BitPay Statistics 2026: Market Growth Revealed

As cryptocurrency continues to gain traction worldwide, BitPay has emerged as one of the leading payment service providers, enabling seamless crypto transactions. The evolution of this platform has mirrored the rapid rise of digital currencies, especially Bitcoin, offering businesses and consumers alike the ability to transact globally with low fees, enhanced security, and growing adoption.

Today, BitPay’s role as a crypto payment processor is more vital than ever, with increasing usage, new features, and expanding integrations. Understanding the trends and statistics surrounding BitPay offers valuable insights into the broader cryptocurrency payment ecosystem.

Editor’s Choice

- Stablecoins made up 40% of total BitPay payment volume, with USDC among the leading assets.

- Bitcoin accounted for about 42% of crypto transactions on BitPay, while the usage reached 36% of customers.

- BitPay Wallet surpassed 12.4 million global downloads with a 17% increase in daily active users.

- While BitPay’s standard merchant pricing ranges between 1–2% per transaction, effective blended fees may vary depending on merchant volume and settlement terms.

- E-commerce represents 48% of BitPay transactions, with travel at 18%, luxury at 14%, B2B at 13%, and retail in-store at 6%.

Recent Developments

- Polygon (MATIC) transactions grew another 24%, keeping it in the top 5 altcoins on BitPay by payment count.

- Bitcoin Lightning Network payments through BitPay increased by 21%, representing roughly 14% of all Bitcoin transactions on the platform.

- BitPay Prepaid Card usage expanded to 130+ countries, with card loads rising 27% year over year.

- Crypto donations processed by BitPay grew 34%, surpassing $100 million in cumulative giving for environmental and social causes.

- BitPay-maintained carbon offset initiatives crossed $3.5 million in funded projects, keeping net emissions at 0.

- Strategic partnerships, including neobank and fintech integrations, boosted cross-platform spending by 20% and extended BitPay’s reach to over 180 countries.

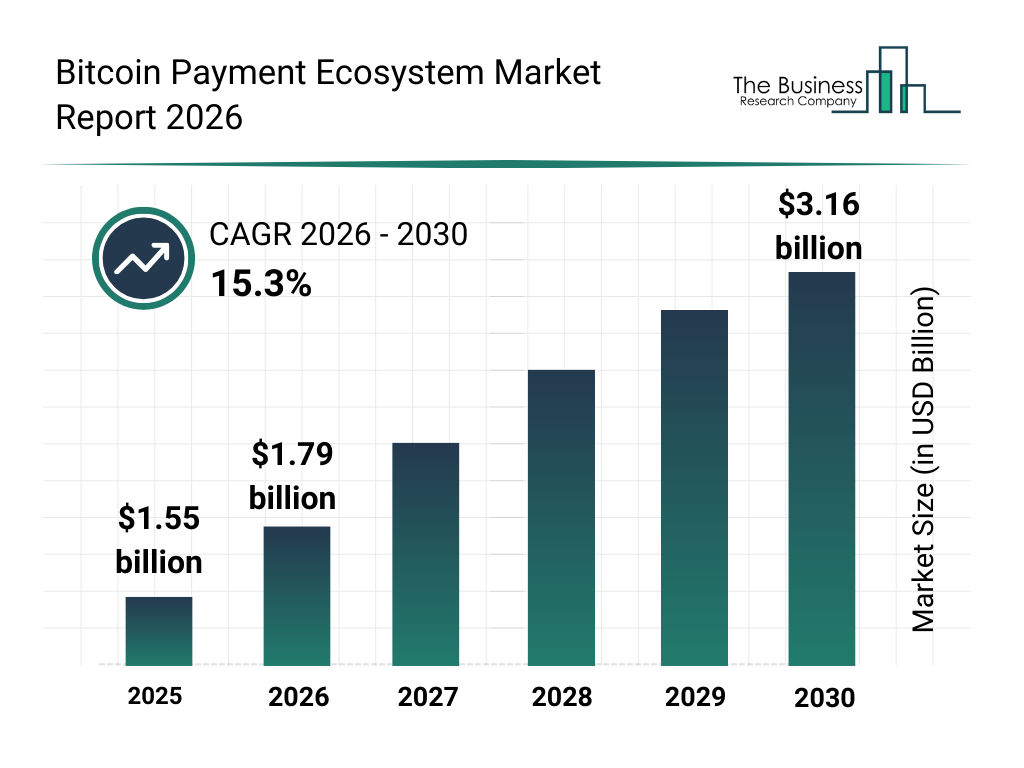

Bitcoin Payment Ecosystem Market Growth Forecast

- The global Bitcoin payment ecosystem market is projected to grow from $1.55 billion in 2025 to $3.16 billion by 2030, more than doubling within five years.

