Chainlink price prediction 2026-2032: A strong buy sentiment for LINK?

Key takeaways

- Chainlink could reach a maximum value of $14.94 in 2026.

- By 2029, LINK could reach a maximum price of $46.15.

- In 2032, Chainlink is expected to range between $57.51 and $65.73.

The Chainlink platform emerged as a prominent player in the cryptocurrency market. It provides a secure, decentralized oracle network that connects smart contracts with real-world data, influencing the current price. As the adoption of decentralized finance (DeFi) and blockchain technology continues to grow, Chainlink’s innovative solutions have attracted significant attention from investors and traditional financial institutions alike.

Chainlink continues to expand its reach and utility across the blockchain ecosystem, showcasing its robust integration capabilities and promoting enterprise adoption across various sectors through its cross-chain interoperability protocol. Recent updates highlight 14 new integrations of 5 Chainlink services across 10 different blockchain platforms, demonstrating its versatility across multiple blockchains, including prominent names like Arbitrum, Avalanche, and Ethereum. These integrations enhance Chainlink’s network and solidify its position as a critical player in the interoperability and functionality of decentralized applications.

Understanding Chainlink’s potential price movements based on the information presented is crucial for making an investment decision. It involves analyzing various factors, including market trends, technological advancements, partnerships, and overall market sentiment. This Chainlink price prediction aims to provide insights into its future performance by examining technical analysis and fundamental aspects that could influence its value.

Overview

| Cryptocurrency | Chainlink |

| Token | LINK |

| Price | $13.77 |

| Market Cap | $9.93B |

| Trading Volume (24-hour) | $1B |

| Circulating Supply | 708.09M LIN |

| All-time High | $52.88, May 09, 2021 |

| All-time Low | $0.1263, Sep 23, 2017 |

| 24-hour High | $14.19 |

| 24-hour Low | $13.50 |

Chainlink price prediction: Technical analysis

| Metric | Value |

| Price prediction | $ 15.79 (13.75%) |

| Price Volatility (30-day variation) | 5.08% |

| 50-day SMA | $ 12.95 |

| 14-day RSI | 61.88 |

| Sentiment | Bearish |

| Fear & Greed Index | 44(Fear) |

| Green days | 14/30 (47%) |

| 200-day SMA | $ 17.24 |

Chainlink price analysis: LINK price pauses as it consolidates around key technical levels

- LINK remains range-bound between $13.50 support and $14.19 resistance, reflecting ongoing consolidation.

- Strong selling pressure near resistance continues to cap upside moves around the $14.00–$14.19 zone.

- Buyers are defending support, with demand near $13.60–$13.70 helping prevent a breakdown despite weakening momentum.

On 7 January 2026, Chainlink trades at $13.77, posting a 0.03% decline over the past 24 hours, according to the chart data provided. The modest pullback reflects a period of consolidation after recent volatility, with market participants closely watching how LINK behaves around key technical levels.

Chainlink 1-day price chart: LINK consolidates within a defined range

On the daily chart, Chainlink (LINK) trades at $13.77 on 7 January 2026, reflecting a 0.03% decline over the past 24 hours. The price remains range-bound between support at $13.50 and resistance at $14.19, indicating a pause in directional momentum after recent swings.

LINK/USDT Chart: TradingView

LINK/USDT Chart: TradingView

Daily candles show extended wicks on both the upside and downside, highlighting strong two-way interest and market indecision. As long as LINK continues to close above $13.50, the broader structure remains intact, but repeated failures below $14.19 suggest sellers are defending this level aggressively, limiting upside continuation.

Chainlink 4-hour price chart: LINK short-term pressure caps upside attempts

On the 4-hour timeframe, LINK displays choppy price action with a series of lower highs forming below the $14.00–$14.10 zone, reinforcing short-term bearish pressure. Despite this, buyers have consistently stepped in near the $13.60–$13.70 area, preventing a deeper breakdown.

LINK/USDT Chart: TradingView

LINK/USDT Chart: TradingView

Momentum on the 4-hour chart appears to be weakening, aligning with the broader consolidation seen on the daily timeframe. A decisive move below $13.50 would likely accelerate selling pressure, while a clean break and sustained hold above $14.19 would invalidate the short-term bearish structure and reopen the path toward higher levels.

