Acurast Launches ‘Staked Compute’ to Challenge AWS, Azure and Google Cloud with Decentralized Smartphone Network

The post Acurast Launches ‘Staked Compute’ to Challenge AWS, Azure and Google Cloud with Decentralized Smartphone Network appeared first on Coinpedia Fintech News

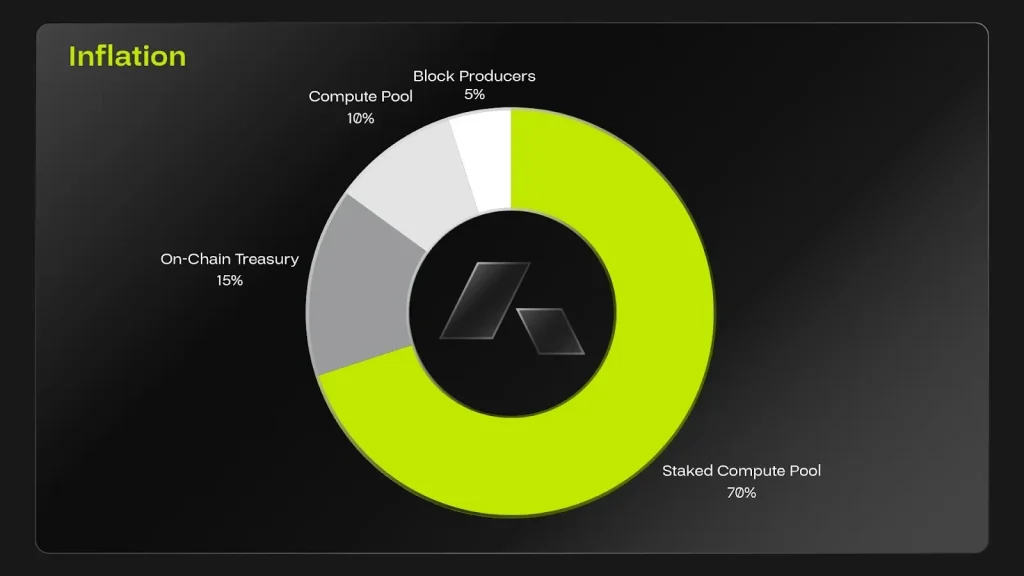

Backed by 119,000+ devices and 360 million transactions, Acurast introduces Staked Compute, aligning smartphone ubiquity with enterprise-grade reliability for decentralized compute.

Decentralized compute and decentralized physical infrastructure network (DePIN) projects have long struggled with reliability and ‘proof-of-hardware’. In the absence of verifiable, device-level assurances, networks have been compromised by virtualized or misreported hardware, resulting in broken deployments and unavailable capacity.

Acurast addresses this head-on by combining smartphone Trusted Execution Environments (TEEs) with a global benchmarking protocol and new stake-based commitments that ensure workloads continue to run.

Under the new design, each participating phone attests to integrity through the device’s TEE, is benchmarked to quantify real capabilities, and can then lock a portion of that capacity for one or more epochs. If a provider meets the commitment, rewards accrue; if they do not, the protocol applies proportional penalties. The result: a service-level mindset for decentralized compute enforced by economics, not a central operator.

Different deployments value different resources, so artificial intelligence (AI) inference might prize sustained compute, while lightweight data-fetching or automation tasks might emphasize availability or residential IP characteristics. In Acurast, benchmarking helps match the right jobs to the right devices, while Staked Compute ensures providers get paid for their reliability rather than just their raw speed.

The network’s natural diversity quickly addresses concerns about centralizing in only high-end devices, as many workloads do not require flagship performance. The global smartphone market is broad, spanning every price tier and manufacturer. This heterogeneity is a feature that allows Acurast to allocate tasks across a wide base, improving resilience while minimizing single-class hardware dependence.

This is not ‘mobile mining’ by another name. Mining burns cycles on synthetic puzzles; Acurast routes compute to productive work, whether that be AI and secure data processing or automation and proof generation. Stake-backed commitments ensure quality of service for builders and businesses alike.

Staked Compute is rolling out with Acurast’s latest protocol release, where providers can participate via the Acurast Processor apps. Developers can also target the network via the Acurast Hub, with full details, parameters, and benchmarking methodology documented in the Acurast docs.

You May Also Like

LMAX Group Deepens Ripple Partnership With RLUSD Collateral Rollout

Pastor Involved in High-Stakes Crypto Fraud