Crypto.com CEO Predicts Strong Q4 if Fed Cuts Rates at September Meeting

Crypto.com CEO Kris Marszalek expects a strong fourth quarter for digital assets if the Federal Reserve (Fed) cuts interest rates at its September 17 meeting, citing improved market conditions and increased liquidity for risk assets.

The prediction comes as CME futures markets price a 90% probability of rate cuts following Fed Chair Jerome Powell’s dovish speech at Jackson Hole, while crypto markets position for extended rallies amid anticipated monetary easing.

In an interview with Bloomberg, Marszalek revealed that Crypto.com generated $1.5 billion in revenue last year, with $1 billion in gross profit, predicting better performance in 2025 driven by lower borrowing costs and increased institutional adoption.

According to him, top investment banks have approached the exchange regarding a potential IPO, but it remains privately held, enjoying operational flexibility while maintaining a solid balance sheet.

Private Exchange Teases IPO Amid Trump Media Partnership

Marszalek confirmed Crypto.com “has the numbers” for a public listing after multiple approaches from leading investment banks, but emphasized no decisions have been made.

The company reported $300 million in profitability last year after reinvesting $700 million, undoubtedly making it one of the most profitable crypto exchanges, considering public markets.

The exchange announced a partnership with Trump Media and Technology Group on August 26, establishing a treasury strategy for its native Cronos token.

The collaboration extends beyond treasury management to include ETF development, payments infrastructure, and subscription services as part of broader Trump administration crypto initiatives.

Marszalek described the partnership as supporting the administration’s ambitious crypto agenda. He emphasized Crypto.com’s role in executing multibillion-dollar Bitcoin strategies and providing infrastructure for various crypto initiatives.

The CEO addressed potential conflict of interest concerns by noting that Trump’s assets are held in blind trusts, while Crypto.com operates as an independent, publicly traded company.

He stressed that the private company structure enables rapid decision-making and strategic partnerships supporting industry advancement.

Crypto.com plans aggressive expansion into prediction markets, targeting sports betting and political events through CFTC-regulated infrastructure.

Fed Rate Cut Optimism Drives Q4 Crypto Rally Expectations

Powell’s Jackson Hole remarks triggered widespread forecast revisions, with Morgan Stanley, Barclays, BNP Paribas, and Deutsche Bank now expecting September rate cuts.

The Fed Chair acknowledged labor market weakening, citing July’s disappointing 73,000 payroll additions and downward revisions to previous months.

Earlier last month, Treasury Secretary Scott Bessent called for 50 basis point cuts following “incredible” inflation data, which is a shift from the Fed’s hawkish stance.

July consumer price index rose 0.2% monthly and 2.7% annually, below expectations, while core CPI reached 3.1% yearly.

However, market optimism faces potential headwinds from excessive social sentiment around rate cuts.

Santiment has recently warned that discussion of “Fed,” “rate,” and “cut” across social platforms reached 11-month peaks, historically indicating euphoric levels that often precede local market tops.

Bitcoin exchange supply accumulation presents concerning signals, with holdings rising approximately 70,000 coins since early June.

The trend reverses sustained patterns of assets being moved into cold storage, potentially indicating increased preparation by holders for liquidation.

The blockchain analytics firm cited that Ethereum’s technical indicators suggest caution, despite its strong price performance, with short-term MVRV nearing 15% and long-term readings at 58.5%.

These levels historically correspond with profit-taking activity and potential retracements before further advances.

Amid all these, the looming replacement of the Fed Chair has sparked some debates. European Central Bank President Christine Lagarde warned that Trump’s undermining of Fed independence would create “very serious danger” for the global economy.

She emphasized that political control over monetary policy would have “very worrying” implications for global economic stability.

Trump intensified criticism of Powell, demanding immediate rate cuts while threatening “major lawsuits” and accusing the Fed Chair of costing America “trillions in interest costs.”

The president maintains tariffs haven’t caused inflation while implementing 40% duties on Brazil and 50% on copper imports.

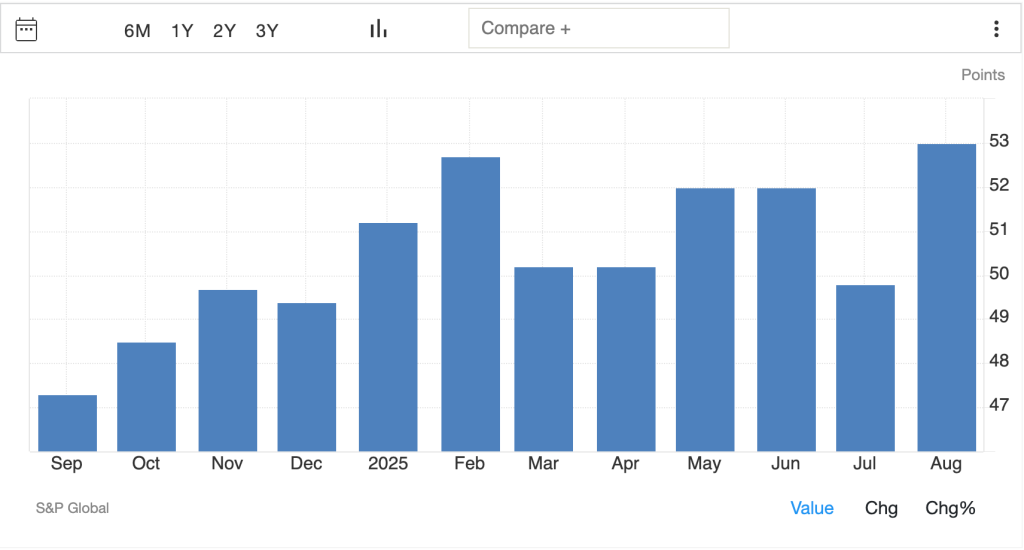

Notably, manufacturing PMI data could influence rate cut timing, with forecasts expecting ISM Manufacturing PMI at 48.9 versus the previous 48.0.

Source: Trading Economics

Source: Trading Economics

Analysts tie the direction of the crypto market to industrial strength, noting that levels below 49.5 could extend correction periods, while improvements support recovery narratives.

You May Also Like

Japan-Based Bitcoin Treasury Company Metaplanet Completes $1.4 Billion IPO! Will It Buy Bitcoin? Here Are the Details

InvestCapitalWorld Updates Platform Features to Support Broader Multi-Asset Market Access