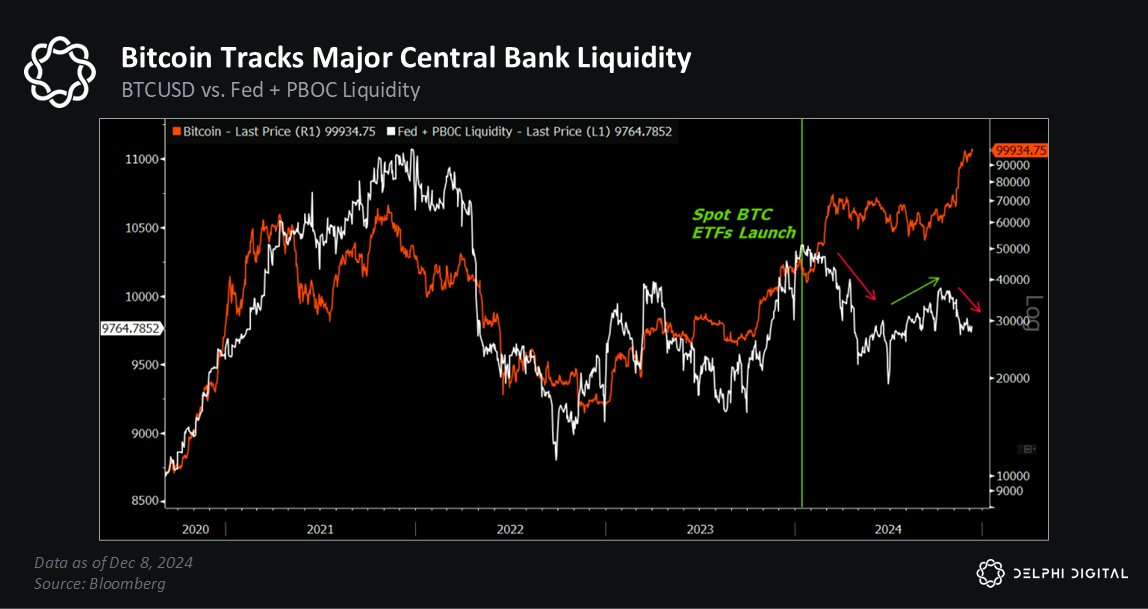

On the macro side, reality has been in line with expectations. So far, the Bitcoin halving has not been the primary catalyst for crypto market cycles, but rather a liquidity cycle.

At the end of last year, Delphi Digital listed favorable conditions for Bitcoin to achieve strong performance in the first quarter, one of which was a surge in global liquidity. It also warned that there is a high risk of a market correction starting from the end of the first quarter to the beginning of the second quarter of 2024. The reason is that signs of weakening liquidity momentum have been seen.

