OP Stack camp welcomes many star projects, Superchain has nearly 40 members, and many of them receive luxurious subsidies

Author: Nancy, PANews

In the past few months, more and more crypto projects have entered the L2 track, among which the technical solution OP Stack has frequently appeared, especially the addition of some star projects, making OP Mainnet (Optimism) attract much attention from the market. While the OP Stack ecosystem is expanding rapidly, the scale and activity of the Superchain ecosystem are also increasing significantly, which is inseparable from the generous subsidy policy of OP Mainnet. However, at present, the income contributed by most Superchains is still relatively limited, and at this stage it mainly relies on the Base chain under Coinbase.

Nearly half of Ethereum L2 is based on OP Stack, and Superchain’s daily transactions account for more than 40% of the market

Coinbase launched the Ethereum L2 network Base based on OP Stack; Worldcoin announced the launch of the OP Stack-based blockchain World Chain and joined the super chain Superchain; Uniswap launched its own Layer2 network Unichain built on OP Stack technology; Sony's Layer2 blockchain Soneium adopted the OP Stack code base... In recent months, OP Stack has welcomed more and more star participants.

In fact, OP Stack is a relatively more popular and attractive L2 Stack in the current Ethereum L2 market. According to L2BEAT data, as of October 31, the number of Ethereum Layer2 has reached 111. According to Superchain Eco statistics, 59 of them are built on OP Stack, which is far more than other competitors, such as 31 L2 projects using Arbitrum One and only 8 using Ploygon.

Moreover, L2 projects running on OP Stack have significant influence. According to L2BEAT statistics, among the top ten Ethereum L2 projects in terms of TVL, six L2 projects use OP Stack as their technical solution, especially Base, which ranks second with $8.17 billion.

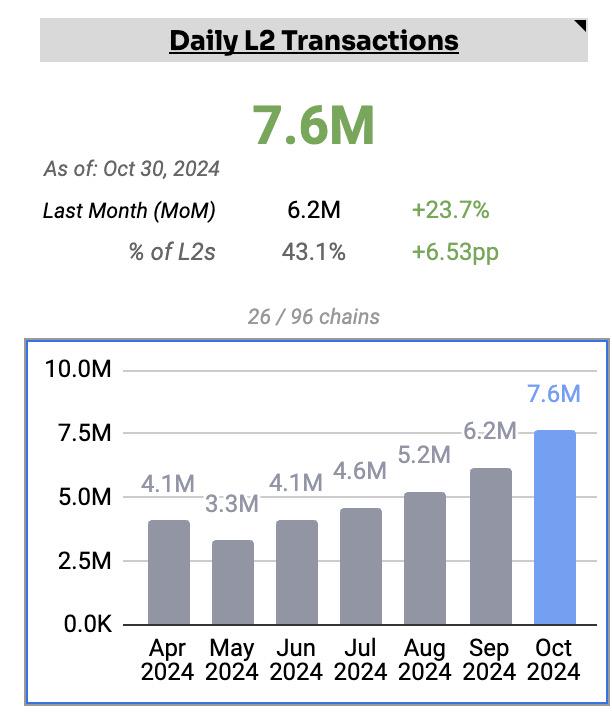

While OP Stack continues to make efforts, the Superchain ecosystem is also growing, which is an important weapon for OP Mainnet to solve the fragmentation problem of L2 ecosystem. According to Superchain Eco statistics, as of October 31, there are 36 OP Chains joining the Superchain ecosystem, and the number of daily transactions of these chains has reached 7.6 million (an increase of 23.7% over the previous month), accounting for 43.1% of the L2 market.