- Market size is expected to reach approximately $1.79 billion in 2026, reflecting strong early-stage expansion.

- By 2027, the market is forecast to surpass the $2 billion milestone, signaling accelerating mainstream adoption.

- Continued growth could push the market to around $2.35 billion in 2028, driven by increasing merchant acceptance and payment infrastructure.

- In 2029, the sector is projected to approach $2.75 billion, highlighting sustained enterprise and consumer demand.

- The industry is expected to achieve a robust compound annual growth rate (CAGR) of 15.3% from 2026 to 2030.

- Rapid growth reflects rising use of cryptocurrency payments for retail, cross-border transactions, and digital commerce.

- Expansion is supported by improvements in payment processing technology, regulatory clarity, and institutional participation.

(Reference: The Business Research Company)

(Reference: The Business Research Company)

BitPay’s Top Coins by Transaction Count

- Litecoin (LTC) remains BitPay’s most used coin with about 200,000+ transactions annually, accounting for roughly 35–40% of payment counts.

- Bitcoin (BTC) holds second place with an estimated 130,000+ transactions, representing around 25–30% of BitPay payments.

- Ethereum (ETH) processes roughly 55,000–60,000 transactions per year on BitPay, or about 10–12% of total counts.

- Dogecoin (DOGE) and USD Coin (USDC) each record around 30,000+ transactions, together contributing about 10–12% of usage.

- Stablecoins (mainly USDC and USDT) now power nearly 20% of BitPay transactions by count, up from low double digits previously.

- Across the last 6 months, BitPay handled 334,486 transactions, with its top 5 coins representing over 80% of this activity.

Industry and Sector Distribution of Payments

- E-commerce still drives 48% of BitPay transactions, with an average transaction size of $390 across channels.

- Travel and tourism represents 18% of total payments as users increasingly book flights and hotels with crypto.

- Luxury goods account for 14% of payment volume, with 1 in 5 BitPay transactions tied to high-end purchases.

- B2B payments contribute 13% of transactions, supported by 14% year-over-year growth in crypto-based settlements.

- Retail (in-store) payments make up 6% of BitPay transactions, reflecting gradual physical point-of-sale adoption.

Impact of Crypto Price Fluctuations on Spending

- During high Bitcoin volatility, BitPay recorded a 26% increase in stablecoin usage, such as USDC, as users avoided price swings.

- Ethereum transactions fell 6.5% at peak volatility, underscoring user caution with more unstable assets.

- When Bitcoin dipped below $38,000 in mid‑year, overall crypto spending slid 9% as many users paused activity.

- Stablecoin payments spiked 33% during the early‑year correction, as merchants and buyers pivoted to price-stable options.

- Altcoin transactions rose 11% in periods of Bitcoin downturns, showing diversification in consumer payment behavior.

- Bitcoin still captured 84% of total BitPay volume, maintaining dominance despite frequent market volatility.

BitPay User Demographics by Age Group

- The largest BitPay user segment is the 25-34 age group, making up 31.58% of website visitors.

- Users aged 35-44 represent 20.99% of the total audience, reflecting strong mid‑career interest in crypto payments.

- The 18-24 age group accounts for 19.39% of users, highlighting rising adoption among younger adults.

- Around 12.53% of BitPay users fall in the 45-54 age bracket, showing moderate engagement from older professionals.

- The 55-64 cohort contributes 9.39% of the user base, indicating a smaller but notable share of late‑career users.

- Older people aged 65+ make up the smallest group at 6.12% of overall BitPay website visitors.

BitPay Acceptance Fees and Cost Structure

- BitPay now uses tiered pricing, charging between 1–2% + $0.25 per transaction based on monthly volume, versus typical card fees of 2.5–3.5%.

- Merchants processing under $500,000 per month pay 2% + $0.25 per transaction, still below many card processors’ blended rates.

- Mid‑volume merchants handling $500,000–$999,999 monthly pay 1.5% + $0.25 per transaction under BitPay’s model.

- High‑volume merchants processing $1 million+ per month qualify for the lowest 1% + $0.25 per‑transaction fee tier.

- BitPay’s crypto processing fees remain on average 1–2 percentage points cheaper than common credit card rates, ranging 2–6%.

- International payments via BitPay can save businesses up to 5% versus traditional cross‑border options such as wires.