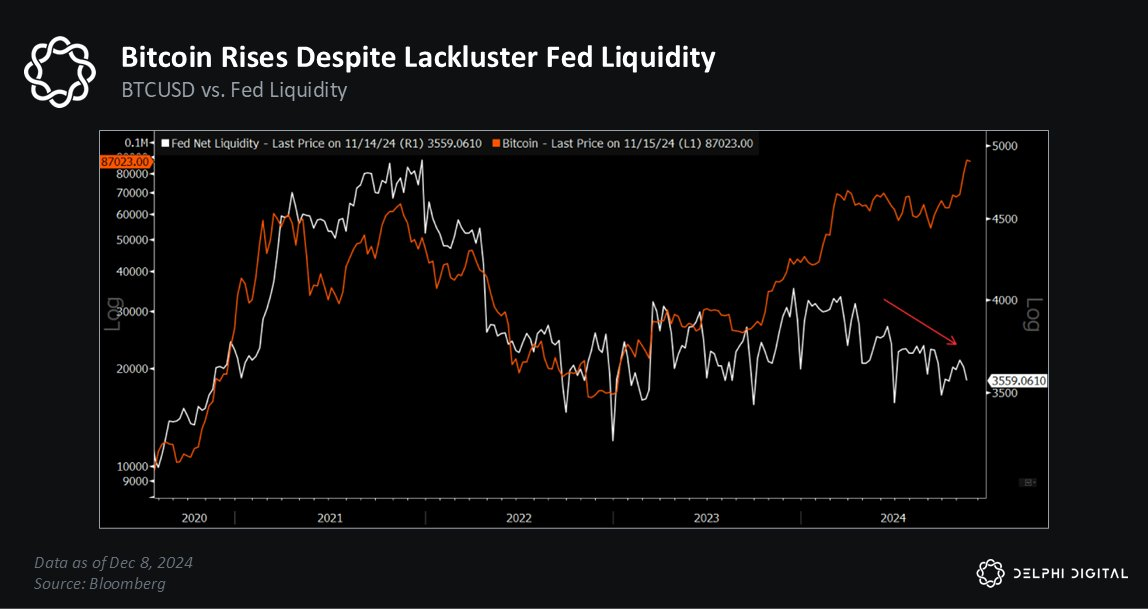

Bitcoin has risen more than 130% so far this year, and this has been achieved without much support from the Federal Reserve. In fact, the Federal Reserve's liquidity has been steadily declining over the past 9-10 months.

Optimism returns

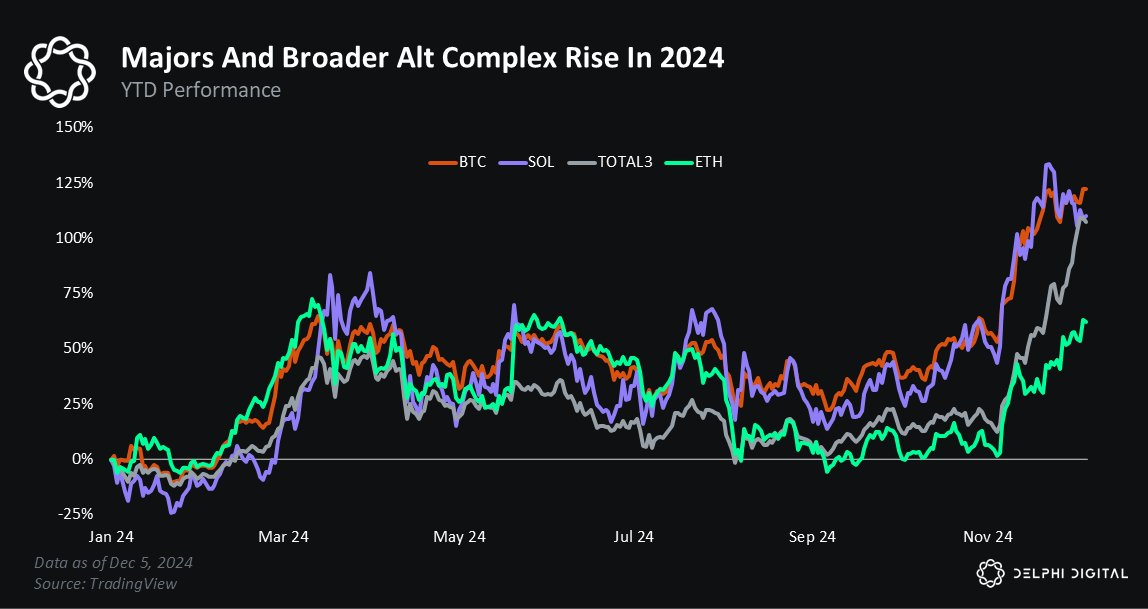

2024 has been a strange year for the crypto market. On one hand, most major currencies have returned to their all-time highs, while the broader altcoin market has also seen a recovery.

But crypto communities (like Twitter) have been infighting for much of this year. The gloomy sentiment for 2024 stands in stark contrast to the positive price action.

