Chainlink price eyes 85% surge as whale buying accelerates

Chainlink price rose for five consecutive days, reaching its highest level in almost two weeks, and this trajectory could continue as whales extend their buying spree and assets in the recently launched LINK Reserves jump.

- Chainlink price could jump by 85% in the coming weeks as whale buying continues.

- The company’s ecosystem is growing, including a recent partnership with UBS, the biggest wealth manager globally.

- The recently launched Strategic LINK Reserves have hit $5.3 million.

Chainlink price to benefit from the ongoing whale accumulation

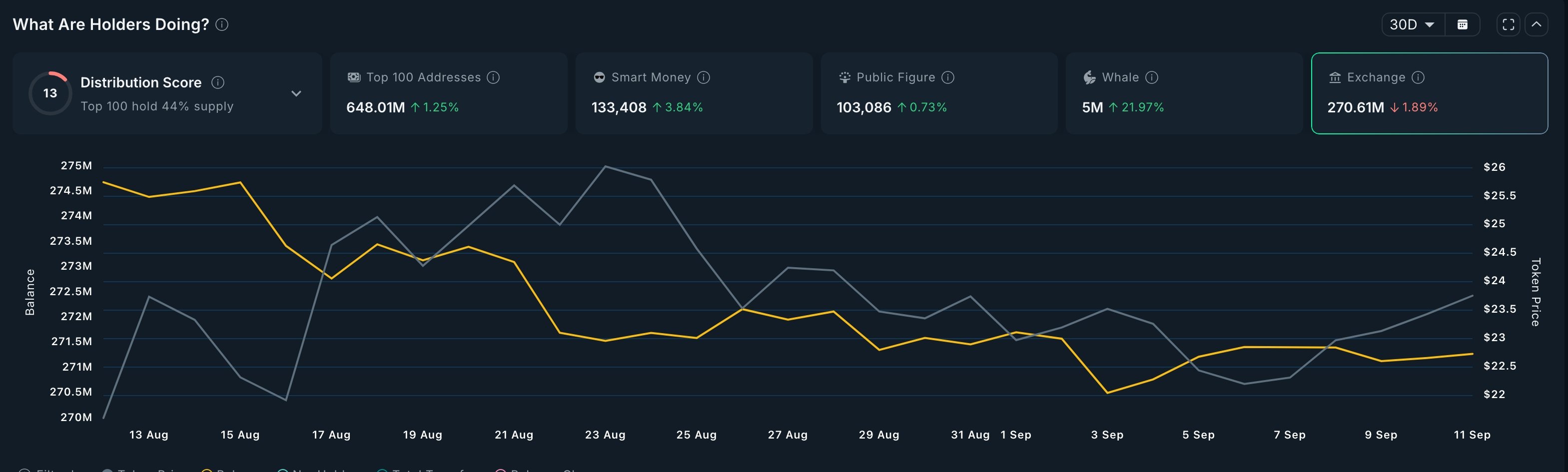

Nansen data shows that whale investors have continued to accumulate Chainlink (LINK) as its fundamentals improve. These whales have boosted their holdings by 22% in the last 30 days to 5 million LINK tokens, a sign that they expect its price to continue rising.

Coincidentally, this whale buying has happened as investors move their tokens from exchanges to self-custody. Data shows that the amount of LINK tokens on exchanges has trended lower in the past few weeks, moving from a high of 275 million in August to 270 million today, Sept. 11.

Chainlink’s fundamentals have improved substantially in the past few months. For example, the network is now being used by the U.S. government to disseminate macroeconomic data.

Chainlink has also continued to ink partnership deals with some of the biggest companies globally. The most recent partnership was with UBS, the world’s largest wealth manager. The partnership will automate tokenized fund operations in Hong Kong.

Further, the recently launched Strategic LINK Reserves continues to do well, with its assets growing to over $5.3 million a month after its launch.

Meanwhile, there are high odds that the Securities and Exchange Commission will approve the LINK ETF proposals from companies such as Bitwise and Grayscale. An approval will likely lead to more inflows by American investors.

LINK price technical analysis

The daily timeframe chart shows that Chainlink price bottomed at $10 in April and then, like other cryptocurrencies, bounced back to the current $24.

LINK remains above the 100-day Exponential Moving Average and is in the process of forming a cup-and-handle pattern, with the recent pullback being the handle section.

Measuring the distance between the cup’s upper side and its lower side shows that it is approximately 62%. Extrapolating the same distance from the cup’s upper side points to an eventual rebound to $43, which is about 86% above the current level.

You May Also Like

Wormhole launches reserve tying protocol revenue to token

XRPL Validator Reveals Why He Just Vetoed New Amendment