- BitPay Wallet users pay 0 network fees on internal wallet‑to‑wallet payments, encouraging low‑cost P2P transfers.

- Settlement fees for receiving fiat payouts are absorbed in 22 countries, improving effective net margins for merchants.

Bitcoin and Altcoin Transaction Shares

- Bitcoin currently represents about 42% of BitPay transactions by count, reflecting a shift toward greater diversification.

- Litecoin (LTC) accounts for roughly 38% of BitPay payment counts, making it the top-used crypto on the platform.

- Ethereum (ETH) holds around a 10–11% share of transactions, driven by its broad ecosystem and smart contract utility.

- Dogecoin (DOGE) captures about 7–8% of BitPay transactions, underscoring its role in community-driven and micro-payments.

- Stablecoins (mainly USDC and USDT) now power close to 20% of total BitPay payments and payouts by volume.

- Altcoins and non-Bitcoin assets are used by 36% of BitPay customers, with altcoin transactions rising 11% during Bitcoin price downturns.

- Ethereum-based stablecoins comprise about 5.4% of total transaction counts, reflecting continued demand for price-stable options.

Features That Enhance User Experience

- BitPay’s Payment Verification Protocol now delivers a 99.98% transaction success rate, virtually eliminating failed payments.

- The BitPay Card supports fee‑free domestic spending at over 100 million Visa locations worldwide.

- Mobile wallet enhancements drove a 17% rise in daily active users and helped push downloads beyond 12.4 million.

- Instant crypto‑to‑fiat settlement moves funds to merchant bank accounts in 1 business day while shielding against volatility.

- BitPay Wallet supports 38+ cryptocurrencies, enabling full multi‑asset management in a single interface.

- The BitPay Invoice Tool processed 26% more invoices year over year, streamlining B2B and services billing.

- QR code payments jumped 24% for in‑store purchases, accelerating checkout for retail users.

Key Payment Innovations and Security Features

- BitPay’s multi-signature wallet support helped secure over $2.5 billion in annual crypto flow for business users.

- The BitPay API now delivers sub-second payment notifications, improving real-time tracking and operational efficiency.

- Mandatory two-factor authentication (2FA) reduced unauthorized access incidents by around 40% across BitPay accounts.

- Cold storage capacity expanded by 40%, strengthening custodial security for high-volume merchants.

- Ledger hardware wallet integration now protects funds for 480,000+ users via offline storage.

- End-to-end encryption covered 100% of processed transactions, ensuring complete data protection on the platform.

BitPay vs. PayPal: A Comparative Analysis

- BitPay’s processing fee averages 1–2%, while standard PayPal merchant fees typically range from 2.9–4.5%, depending on country and transaction type.

- BitPay supports 30+ cryptocurrencies, whereas PayPal’s core app directly supports 4 major coins for buy/hold/spend.

- BitPay offers near‑instant crypto settlement, while PayPal fiat withdrawals from crypto sales can still take 1–3 business days.

- BitPay serves 100,000+ merchants globally, compared with PayPal’s network of over 30 million business accounts.

- Cross‑border payments via BitPay can be up to 5% cheaper than traditional methods, while PayPal adds extra FX and international fees.

- PayPal’s U.S. users can buy up to $100,000 of crypto per week, while BitPay supports higher, large‑ticket merchant transactions without such low caps.

- PayPal Pay with Crypto charges an introductory 0.99% fee (rising toward 1.5%), broadly comparable to BitPay’s low‑single‑digit crypto processing fees.

Frequently Asked Questions (FAQs)

Nearly 40% of all BitPay payments and payouts are made with stablecoins such as USDC and USDT.

The average BitPay transaction size is about $390–$800, depending on the reporting period.

E-commerce accounts for about 48% of BitPay transactions, while retail in‑store payments make up around 6%.

BitPay Wallet has surpassed 12.4 million global downloads.

Conclusion

BitPay continues to drive innovation in the cryptocurrency payment space, providing both businesses and consumers with secure, efficient, and low-cost solutions for digital transactions. With the growing acceptance of cryptocurrency across various industries, BitPay’s role is likely to expand, offering even more diverse features and integrations. The platform’s commitment to security, cost-effectiveness, and user experience ensures that it will remain a key player in the rapidly evolving landscape of crypto payments.

The post BitPay Statistics 2026: Market Growth Revealed appeared first on CoinLaw.

You May Also Like

Do You Need a Lawyer to Start a Company in Los Angeles?

Microsoft Corp. $MSFT blue box area offers a buying opportunity