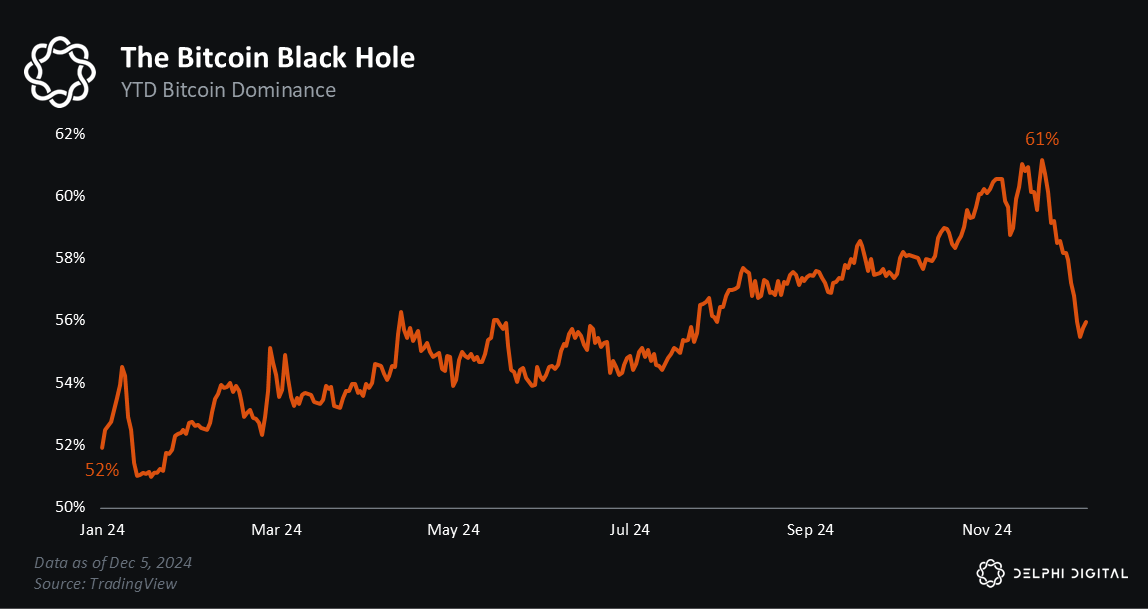

The first reason for the poor market sentiment is the dominance of Bitcoin. Bitcoin has soared 130% year-to-date, and its dominance has hit a three-year high.

The second factor is dispersion: some tokens are rising in price, some are rising slightly, but most are falling or moving sideways.