Chainlink technical indicators: levels and action

Daily simple moving average (SMA)

| Period | Value | Action |

| SMA 3 | $ 17.00 | SELL |

| SMA 5 | $ 15.65 | SELL |

| SMA 10 | $ 14.41 | SELL |

| SMA 21 | $ 13.09 | BUY |

| SMA 50 | $ 12.95 | BUY |

| SMA 100 | $ 15.50 | SELL |

| SMA 200 | $ 17.24 | SELL |

Daily exponential moving average (EMA)

| Period | Value | Action |

| EMA 3 | $ 13.02 | BUY |

| EMA 5 | $ 13.60 | BUY |

| EMA 10 | $ 15.48 | SELL |

| EMA 21 | $ 18.12 | SELL |

| EMA 50 | $ 19.27 | SELL |

| EMA 100 | $ 18.39 | SELL |

| EMA 200 | $ 17.39 | SELL |

What to expect from Chainlink?

Chainlink (LINK) is consolidating between $13.50 support and $14.19 resistance. A decisive break above $14.19 could trigger a short-term uptrend toward $14.50–$14.80, while a drop below $13.50 may accelerate selling toward $13.20–$13.00. Momentum is weakening, so traders should watch key levels closely for signs of the next move.

Is Chainlink a good investment?

LINK remains popular due to its role in decentralized oracle networks and growing adoption. While it offers potential opportunities, volatility is high, and breaking key support or resistance could trigger sharp swings. Investors should consider fundamentals, network growth, and adoption alongside price action before making decisions.

Why is the LINK price down today?

Chainlink (LINK) dipped slightly to $13.77 on 7 January 2026, down 0.03% over 24 hours. The modest decline reflects ongoing consolidation between $13.50 support and $14.19 resistance. Short-term selling near resistance and weakening momentum have capped upside, while buyers continue to defend support, keeping losses limited. Overall, today’s move is part of a range-bound pause rather than a major trend shift.

Recent news

Bitwise has secured approval to list its spot Chainlink ETF (CLNK) on NYSE Arca, set to launch this week and offer direct LINK exposure without token custody. The fund will waive fees for three months on up to $500 million before moving to a 0.34% management fee, launch with $2.5 million in seed capital, and use Coinbase Custody and BNY Mellon for asset safeguarding. The approval boosted sentiment, with LINK up over 11% this week near $13.86, trading volume and futures open interest rising, analysts eyeing $14.63 as the next resistance, and institutional demand growing alongside steady inflows into Grayscale’s Chainlink ETF.

Will Chainlink reach $50?

Based on long-term forecasts from industry experts, Chainlink (LINK) is projected to reach $50 by 2031.

Will Chainlink reach $65?

Chainlink can reach $65 by 2032. This aligns with real-world asset tokenization according to expert predictions, indicating a potential turning point.

Does Chainlink have a promising long-term future?

Chainlink shows signs of stabilization and potential for recovery, indicating that the token may have a bullish case and promising long-term future within the blockchain industry.

Chainlink price prediction January 2026

ForJanuary 2026, Chainlink is primed for notable growth, according to the latest link price prediction. The minimum projected trading price is $13.00, with an average of around $13.57 for LINK tokens, relative to the current Chainlink price. LINK is expected to attain a peak price of $14.09.

| Chainlink Price Prediction | Potential Low | Average Price | Potential High |

| January 2026 | $13.57 | $14.09 | $14.52 |

Chainlink (LINK) price prediction 2026

The market price for LINK is expected to reach a maximum of $14.94 in 2026. However, traders can expect a minimum trading price of $14.00 which is influenced by the overall market capitalization and external data sources. The average price of Chainlink is expected to be $14.82.

| Chainlink Price Prediction | Potential Low | Average Price | Potential High |

| Chainlink Price Prediction 2026 | $13.00 | $14.39 | $14.94 |

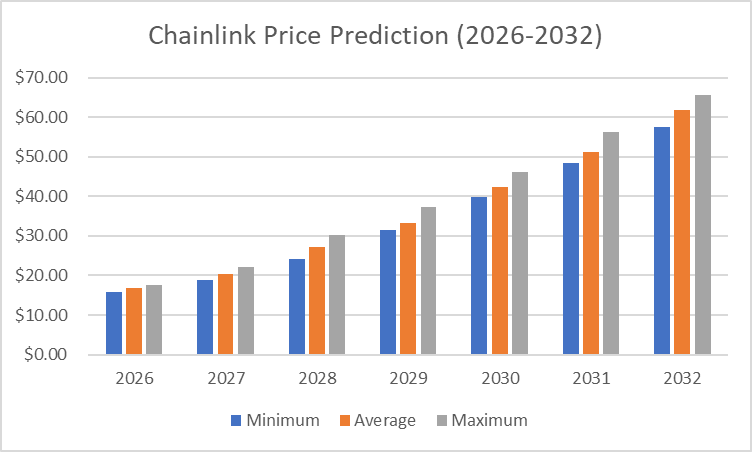

Chainlink price prediction 2027-2032

| Year | Minimum | Average | Maximum |

| 2027 | $18.85 | $20.39 | $22.09 |

| 2028 | $24.04 | $27.09 | $30.23 |

| 2029 | $31.40 | $33.30 | $37.39 |

| 2030 | $39.89 | $42.28 | $46.15 |

| 2031 | $48.46 | $51.34 | $56.37 |

| 2032 | $57.51 | $61.84 | $65.73 |

Chainlink price prediction 2027

In 2027, Chainlink is expected to reach a maximum value of $22.09, a minimum price of $18.85, and an average value of $20.39.

