Robert Kiyosaki Warns of European Bond Market Collapse, Recommends Gold and Bitcoin

TLDR

- Robert Kiyosaki warns of major financial collapse in Europe, with European bonds down 24% and British bonds falling 32%

- France faces potential bankruptcy and civil unrest similar to Bastille Day, according to Kiyosaki

- Japan and China are selling U.S. bonds to buy gold and silver instead

- Gold futures hit record high of $3,500 while Bitcoin falls below $108,000 under selling pressure

- Kiyosaki recommends investors save gold, silver, and Bitcoin as safe havens during economic crisis

Robert Kiyosaki has issued fresh warnings about a coming financial crisis across Europe and the United States. The Rich Dad Poor Dad author says European bonds have crashed 24% while British bonds dropped 32%.

Kiyosaki describes Europe as “toast” in his latest social media posts. He predicts France will face bankruptcy and civil unrest similar to the historic Bastille Day revolt.

The veteran investor points to major bond market declines as evidence of the crisis. U.S. Treasury bonds have fallen 13% since 2020, he notes.

According to Kiyosaki, both Japan and China are dumping U.S. bonds. These countries are buying gold and silver instead of holding American debt.

Bond Market Pressure Builds

Kiyosaki criticizes traditional financial planning advice during this period. He specifically targets the common 60/40 portfolio split between bonds and stocks.

The author warns that “nothing is safe” in current market conditions. He sees the bond sell-offs as a sign of deeper economic problems.

France appears to be at particular risk according to Kiyosaki’s analysis. He suggests the country faces both financial collapse and social upheaval.

Germany also faces potential civil unrest, Kiyosaki claims. He sees widespread instability across European nations.

The United States has become the largest debtor nation in history. This debt burden creates systemic risks for the American economy.

Gold Reaches New Heights While Bitcoin Struggles

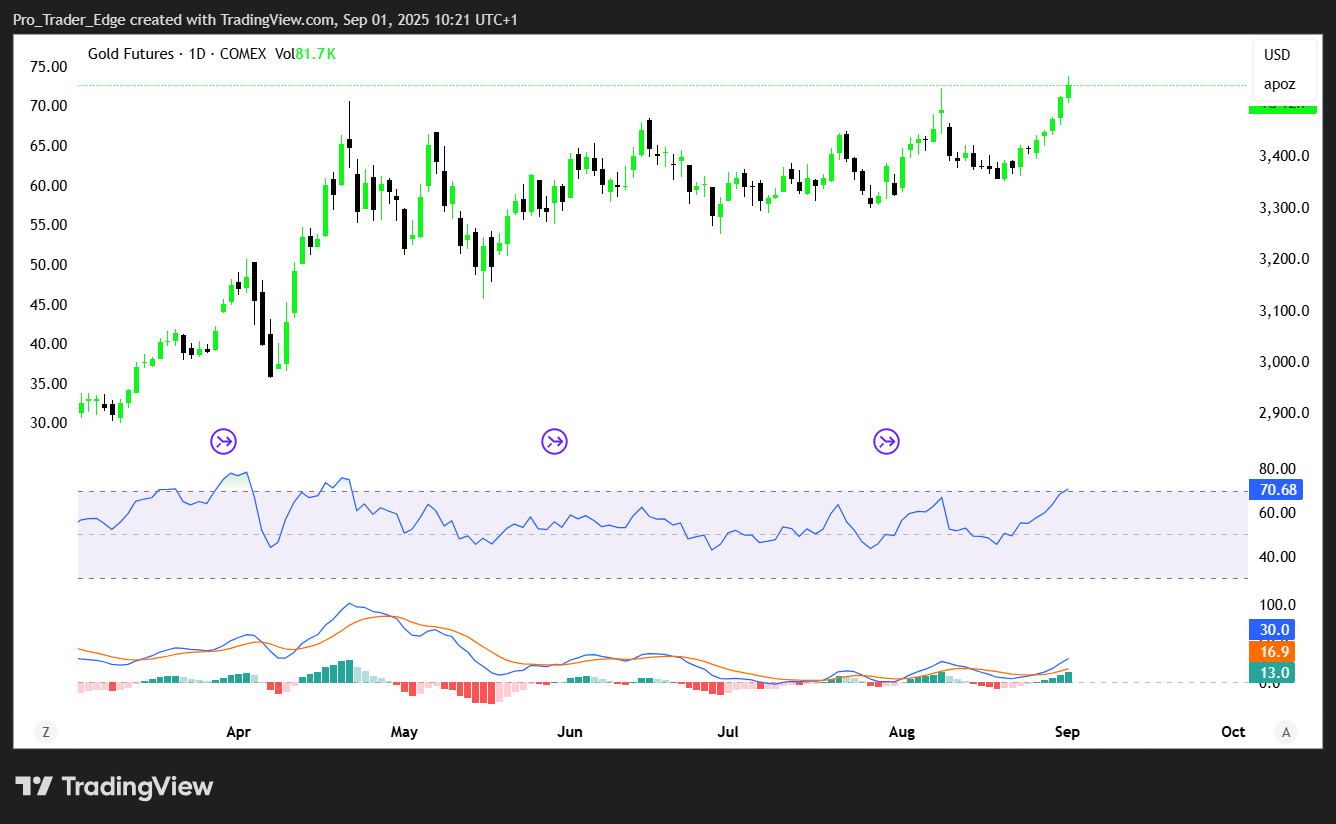

Gold futures recently touched a record high of $3,500 per ounce. Silver prices have also reached 14-year highs during this uncertainty.

Source: TradingView

Source: TradingView

Bitcoin tells a different story despite Kiyosaki’s endorsement. The cryptocurrency has fallen below $108,000 and faces continued selling pressure.

Monthly gains for Bitcoin in August have been completely erased. The digital asset now trades more than 15% below its all-time high.

Bitcoin critic Peter Schiff has questioned Bitcoin’s performance compared to gold. He notes Bitcoin remains 13% below its record high while gold sets new peaks.

Banking giant JPMorgan stated last week that Bitcoin appears undervalued relative to gold. This creates questions about Bitcoin’s role as a hedge asset.

Long-term Bitcoin holders have been selling their positions recently. Many have moved funds from Bitcoin into Ethereum in a capital rotation.

Kiyosaki maintains his recommendation for gold, silver, and Bitcoin despite Bitcoin’s recent weakness. He sees all three assets as protection against the financial crisis he predicts.

The post Robert Kiyosaki Warns of European Bond Market Collapse, Recommends Gold and Bitcoin appeared first on CoinCentral.

You May Also Like

The Channel Factories We’ve Been Waiting For

How ZKP’s Daily Presale Auction Is Creating a New Standard for 1,000x Returns