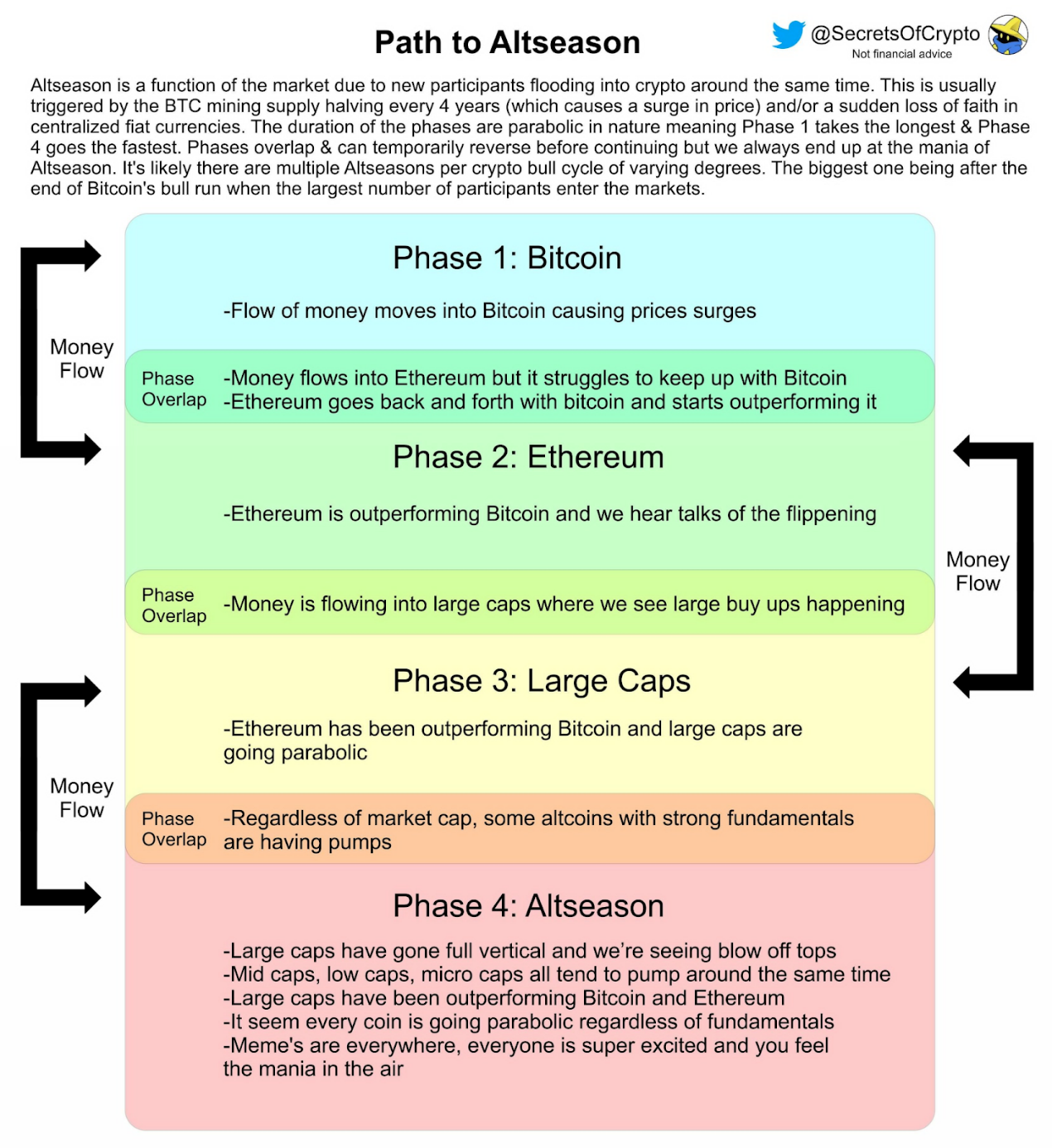

The classic “Road to Cottage Season” that many people are accustomed to failed to materialize.

Supply and demand imbalance

As mentioned in many reports over the past year, the crypto market faces a huge supply-demand imbalance. Simply put, cryptocurrency demand has not kept pace with overall cryptocurrency supply. Here are the reasons why.

Too many tokens

Aggregators now list more than 10,000 tokens, up from about 1,500 in 2017, a tenfold increase.

