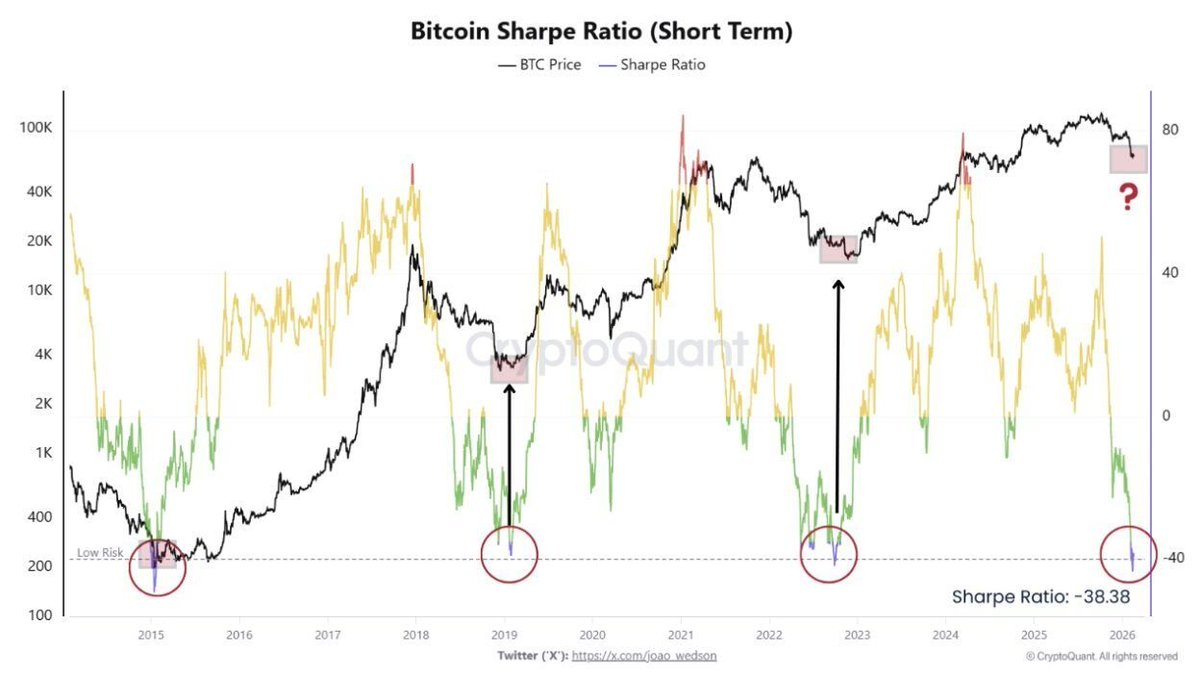

Bitcoin Sharpe Ratio Crashes to Historic “Low Risk” Zone

Bitcoin’s short-term Sharpe Ratio has dropped to one of the lowest levels on record, signaling extreme risk-adjusted underperformance. Historically, similar deeply negative readings have appeared during periods of heavy market stress and capitulation.

In previous cycles, these moments often aligned with long-term accumulation zones that preceded major bull markets. The current reading is now drawing attention as it matches those earlier inflection points.

According to a tweet from Michaël van de Poppe, Bitcoin’s short-term Sharpe Ratio has dropped to -38.38, a level that historically marked major accumulation zones.

The Sharpe Ratio measures risk-adjusted returns. When it turns deeply negative, it signals that Bitcoin has underperformed so severely on a risk-adjusted basis that conditions may be historically attractive for long-term entries.

Source: https://x.com/CryptoMichNL/status/2025101261784199502

Source: https://x.com/CryptoMichNL/status/2025101261784199502

A Pattern Seen Before Major Bull Runs

Van de Poppe highlights that similar extreme negative readings occurred in:

- Early 2015

- Early 2019

- Late 2022

Each of those periods preceded significant bull markets. On the chart, previous dips into deeply negative territory were followed by strong upside moves, suggesting that extreme pessimism often aligns with opportunity.

Bitcoin vs. Gold Imbalance

The recent correction has pushed Bitcoin significantly lower relative to Gold. This divergence suggests that markets may be temporarily out of balance between risk assets and safe havens.

In this context, the Sharpe Ratio becomes a key signal. When risk-adjusted performance collapses to such extreme levels, it historically marked periods where downside was largely exhausted.

What It Could Mean

If historical patterns hold, the current reading may represent another “low risk” accumulation zone. While short-term volatility remains elevated, previous instances of similar Sharpe Ratio crashes preceded strong multi-month and multi-year advances.

The takeaway from the chart is clear: extreme negative Sharpe Ratio readings have historically aligned with major turning points, and the current level is one of the lowest on record.

The post Bitcoin Sharpe Ratio Crashes to Historic “Low Risk” Zone appeared first on ETHNews.

You May Also Like

Vitalik Buterin’s Strategic Decisions Cause Stir in Crypto Markets

XRP Just Flashed the Same Signal Before a 114% Explosion