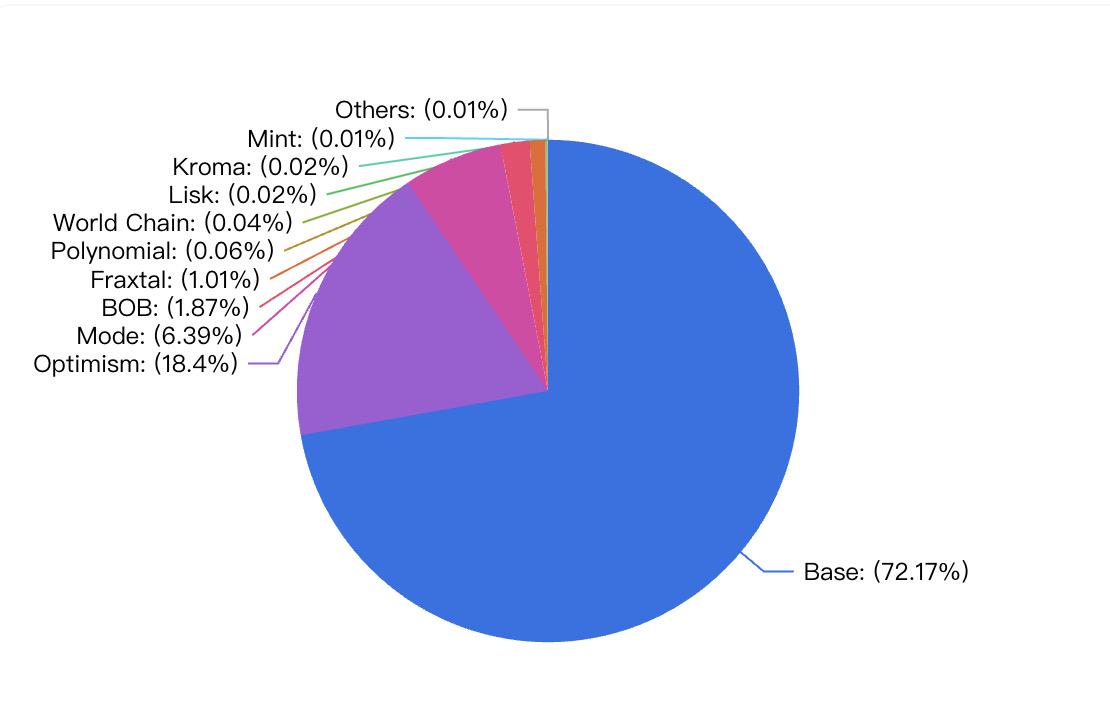

In addition, DeFiLlama data shows that the TVL of OP Chain on Superchain has exceeded 3.67 billion US dollars. Among them, Base ranks first with a scale of 2.65 billion US dollars, accounting for 72.1% of the share; followed by OP Mainnet, with a TVL of 670 million US dollars, accounting for 18.4%; Mode followed closely with a TVL of more than 230 million US dollars, accounting for nearly 6.4%. In contrast, the TVL of the remaining projects is mostly less than 100 million US dollars, and some projects are even only thousands of dollars.

A large amount of money was spent to subsidize Superchain, with revenue of over $42 million mainly relying on Base

The rapid development of the OP Mainnet ecosystem is largely due to its generous funding subsidy strategy. This "coin-throwing" subsidy not only successfully attracted many developers and projects, but also effectively motivated the enthusiasm of market participants, laying a solid foundation for the rapid growth and prosperity of its ecosystem.

According to official documents, Optimism Collective mainly supports builders through two types of funding, one is Retro Funding, and the other is Mission Grants. Among them, official data statistics show that since 2022, Optimism Collective has issued more than 60.81 million OP tokens in the past rounds of Retro Funding, and the official disclosure has reserved 800 million OP tokens for future rounds of rewards. From the perspective of the funding scale of each project, it ranges from thousands of tokens to hundreds of thousands.

This strategy has also been applied to the construction of the Superchain ecosystem, making it more attractive among many L2Stacks solutions. For example, in the fourth round of retroactive public goods fundraising in April this year, 10 million OP tokens were dedicated to on-chain builders who deployed contracts on Superchain and generated block space demand. In August, Optimism announced that 50 million OP tokens had been awarded to the creators and builders of Superchain.

At present, many Superchain members have received funding. For example, the Optimism Foundation will provide Base with 118 million OP tokens in the next six years; the DeFi L2 Mode module based on the OP Stack will receive 2 million OP tokens from the Optimism Foundation (worth about $5.3 million at the time); the L2 network Ink launched by the US crypto exchange Kraken received funding of 25 million OP tokens in an agreement reached at the beginning of this year, which is now worth about $42.5 million. The tokens will be unlocked in batches on a monthly basis; the Bitcoin L2 project BOB, as the first Bitcoin native project integrated into the Superchain ecosystem, received funding of $870,000 in OP tokens from the Optimism Foundation; Mint Blockchain received a strategic investment of 750,000 (worth $1.35 million) from the Optimism Foundation...

