Why is Bitcoin difficulty surging at its fastest pace since 2021?

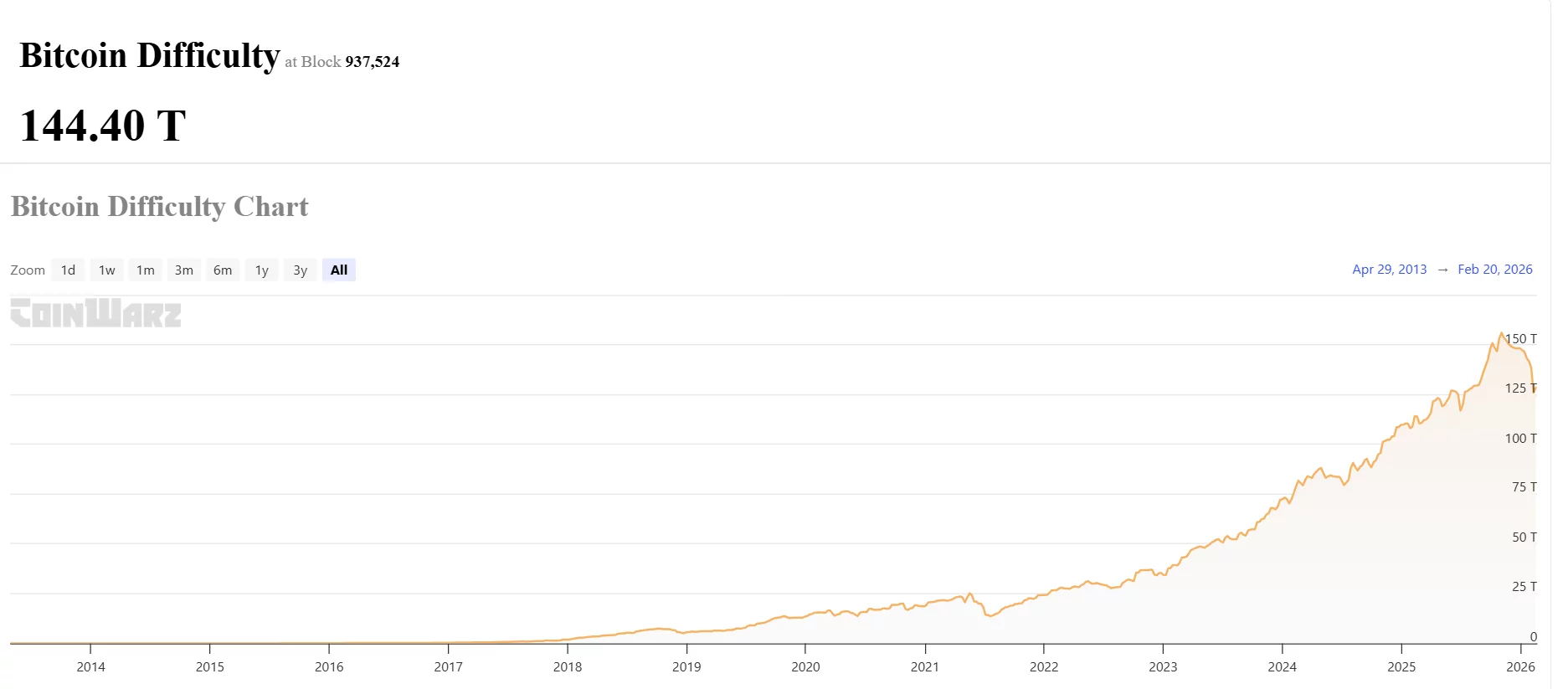

Bitcoin’s mining difficulty has climbed to 144.40 trillion (T) at block 937,524, marking one of the sharpest accelerations in network competition since the 2021 bull cycle.

- Bitcoin’s mining difficulty has climbed to 144.40 trillion at block 937,524, marking one of the fastest accelerations in network competition since the 2021 bull market.

