Crypto Industry Warns Bank Of England: Stablecoin Limits Bad For UK Savers, Sterling, City

The crypto industry is warning the Bank of England against imposing limits on stablecoin holdings, after a Financial Times report said it plans to cap them for individuals and businesses.

According to a Sept. 15 story, the Financial Times (FT) said the BoE is considering imposing caps of £10,000 to £20,000 ($13,600 to $27,200) on individuals, while limiting businesses to around £10 million ($13.6 million).

Stablecoins are already widely used for payments in the UK, with adoption of these tokens expected to grow.

Executives say the proposed rules could stifle adoption, complicate enforcement, and leave the UK trailing behind the US and EU in digital finance.

Bank Of England Says It Wants To Prevent Massive Outflows

According to the BoE’s executive director for financial market infrastructure, Sasha Mills, the planned restrictions on systemic stablecoin ownership is part of an effort to prevent any sudden deposit withdrawals. It would also limit the scaling of alternative payment systems.

The plan to limit stablecoin ownership comes as the central bank and the Financial Conduct Authority work on developing a regulatory framework for digital tokens pegged to fiat currencies.

BoE officials have insisted that the limits could be transitional while the market adjusts to digital money.

Central Bank’s Planned Stablecoin Rules Are A “Bad” Idea

Crypto groups and executives in the space are urging the BoE not to impose the restrictions. Among them is Coinbase’s vice president of international policy Tom Duff Gordon, who told the FT that “imposing caps on stablecoins is bad for UK savers, bad for the City and bad for the sterling.”

Riccardo Tordera-Ricchi of The Payments Association also told the FT that the limits would “make no sense,” because there aren’t currently any caps on cash or bank accounts in the UK.

Some have also said that imposing the planned rules would be nearly impossible. Simon Jennings of the UK cryptoasset business council said enforcement would require digital IDs and other systems to realistically monitor stablecoin ownership.

The BoE’s plans could also deepen tensions between the central bank and the Treasury, which has shown support for digital innovation in the financial sector.

In July, Chancellor Rachel Reeves said she wanted to push forward developments in blockchain technology within the traditional finance sector, including efforts around tokenized securities and stablecoins.

Crypto industry groups and executives have also warned that the rules would leave the UK with stricter oversight than the US or the European Union (EU).

US And EU Embrace Stablecoins

The US and EU have signaled an embrace of stablecoins, and have both established their own frameworks for the digital assets.

Back in September 2020, the EU proposed its Markets in Crypto-Assets (MiCA) regulation as part of its “Digital Finance Package.” The regulation is designed to provide legal clarity and a regulatory framework for crypto assets and any related services across the EU.

The MiCA framework entered into force in June 2023, but stablecoin-related rules only started being applied in June 2024. Broader rules for crypto service providers were applied later from December 2024.

This year, the US Senate also approved the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, which was signed into law in July by US President Donald Trump. It aims to create a regulatory framework for the issuance and use of stablecoins within the US.

Both the MiCA framework and the GENIUS Act don’t impose limits on the amount of stablecoins citizens can hold. Instead, they focus on issuance, reserve management, and compliance with anti-money laundering (AML) and anti-terrorism policies.

Stablecoin Market Expected To Balloon To $1.2 Trillion

The stablecoin market has grown steadily since both the MiCA framework and the GENIUS Act have gone into force, with the latter serving as a bigger catalyst.

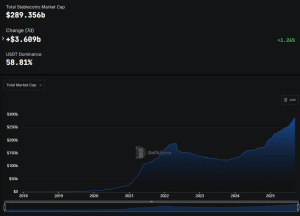

According to DefiLlama data, the stablecoin market cap stands at around $289.356 billion. This is after it grew by more than $3.609 billion in just the past seven days.

Stablecoin market cap (Source: DefiLlama)

That growth is expected to continue, with Coinbase predicting earlier this year that the stablecoin market could soar to above $1.2 trillion by 2028.

Similarly, Goldman Sachs has predicted that a “stablecoin summer” could see the market reach a capitalization of $2 trillion by the end of 2028.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Bitcoin ETFs Surge with 20,685 BTC Inflows, Marking Strongest Week