Bitcoin and Ethereum ETFs Record Five Consecutive Weeks of Outflows Totaling Billions

TLDR

- US spot Bitcoin ETFs have seen five straight weeks of outflows, totaling $3.8 billion withdrawn

- Last week alone saw $315.9 million leave Bitcoin ETFs during a shortened trading week

- Ether ETFs also posted five consecutive weeks of outflows, losing about $1.39 billion over that stretch

- SOL and XRP ETFs bucked the trend, posting modest inflows of $14.3 million and $1.8 million

- Analysts say the selling reflects institutional de-risking tied to macro uncertainty, not a collapse in long-term interest

US spot Bitcoin ETFs have now recorded five straight weeks of net outflows, the longest such streak since early 2025. The total pulled from these funds over the five-week period has reached approximately $3.8 billion.

Last week’s outflows came to about $316 million across a four-day trading week, shortened by the Presidents’ Day holiday. The first three sessions of the week were all negative.

Tuesday saw roughly $105 million leave the funds. Wednesday and Thursday added another $133 million and $166 million in outflows respectively.

Friday offered some relief. About $88 million flowed back in, led by BlackRock’s IBIT at $64.5 million and Fidelity’s FBTC at $23.6 million. It wasn’t enough to flip the week positive.

The heaviest single weeks in the streak came in late January. The funds shed $1.33 billion and $1.49 billion in back-to-back weeks at that time. The past three weeks have been more moderate by comparison.

Since launching in January 2024, Bitcoin ETFs still hold around $54 billion in total cumulative net inflows. Total net assets across all products sit near $85.3 billion.

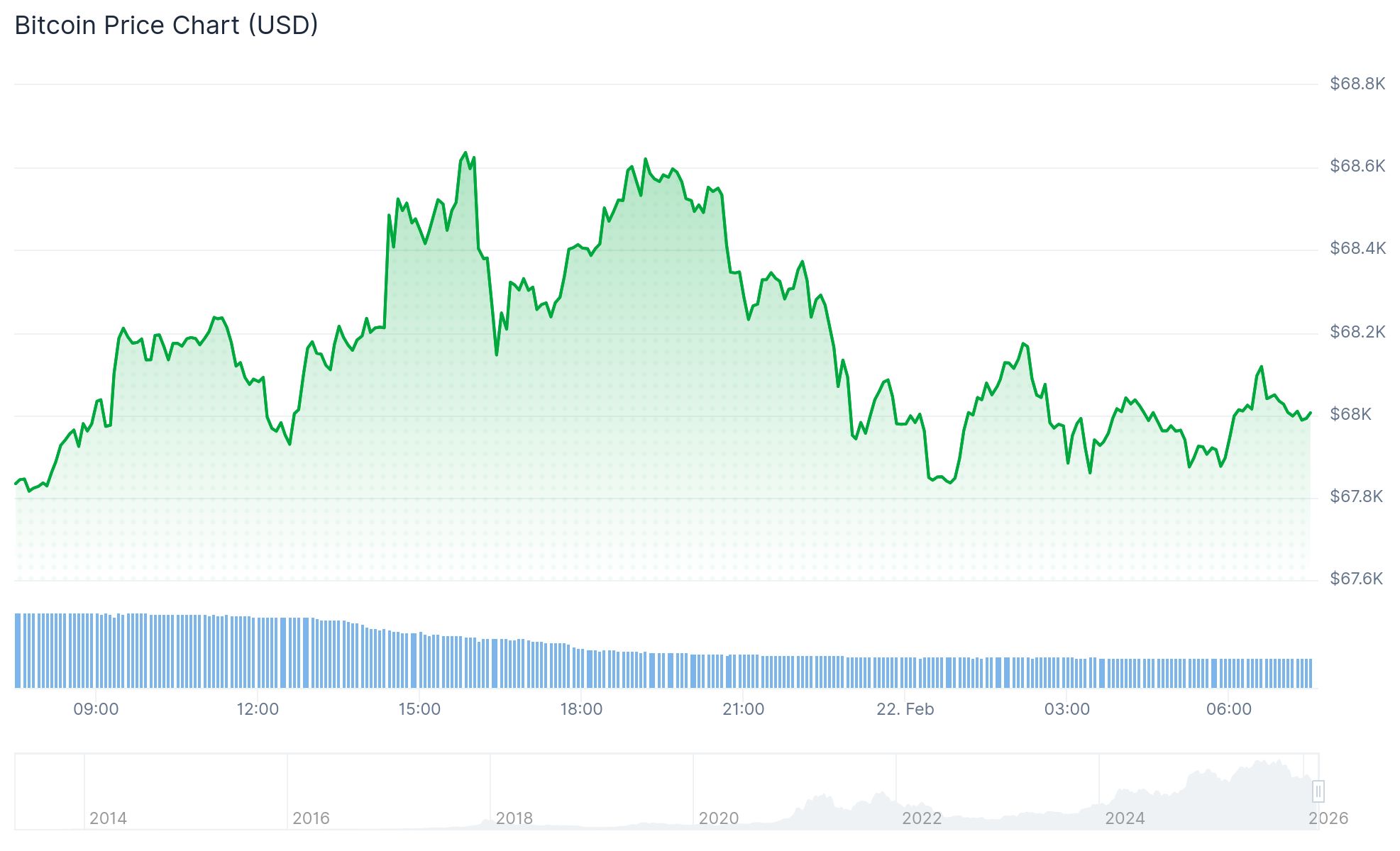

Bitcoin (BTC) Price

Bitcoin (BTC) Price

Bitcoin is currently trading around $68,600, down more than 20% year-to-date. That puts it below what on-chain analytics firm Glassnode calls the “True Market Mean” of around $79,000.

21Shares head of macro Stephen Coltman said bulls want to see $65,000 hold as a floor. He added that a sustained move above $70,000 would suggest the recent selling has run its course.

Ether ETFs Also Under Pressure

Spot Ethereum ETFs have followed a similar pattern. They posted five consecutive weeks of outflows as well, with last week’s losses coming to about $123 million.

The five-week outflow total for Ether ETFs stands at roughly $1.39 billion. Some positive days were mixed in, but heavier selling earlier each week kept totals in the red.

SOL and XRP ETFs Move in the Opposite Direction

Not all crypto ETFs are seeing the same pressure. Spot Solana ETFs took in about $14.3 million last week, continuing a streak of consistent inflows. Bitwise’s BSOL leads the SOL ETF category by assets under management.

XRP ETFs added a modest $1.8 million for the week. These products have drawn steady demand since launching in November.

Analysts at BRN described the current environment as one of “fatigue, not panic.” They noted that crowded short positioning and compressed volatility could set up a sharp move in either direction.

Vincent Liu, CIO at Kronos Research, said flows may remain unstable in the near term due to geopolitical tensions and trade disputes keeping markets in a risk-off mode.

The post Bitcoin and Ethereum ETFs Record Five Consecutive Weeks of Outflows Totaling Billions appeared first on CoinCentral.

You May Also Like

‘One Battle After Another’ Becomes One Of This Decade’s Best-Reviewed Movies

XMR Technical Analysis Feb 22