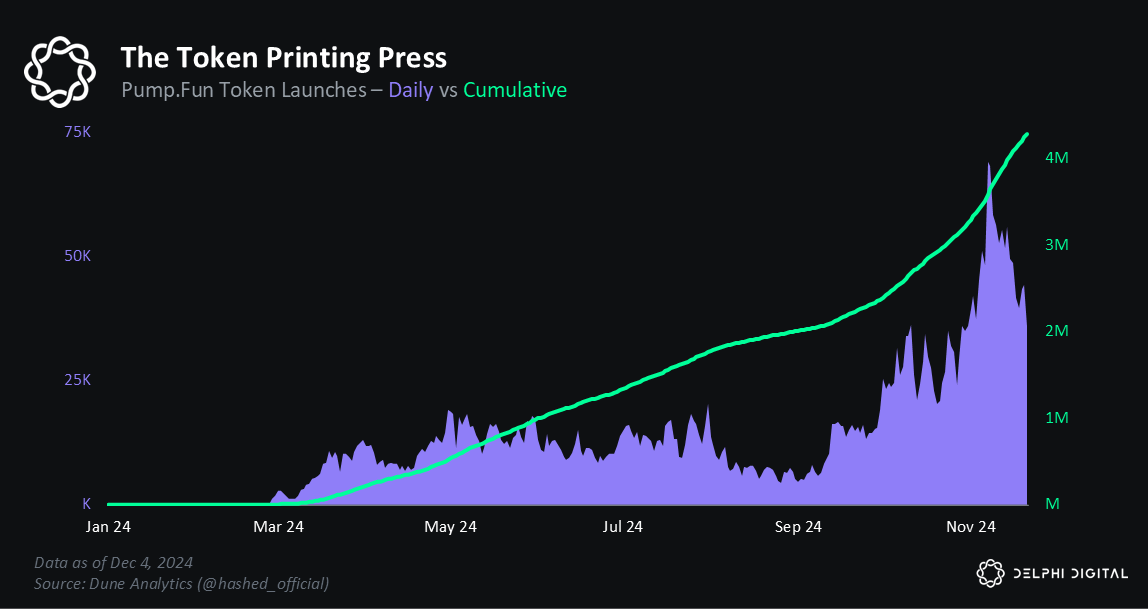

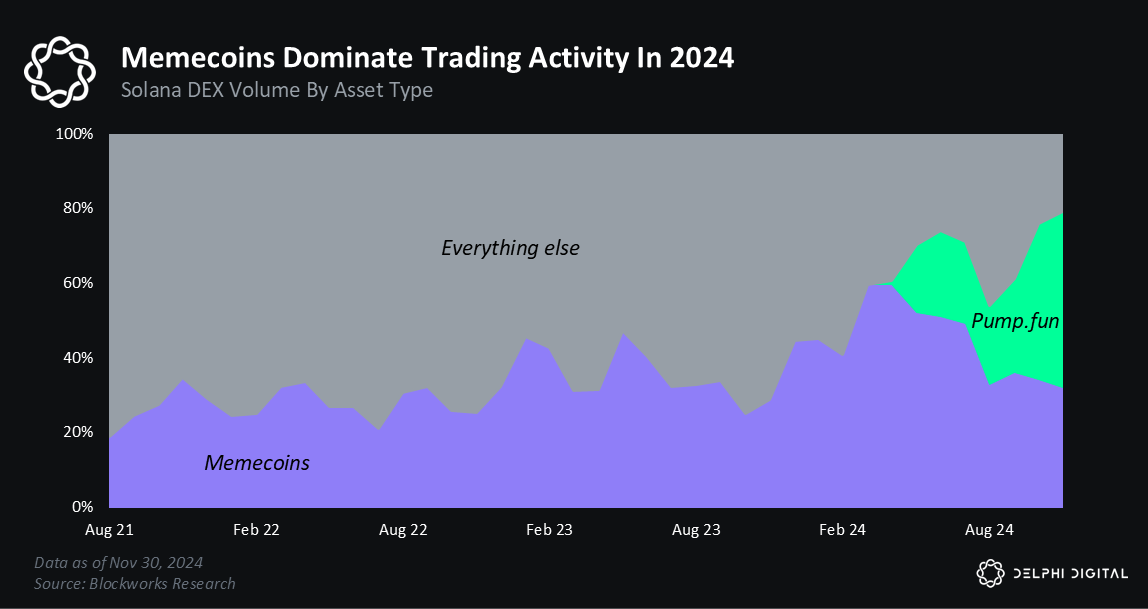

Apps like pump.fun make token creation easy: since January 2024, over 4 million tokens have been issued and over 50,000 tokens have entered Solana’s Raydium.

