Institutions Pile Into Ethereum As Futures Open Interest And ETF Inflows Leave Bitcoin Rivals In The Dust

Institutional adoption of Ethereum is accelerating at a pace that now eclipses Bitcoin, with ETH futures open interest topping $10 billion and spot ETH ETFs seeing inflows ten times higher than their BTC rivals.

The total notional open interest (OI) in ETH futures recently crossed above $10 billion for the first time on record, according to the CME Group. Notional OI represents the total dollar value of active or open contracts at any given time.

“We’re certainly seeing a resurgence and renewed enthusiasm in Ether futures — especially as it relates to institutional participation,” CME Group’s global head of cryptocurrency products, Giovanni Vicioso, told CoinDesk.

Large Open Interest Holder Count Hits A New Record

The CME offers standard-sized contracts of 50 ETH as well as micro-sized contracts of 0.1 ETH. Earlier this month, the number of large open interest holders, who hold at least 25 ETH contracts at a given time, reached a record of 101.

That, according to Vicioso, “signals a strengthening of the institutional and professional ecosystem around ether.”

Other metrics have also soared to record levels, including the number of open micro ETH contracts, which exceeded 500,000. ETH notional options open interest recently broke above $1 billion as well.

Meanwhile, the number of contracts for ETH options OI reached a year-to-date high of more than 4,800.

“As far as broader trends around the surge, increased network activity, corporate treasury accumulation of ether, and positive regulatory developments have further contributed to a broad-based rally around ether and ether-based derivatives,” Vicioso said.

Ethereum ETFs Leave Bitcoin ETFs Trailing In The Dust

In addition to the soaring futures OI, surging on-chain metrics, and ongoing corporate accumulation, US spot ETH ETFs have also been on a multi-day inflows streak that has seen them outperform their Bitcoin counterparts by 10-to-1.

Since Aug. 21, the ETH products have seen an impressive $1.83 billion in inflows. This is ten times more than the $171 million that spot Bitcoin ETFs recorded during the same period, according to data from CoinGlass.

That outperformance was also seen in the latest trading session. Yesterday, the nine Ethereum funds posted $310.3 million in inflows, while the eleven spot Bitcoin ETFs saw just $81.1 million on the day.

ETH has also surged more than 7% in the last week, while BTC’s price slipped in the last seven days.

Network Activity Surges As Crypto Industry Gains Regulatory Clarity

Accompanying the soaring futures OI is an uptick in on-chain activity for Ethereum.

According to data from YCharts, the number of ETH transactions per day is around 1.6 million. While this is around a 2% drop from the 1.633 million transactions seen yesterday, it’s an over 43% increase from where the metric stood at a year ago at the same time.

Back then, daily transactions stood at around 1.114 million.

Earlier this month, the number of daily transactions on the Ethereum network soared to a new record high of approximately 1.875 million.

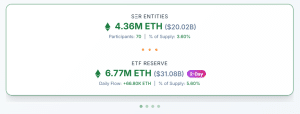

Several institutions have also started to rapidly accumulate Ethereum as part of a treasury strategy. As of Aug. 28, 70 companies have added the altcoin to their balance sheets, according to data from StrategicETHReserve.

The biggest ETH treasury firm is BitMine Immersion Technologies, which holds 1.7 million ETH valued at around $7.87 billion. SharpLink Gaming, the company who Ethereum co-founder Joe Lubin is a shareholder of, holds 797.7K ETH worth approximately $3.66 billion.

ETH treasury statistics (Source: StrategicETHReserve)

Collectively, all of the treasury companies hold 4.36 million ETH tokens, which equates to 3.6% of its supply.

That’s as analysts, including VanEck CEO Jan van Eck, predict that Ethereum is poised to benefit from the recently passed GENIUS Act, a key bill that establishes the requirements for stablecoin issuers in the US to follow.

That Act is one of the first bills to provide the crypto industry with long-awaited regulatory clarity.

VanEck’s CEO predicts that the bill will kickstart a stablecoin race, where banks and institutions will rush to adopt the technology.

Ethereum, which is currently the preferred chain for stablecoin issuers with an over 50% share of the stablecoin market, is predicted to maintain its first-mover advantage.

You May Also Like

LMAX Group Deepens Ripple Partnership With RLUSD Collateral Rollout

Pastor Involved in High-Stakes Crypto Fraud