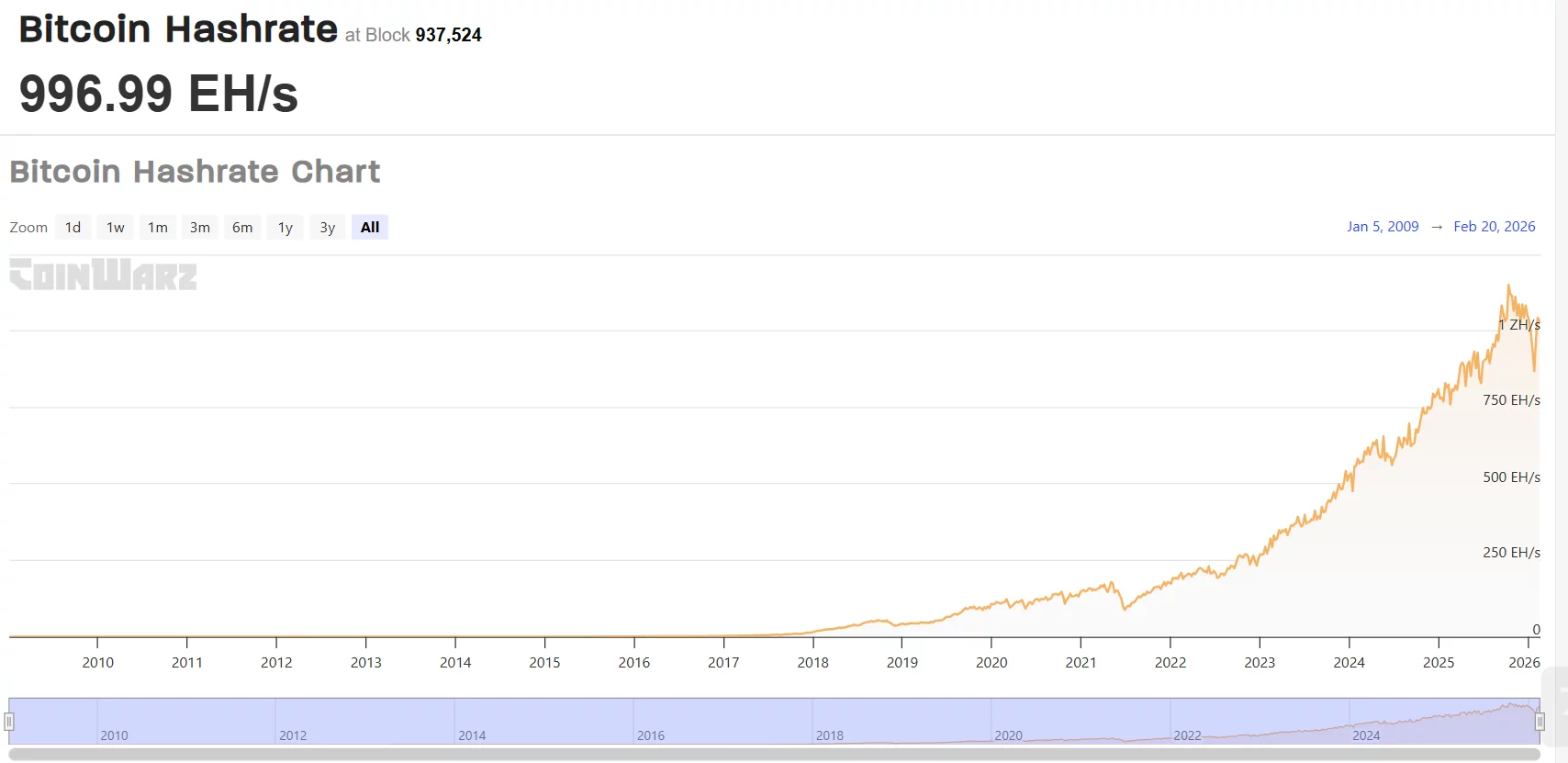

- Total hashrate has jumped to 996.99 EH/s, just shy of the 1 zettahash per second (ZH/s) threshold, reflecting a sharp expansion in mining power through 2024 and 2025.

- While rising hashrate and difficulty strengthen network security and signal miner confidence, rapid growth could squeeze margins for smaller operators if Bitcoin’s price fails to keep pace.

At the same time, Bitcoin’s (BTC) total hashrate has surged to 996.99 EH/s, hovering just below the symbolic 1 zettahash per second (ZH/s) milestone.

For context, Bitcoin difficulty is an adjustment mechanism that ensures blocks are mined roughly every 10 minutes. When more computing power joins the network and hashrate rises, the protocol automatically increases difficulty to maintain that steady issuance schedule.

Bitcoin hashrate refers to the total computing power being used by miners to process transactions and secure the network. A higher hashrate means more machines are competing to validate blocks, making the network stronger and more resistant to attacks.

The two metrics are tightly linked, and together they help explain why the network is seeing its fastest pace of growth in years.

Bitcoin hashrate near 1 ZH/s

The hashrate chart shows a steep climb through 2024 and 2025, with computational power accelerating sharply in recent months. After dipping during prior market downturns, the network has staged a powerful recovery, pushing toward 1,000 EH/s or nearly 1 ZH/s a historic threshold for Bitcoin.

When hashrate rises rapidly, it signals that miners are deploying more machines and bringing new facilities online. This expansion is typically driven by improved profitability, access to capital, and infrastructure scaling.

The current pace mirrors the aggressive buildout last seen during the 2021 rally.

Bitcoin difficulty follows higher

Bitcoin’s difficulty adjusts roughly every two weeks to ensure blocks are mined every 10 minutes. As hashrate rises, the protocol increases difficulty to maintain balance.

The difficulty chart reflects that dynamic. After a brief pullback from a recent peak near the 150T level, difficulty remains elevated at 144.40T, a level that represents a dramatic increase from just a few years ago. The slope of the curve over the past year is among the steepest on record.

This sharp upward trend signals intense competition among miners, with more computational power chasing a fixed block reward.

Historically, sustained increases in hashrate and difficulty are seen as long-term bullish indicators. They reflect miner confidence and make the network more secure and resilient.

However, rapid difficulty growth can compress margins, particularly for smaller or higher-cost operators. If Bitcoin’s price does not keep pace with rising competition, weaker miners may face pressure, potentially leading to consolidation.

You May Also Like

Strategy CEO to discuss Bitcoin with Morgan Stanley’s digital asset head next week

Stablecoin Yield ‘Effectively Off The Table’: White House Narrows Rewards Debate In Latest Meeting