Memecoin Continuation

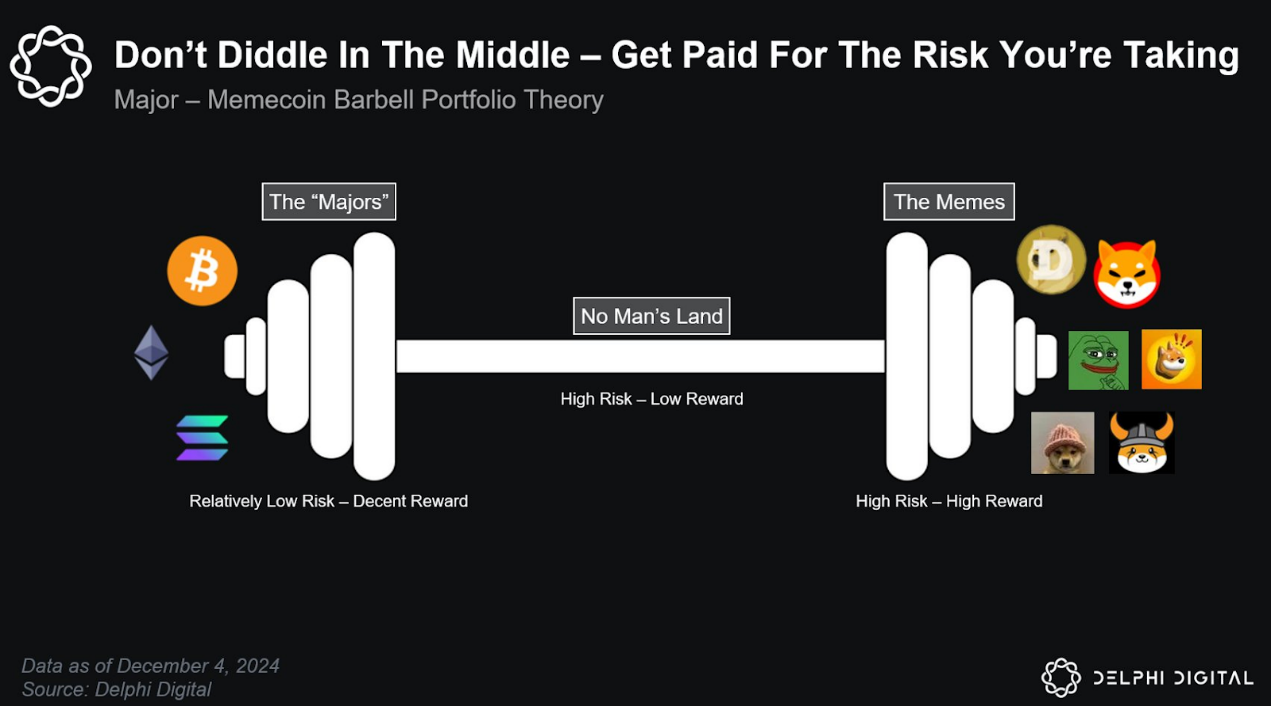

2024 gave birth to the Major-Memecoin Barbell Portfolio.

Will these market dynamics remain intact and memecoin will dominate for another year, or will the crypto market return to fundamentals?

The reality is more complex, influenced by speculative enthusiasm and changing market trends.