Chainlink price prediction 2028

In 2028, LINK’s average price is expected to be $27.09; its minimum and maximum trading prices, following its historical performance, are predicted to be $24.04 and $30.23, respectively.

Chainlink price prediction 2029

The Chainlink price forecast for 2029 is a high of $37.39. It will reach a minimum price of $31.40 and average at $33.30.

Chainlink price prediction 2030

According to the Chainlink price prediction for 2030, the price of LINK will range from $39.89 to $46.15, with an average price of $42.28.

Chainlink price prediction 2031

In 2031, Chainlink prediction expects LINK to reach a maximum value of $56.37, a minimum price of $48.46, and an average value of $51.34.

Chainlink price prediction 2032

Chainlink prediction climbs even higher into 2032. According to the prediction, LINK’s price will range between $57.51 and $65.73, with an average price of $61.84.

Chainlink price prediction 2026-2032

Chainlink price prediction 2026-2032

Chainlink market price prediction: Analysts’ LINK price forecast

| Firm Name | 2026 | 2027 |

| DigitalCoinPrice | $17.59 | $22.09 |

| CoinCodex | $16.01 | $42.12 |

Cryptopolitan’s Chainlink price prediction

According to our Chainlink price forecast, the coin’s market price might reach a maximum value of $14.94 by the end of 2026. In 2028, the value of LINK could surge to a maximum cost of $30.23.

Chainlink’s historic price sentiment

Chainlink price history: Coinmarketcap

Chainlink price history: Coinmarketcap

- Chainlink launched at around $0.20 and remained under $1 throughout 2018, with moderate market cap growth. In 2019, LINK had substantial growth, reaching $1 in May and peaking around $3 by year-end, driven by its utility in providing reliable data feeds for smart contracts.

- 2020 marked a breakout year as LINK surged from $2 to $20 by August, fueled by DeFi demand. In 2021, it reached an all-time high of around $52 in May but dropped to $22 by mid-year due to market volatility.

- In 2022, LINK ranged between $15 and $25 amid broader market corrections. In 2023, it further declined, stabilizing in the $6 to $13 range as investor sentiment cooled.

- Starting 2024 at $15, LINK briefly spiked to $18 in February before falling to $12 by April. The coin’s price has fluctuated throughout 2024, peaking near $15 in May, dropping to around $10 by August, and stabilizing between $10 and $12.28 in October. In November, LINK is trading within the range of $10.68 to $11.94. In December, LINK maintained a range of $18.43 to $30.94.

- In January 2025, Chainlink peaked at $22.90 but lost momentum towards the end of the month, leading to a trading range of $19.20-$21.00 in February.

- In March 2025, Chainlink (LINK) experienced a strong upward trend, starting at approximately $13.73 and steadily rising to $16.02, with periods of volatility.

- In April, Chainlink (LINK) showed relatively stable price movement, fluctuating between $10.7 and $15.3, indicating volatility within a broad trading range.

- In May, Chainlink (LINK) began trading at approximately $14.20 and experienced some price fluctuations, dipping to a low of $13.90. According to the latest data, the price has slightly recovered and is currently around $14.06, exhibiting mild volatility.

- Chainlink (LINK) fluctuated between $11.50 and $15, experiencing a sharp mid-June dip but essentially stabilizing around $13.10 by early July.

- In August, Chainlink (LINK) traded in the price range of approximately $15.8 to $16.6, with its latest price reaching $16.6 on August 4th.

- The Chainlink (LINK) price ranged between a high of $23.19 and a low of around $22.20, currently trading at $22.71 as of September 2025.

- In October 2025, Chainlink traded around $22.6, showing strong recovery momentum compared to its earlier lows in previous years.

- Chainlink traded within a tight range between $13.75 and $15.25 from November 4 to 5, 2025, ultimately closing at $14.67 after a volatile 24-hour session.

- As of January 2026, Chainlink (LINK) traded between roughly $13.6 and $14.2, showing intraday volatility but ending the period near $14.16 after a late rebound.

You May Also Like

Uniswap & Monero Chase Gains: While Zero Knowledge Proof’s Presale Auctions Target Record $1.7B

Quantum Threat Looms Over Bitcoin, VanEck CEO Says — Zcash Prepares Quantum Upgrade