Regarding the unlocking rules of these funding tokens, Shier Han, co-founder of Mint Blockchain, revealed to PANews, "For projects with smaller token rewards, OP officials often directly provide subsidy support, but at the same time, they also come with some incentive requirements for promoting ecological development. When blockchain projects conduct community rewards, they will also formulate corresponding rules. For example, ordinary users can directly obtain rewards by using ecological applications, while application developer teams need to lock positions accordingly. The normal lock-up period is one year. According to relevant personnel of the Optimism Foundation, of the 25 million OPs allocated to Ink, 5 million are directly used for project development and construction, and the other 20 million are released according to the number of transactions on the chain. Therefore, for projects with greater support like Ink, OP officials will sign more complex cooperation models such as betting agreements, and examine the contribution of key data such as gas fees."

Since each OP Chain operates under a standardized revenue-sharing model, these Superchains are required to contribute 2.5% of the total revenue of the on-chain sorter or 15% of the net profit (whichever is the highest) to the Optimism Collective, but the economic benefits are currently limited.

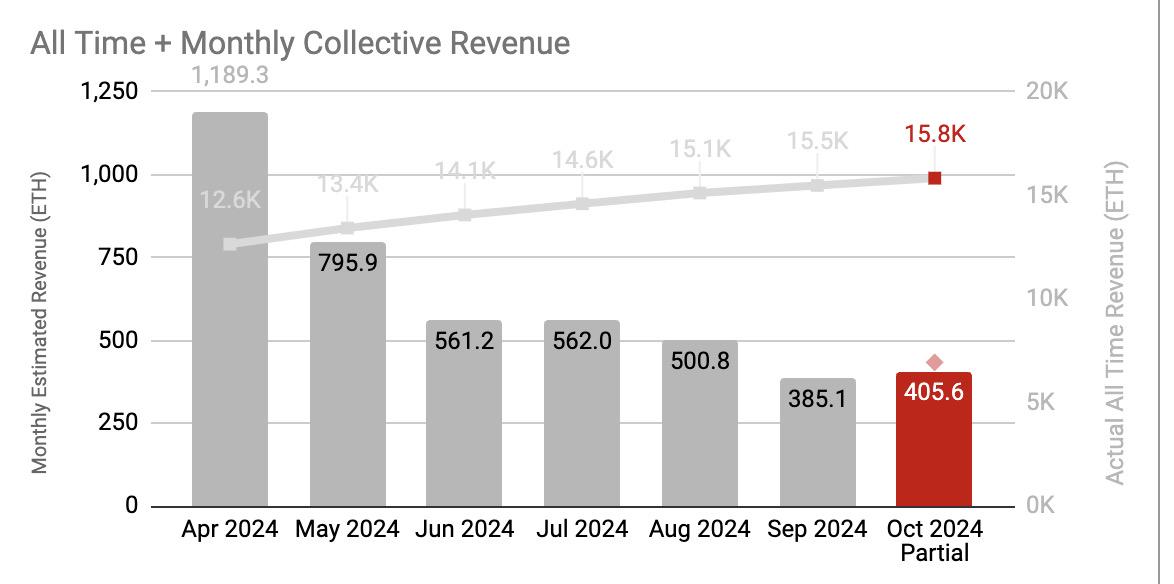

According to statistics from Superchain Eco, these Superchains have contributed a total of about 15,800 ETH in revenue (currently worth over 42 million USD), of which OP Mainnet contributed the most with over 12,800 ETH in revenue (accounting for 80.2%); followed by Base, which brought about 2,878.7 ETH (accounting for 18.6%); the revenue contribution of other chains was less than 0.5%. In terms of monthly revenue, Optimism Collective's monthly revenue showed a downward trend, and this month it has dropped by nearly 65.9% compared to April this year. However, with the addition of more projects with their own traffic, such as Unichain and Ink, OP Mainnet's revenue space will further increase.

You May Also Like

While Shiba Inu and Turbo Chase Price, 63% APY Staking Puts APEMARS at the Forefront of the Best Meme Coin Presale 2026 – Stage 6 Ends in 3 Days!

SUI Price Is Down 80%: Price Nears Level Bulls Cannot Afford to Lose