Solana Accelerates

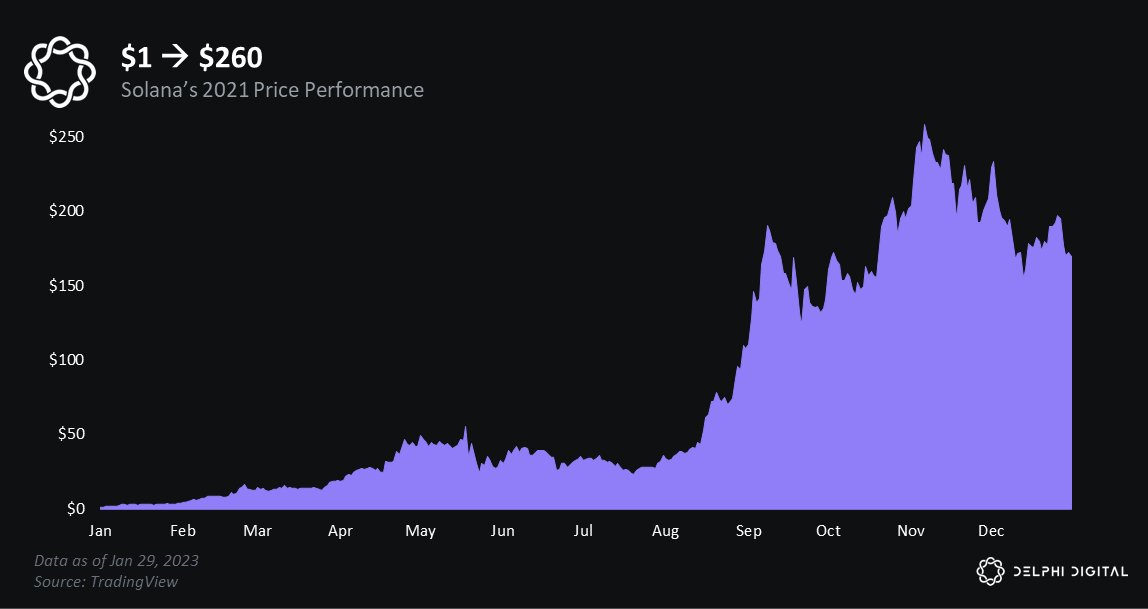

In the last cycle, SOL went from $1 to $260 in 1 year. Although the ecosystem is still in its infancy, it has attracted teams such as Jito, Drift, and Helium. All of these teams will become a fundamental part of the network.

