Big News! CRED MINER Launches “One-Click Multi-Currency Mining” for Simultaneous Mining of DOGE, XRP, and SOL for More Stable Returns!

With the increasingly diverse crypto market, single-currency mining is no longer sufficient to meet user needs. CRED MINER has launched the One-Click Multi-Currency Mining feature, enabling simultaneous mining of all three major cryptocurrencies: DOGE, XRP, and SOL!

No more manual switching or being affected by a particular cryptocurrency’s market conditions—the system automatically and intelligently allocates computing power based on market profitability, maximizing returns and diversifying risks.

Automatic Multi-Currency Computing Power Allocation Optimizes Daily Output

With a single click, activate the platform and it will intelligently manage your computing resources, flexibly allocating them between DOGE, XRP, and SOL for optimal mining efficiency.

✅ No operation required

✅ Real-time profit monitoring

✅ 24/7 system maintenance

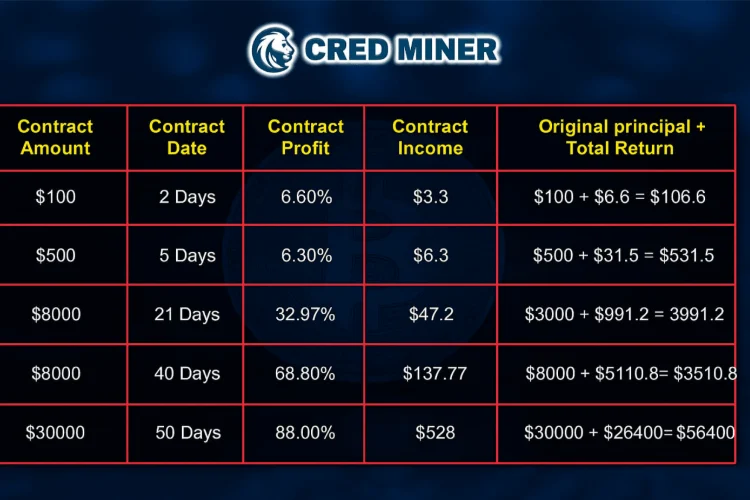

High-return contract examples, easily achieve stable growth

Contract Name Investment Amount Maturity Return

All profits are automatically settled daily and can be withdrawn to your wallet or reinvested at any time, with no lock-up restrictions.

Greener and More Secure Infrastructure

CRED MINER is committed to sustainable development.

All data centers are powered by 100% green energy, such as hydropower from Northern Europe, solar power from Africa, and wind power from North America. The platform also uses on-chain audits and cold wallet storage technology to ensure the authenticity, security, transparency, and traceability of your assets.

Register now to receive $12 in free computing power

Be the first to experience multi-currency mining!

https://www.credminer.com

Contact: info@credminer.com

This article is not intended as financial advice. Educational purposes only.

You May Also Like

Russia’s Central Bank Prepares Crackdown on Crypto in New 2026–2028 Strategy

Strategic Investment Plays Amid Rising US-Iran Tensions