Here’s Why Bitcoin Price is Falling Continues?

The post Here’s Why Bitcoin Price is Falling Continues? appeared first on Coinpedia Fintech News

Over the past month, the Bitcoin price has dropped 26%, falling from its January high of $97,682 to around $67,190. It is struggling to recover, which has made many investors worried. Even with strong institutional buying and strong global liquidity, Bitcoin value is still lagging behind assets like gold and silver.

Lost Bitcoin Supply and Quantum Computing Fear

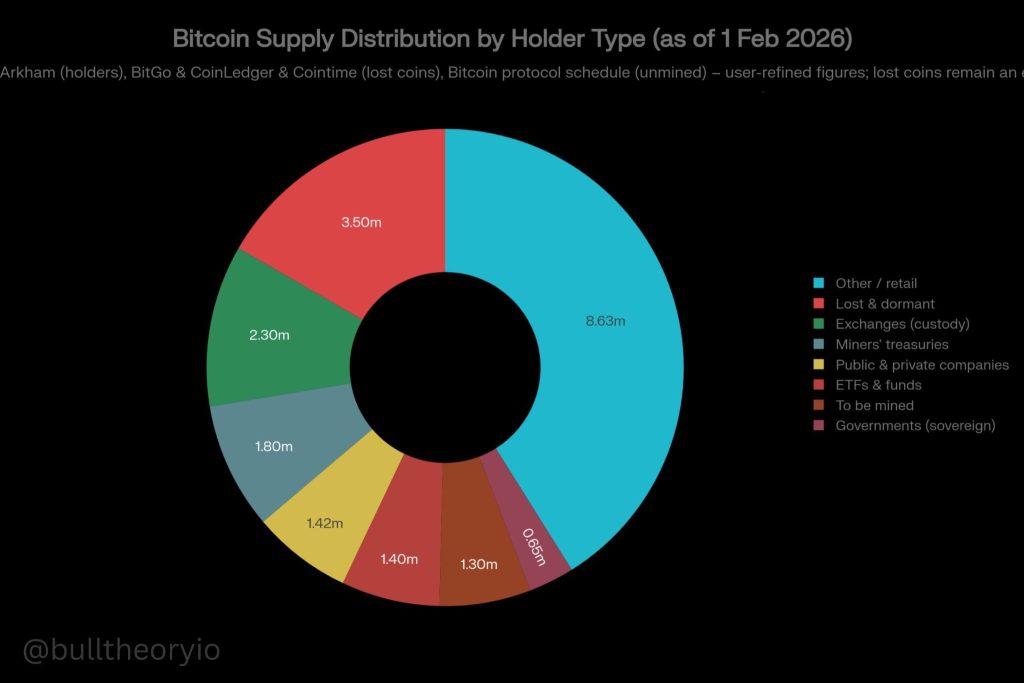

One major concern affecting Bitcoin value is the large amount of lost or inactive coins. Crypto experts estimate that around 3.5 to 4 million BTC, nearly 18% of the total supply, have not moved since Bitcoin’s early days and are believed to be permanently lost.

Perhaps, with fast progress in quantum computing, analysts believe these old wallets could become easier to access in the future. Even though this risk is not confirmed, markets react to such possibilities.

If investors expect some of these coins to return, it increases future supply fears, which can put pressure on Bitcoin’s price.

Institutional Buying Matches Lost Bitcoin Supply

Interestingly, institutional investors have been buying Bitcoin aggressively over the past few years. Since the launch of the spot Bitcoin ETF, institutions & corporations have accumulated around 2.5 to 3 million BTC. This amount is almost equal to the number of coins believed to be lost.

This means that while new demand exists, the fear of future supply returning is balancing out bullish momentum. As a result, Bitcoin is not seeing the strong price growth many expected.

Massive Bitcoin Redistribution Adds Selling Pressure

On-chain data shows that around 13 to 14 million BTC have already moved in this market cycle, marking the largest redistribution in Bitcoin’s history.

Despite this massive movement, Bitcoin did not see a full crash. This shows the market has already absorbed a large amount of supply.

Because of this, fears about another 3 to 4 million BTC returning in the future may have a smaller impact than many expect.

Bitcoin Price Liquidations Trigger Market Panic

Bitcoin price also reacted after the Fed decided to keep interest rates unchanged. This added pressure on the market. Coinglass data shows that around $223 million was liquidated in the last.

Meanwhile, Bitcoin alone saw a liquidation of $78 million after falling below its important 200-week EMA level near $68,000.

As of now, Bitcoin is trading near $66,900, showing continued weakness in market momentum.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Top Crypto Presale 2026: DOGEBALL Stage 1 at $0.0003 With a Structured $0.015 Launch Model