In this article:

1. Guide to completing the activities

2. Conclusion

VOOI is an intent-based, cross-chain aggregator of decentralized derivatives exchanges. The project aims to expand DeFi trading by simplifying access, improving interoperability, and driving innovation across multiple networks. VOOI aggregates liquidity from numerous decentralized exchanges and provides users with convenient access through a single interface.

As of writing, the Points Program campaign is active, where users need to farm points in anticipation of a future airdrop. Points are credited weekly, and the aggregator currently supports three DEXs — Hyperliquid, Orderly, and Ostium. This means that by completing a single activity, you can, for example, also become eligible for a second airdrop from Hyperliquid.

The team raised $1.25 million through an IDO on the Echo platform and also received funding from YZi Labs, although the amount has not been disclosed.

In this guide, we’ll take a closer look at the activity and provide a step-by-step guide to interacting with the platform.

- Go to the website and connect your wallet. Click Deposit, then select Receive EVM Funds and deposit funds on the Arbitrum One network:

Make a deposit. Data: VOOI

- In the Pro section, select Hyperliquid (or another DEX of your choice), then choose a trading pair, set the trade parameters, and execute the trade:

Pro section. Data: VOOI

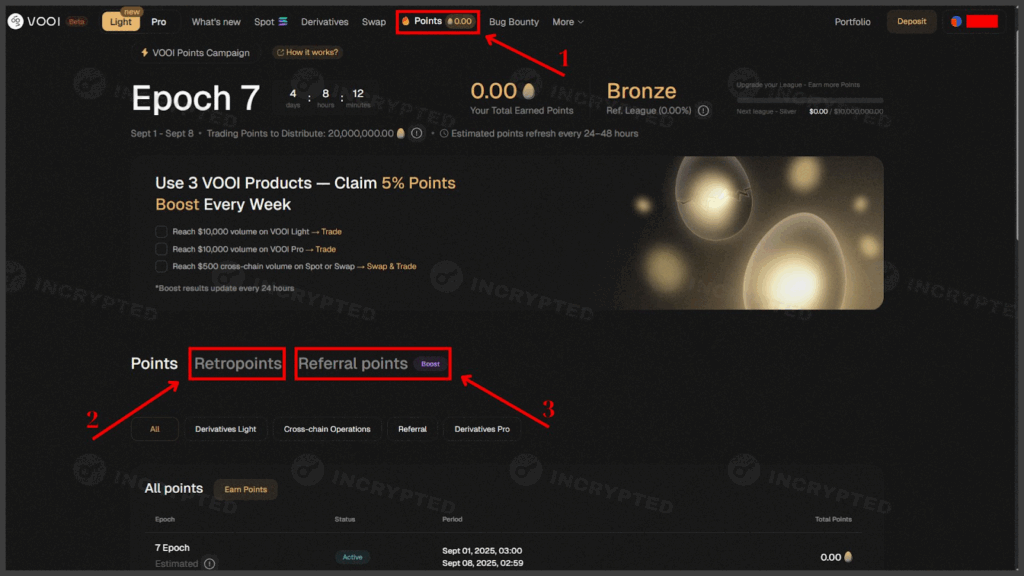

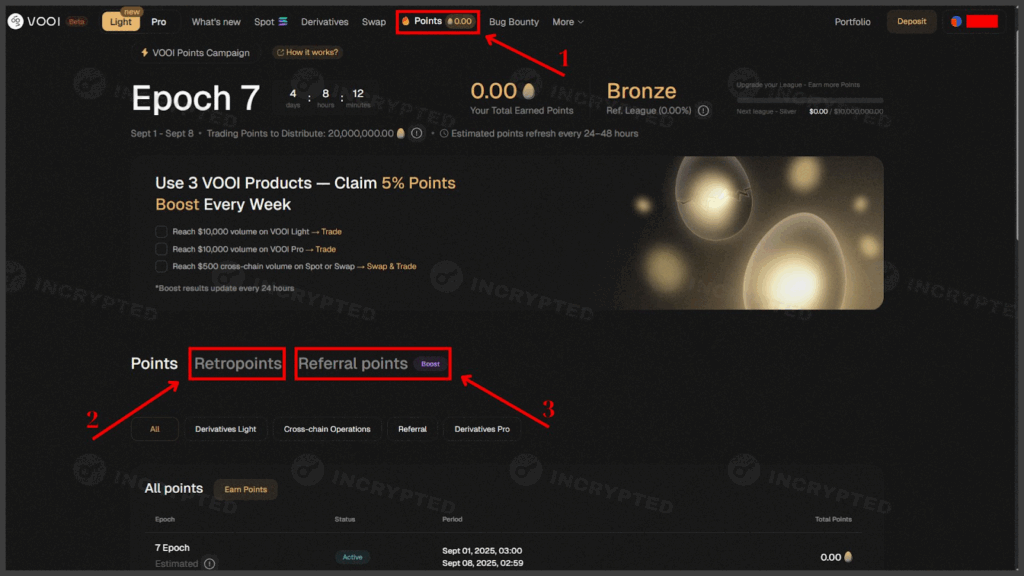

- Trade periodically, build up volume, and farm points. Track your points in the Points section. Additionally, stay active in the Retropoints section and invite friends by clicking Referral points:

Points tab. Data: VOOI

- In the Light tab, you can also trade stocks, forex, and indices on the Solana network if you wish, and in the Swap section you can exchange tokens:

Light section. Data: VOOI

As of writing, the service provides access to three DEXs. This means that active traders, by trading on the platform, are simultaneously participating in several projects and therefore have a chance to qualify for a second airdrop from Hyperliquid.

Follow the project’s social media channels to make sure you don’t miss important updates.

Highlights:

- raised investment from YZi Labs;

- involves costs;

- covers multiple projects.

If you have any questions while completing activities, you can ask them in our Telegram chat.

Useful links: Website | X | Discord

Disclaimer: The articles reposted on this site are sourced from public platforms and are provided for informational purposes only. They do not necessarily reflect the views of MEXC. All rights remain with the original authors. If you believe any content infringes on third-party rights, please contact service@support.mexc.com for removal. MEXC makes no guarantees regarding the accuracy, completeness, or timeliness of the content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be considered a recommendation or endorsement by MEXC.

Make a deposit. Data: VOOI

Make a deposit. Data: VOOI

Pro section. Data: VOOI

Pro section. Data: VOOI

Points tab. Data: VOOI

Points tab. Data: VOOI

Light section. Data: VOOI

Light section. Data: VOOI