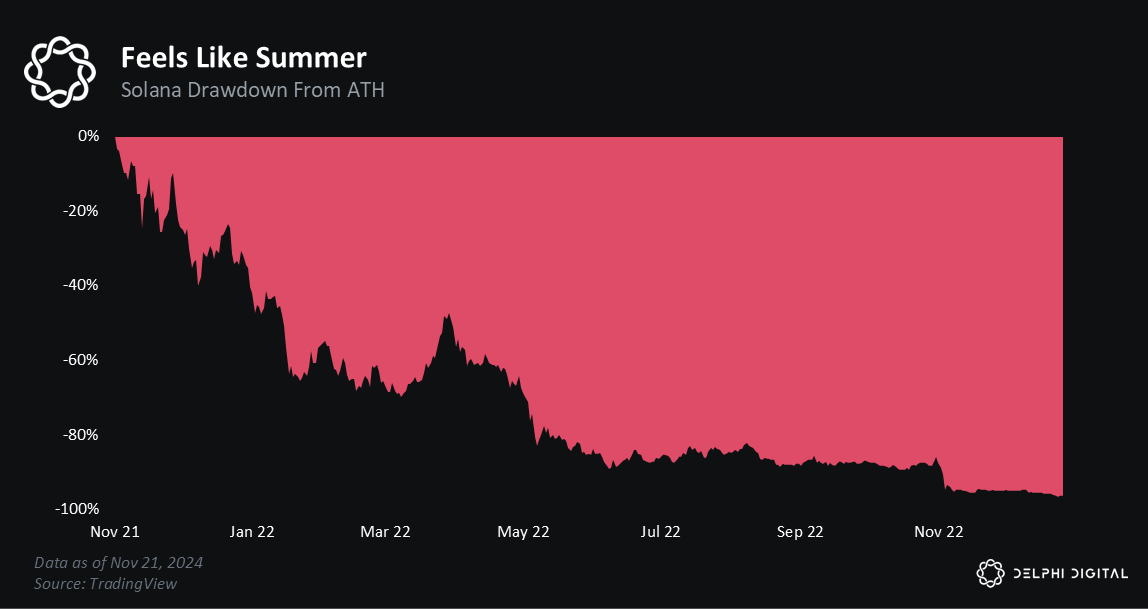

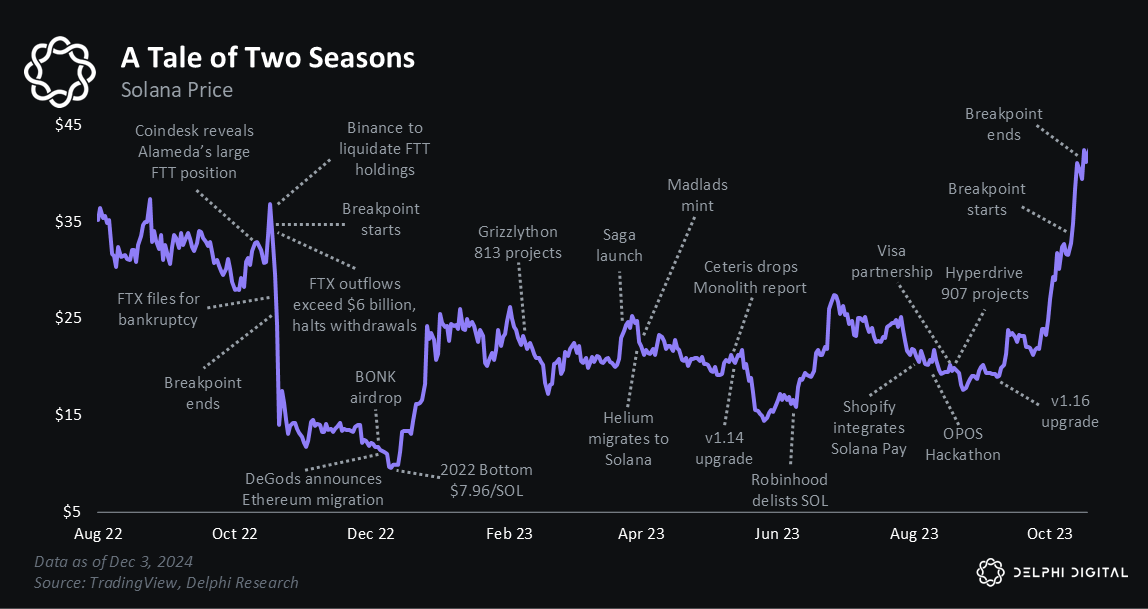

Solana eventually rose too high. Following the FTX crash, the bear market, and doubts about the chain’s stability, SOL fell 96%.

On Christmas Day 2022, Bonk airdropped 50% of the supply to the Solana community. SOL was trading at $11, and the outlook was not optimistic. A few days later, SOL fell to a low of $8, ending a brutal year.

Solana is reborn in 2023. The core team is focused on serving its loyal user base and steadily innovating to drive recovery with Drift Protocol, Jito, and Tensor Foundation.

As we head into 2025, some questions remain:

- Is the SOL rally over?

- Will memecoin disappear?

- Can Base grab market share?

- Will Ethereum fight back?

While these concerns are valid, they miss the point. Solana’s performance in 2025 will be based on two core beliefs:

- Solana’s data suggests that SOL/ETH is re-pricing. Activity at lower levels shows strong fundamentals, suggesting more upside compared to ETH.

- Leadership and Culture: Solana’s relentless innovation and thriving ecosystem give it a unique advantage in the cryptocurrency space

2024 could be seen as a turning point for the industry, but no one knows exactly how 2025 will pan out.

Related reading: Bitwise's Top 10 Cryptocurrency Predictions for 2025

You May Also Like

PBOC sets USD/CNY reference rate at 6.9590 vs. 6.9570 previous

Federal Reserve Announces Rate Cut Amid Shifting Economic Risks