Bitcoin ETFs Pull $332.7M in a Day as Ethereum Sees $135M Outflows — Rotation Back into BTC?

Spot bitcoin exchange-traded funds (ETFs) roared back into the spotlight on Tuesday, attracting $332.7 million in net inflows, even as Ethereum funds posted sharp withdrawals. The move suggests a potential rotation back to Bitcoin after Ethereum dominated ETF flows throughout August.

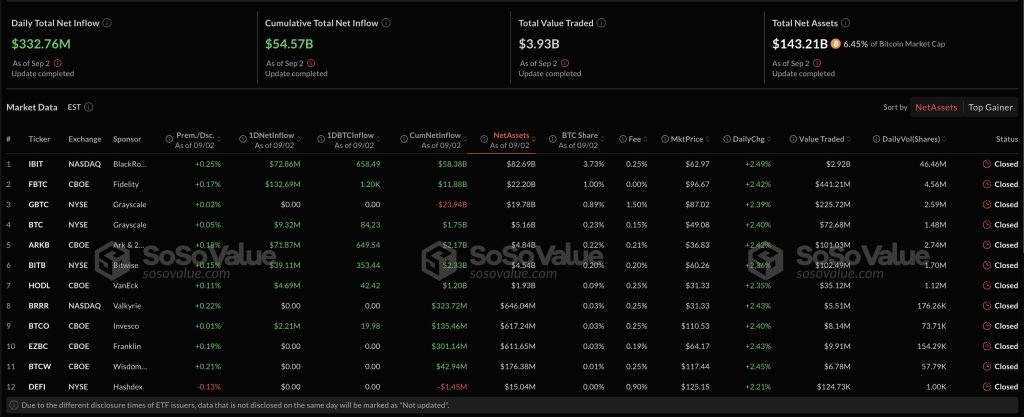

According to SoSoValue, Fidelity’s FBTC led the charge with $132.7 million in inflows, followed by BlackRock’s IBIT at $72.8 million. Other issuers, including Grayscale, Ark & 21Shares, Bitwise, VanEck, and Invesco, also logged gains.

Source: SoSoValue

Source: SoSoValue

In contrast, Ethereum products recorded $135.3 million in daily net outflows, weighed down by Fidelity’s FETH shedding $99.2 million and Bitwise’s ETHW losing $24.2 million.

Ethereum’s August Surge vs. Bitcoin’s September History

August had been Ethereum’s month. Analysts described a “rotational shift” toward ETH, driven by yield-bearing staking, improving regulatory signals, and rising adoption by corporate treasuries.

Ethereum ETFs attracted $3.87 billion in net inflows last month, compared to Bitcoin’s $751 million in outflows. Trading activity showed the divergence, with Ethereum ETF volume surging to $58.37 billion in August, nearly doubling July’s $33.87 billion, while Bitcoin ETF volume dipped slightly to $78.14 billion.

The price action reinforced that enthusiasm. Ethereum notched a new all-time high of $4,953.73 in August, and public company holdings of ETH swelled dramatically. 71 companies disclosed a combined $119.68 billion in Ethereum by August 31st, up from 67 firms with $98.97 billion the prior month.

Bitcoin, by contrast, saw outflows and lagged in performance despite maintaining a far larger total ETF inflow base of $54.24 billion cumulatively.

But September tells a different story. Historically, Ethereum has stumbled during the month: in September 2024, ETH ETFs saw $46.54 million in outflows, registering redemptions in three out of four weeks.

Bitcoin ETFs, meanwhile, posted a $1.26 billion inflow over the same period, benefiting from risk-averse positioning as markets cooled.

What’s Fueling the Rotation from Ethereum to Bitcoin?

Market watchers suggest this September may again favor Bitcoin. Historically, September has been a “cool-down” month for crypto, with ETH often underperforming due to weaker seasonal flows and lower risk appetite. Bitcoin, seen as the safer benchmark asset, typically regains inflows when volatility rises.

Macro forces are also at play. With global central banks signaling caution and bond yields holding firm, investors appear to be trimming higher-risk ETH exposure in favor of Bitcoin, still viewed as the digital reserve asset of choice.

The derivatives market shows the shift. Over the past 24 hours, Ethereum futures saw $1.22 billion in outflows, nearly double Bitcoin’s $646.7 million in outflows, according to Coinglass.

Also, Bitcoin treasuries remain a magnet for institutional flows. As of Sept. 1, weekly bitcoin net inflows totaled 3,102 BTC (about $335.8 million), with Michael Saylor’s MicroStrategy adding 4,048 BTC worth $449 million on Sept. 2 alone.

By contrast, Ethereum treasuries have lagged, with fewer corporate balance sheets disclosing significant ETH allocations despite August’s record price run-up. The gap shows a key reason for the rotation: while ETH may offer yield and programmability, Bitcoin continues to dominate as the go-to institutional treasury asset.

That hunt for yield is exactly where the danger lies, according to Sharplink Gaming co-CEO Joseph Chalom. Speaking on Bankless, Chalom warned that companies piling into Ether to squeeze out extra returns could expose themselves to cascading risks if markets turn.

“There will be people just like in traditional finance who want that last 100 basis points of yield and think it’s riskless,” Chalom said, noting that double-digit ETH yields often carry credit, counterparty, duration, and smart contract risks. The greater concern, he added, is that firms already behind the curve may double down imprudently in an attempt to catch up.

“The sector could be tainted by people that do imprudent things—whether in how they raise capital or in the kind of yield strategies they chase with their ETH holdings,” he cautioned.

As of late Tuesday, Bitcoin rose 0.55% to $110,943, while Ethereum slipped 1% to $4,327. Whether this marks the start of a sustained September rotation back into Bitcoin or just a short-term rebalancing remains the key question hanging over crypto markets.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

![[Tambay] Tres niños na bagitos](https://www.rappler.com/tachyon/2026/01/TL-TRES-NINOS-NA-BAGITOS-JAN-17-2026.jpg)