Solana Edges Nearer To All-Time Highs As Traders Talk About Rollblock Becoming The Cycle’s Viral Breakout Star

Solana’s steady climb toward its all-time highs is sparking fresh excitement across the crypto market. With institutional players pouring in, momentum is clearly building. But while SOL grabs headlines, traders are also buzzing about Rollblock.

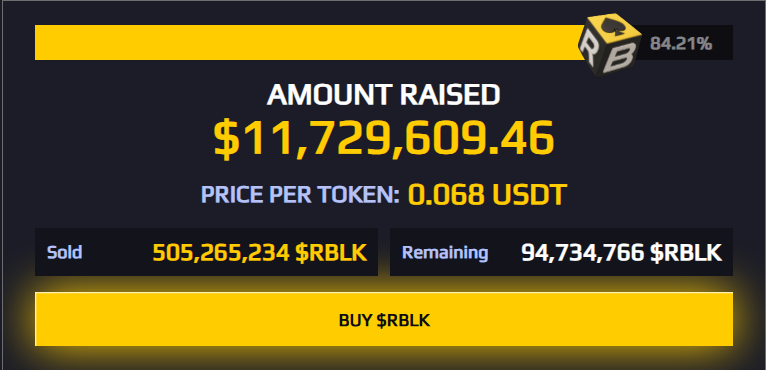

The project has already raised $11.7 million and delivered returns of more than 500%, quickly earning a reputation as the cycle’s viral breakout star. Together, Solana and Rollblock highlight how fast capital is moving into high-growth crypto opportunities.

Traders Talk About Rollblock Becoming The Cycle’s Viral Breakout Star

Rollblock is fast becoming one of the most talked-about tokens of this cycle. Unlike many GameFi launches that rely purely on hype, Rollblock has already proven its traction—processing over $15 million in wagers across 55,000 users even before its exchange debut. That early performance signals adoption and credibility, qualities that most new projects struggle to achieve.

The platform is built to satisfy both players and investors. Players enjoy over 12,000 games, including live sports wagering, exclusive gaming offers, VIP treatment, and huge bonuses such as 50% presale bonuses and $500 welcome bonus. With immediate payouts and payment via fiat like Visa, Apple Pay, and Google Pay, it is obvious that Rollblock has created an easy-to-use gaming platform that would be attractive to ordinary consumers.

For investors, the value proposition is just as strong. They get staking rewards of up to 30% APY, monthly prize pools above $2 million, and a weekly buyback-and-burn program that reduces supply while rewarding long-term holders. The platform is built to satisfy both players and investors.

Here’s what Rollblock delivers:

- Exclusive bonuses, VIP access, and massive promotions like 50% presale bonuses and $500 welcome packs

- Lower fees with instant rewards for smoother transactions

- Fiat-friendly payments supported by Visa, Apple Pay, and Google Pay

- Staking rewards up to 30% APY for long-term holders

And here’s the kicker—despite raising over $11.7 million in presale and delivering 500% ROI so far, Rollblock is still priced at only $0.068 per token, giving investors access to all these benefits for under 7 cents.

Solana Edges Closer to a New ATH

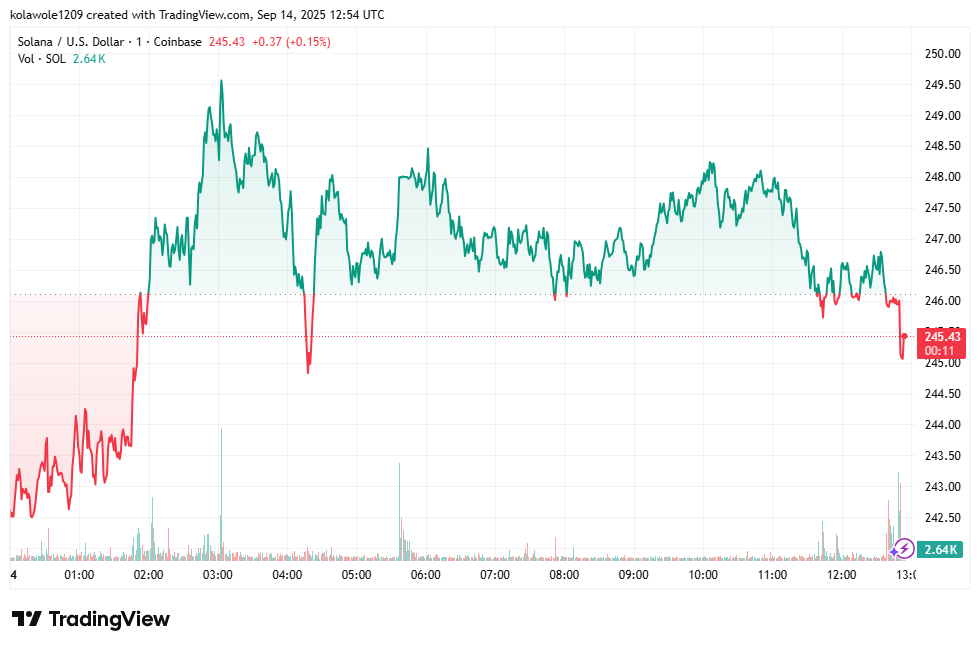

Solana is pushing into fresh territory again, trading around $245 and showing strong momentum after weeks of steady gains. What’s fueling this climb is some heavyweight moves from major players. Galaxy Digital’s $700 million acquisition of SOL has turned heads across the market, especially with talk of Nasdaq integration opening the door for more institutional exposure.

Source

On top of that, Ford has put $1.65 billion into Solana, a move that’s not only boosting trading activity but also helping unlock an estimated $17 billion ecosystem value. Together, these milestones show that Solana is becoming a serious contender in the broader financial landscape.

With the chart breaking past key resistance and institutional backing at its strongest yet, Solana looks like it’s edging closer to rewriting its all-time high. If the momentum continues, seeing SOL test the $260–$280 range in the near term doesn’t feel far-fetched at all.

RBLK vs SOL: The Breakout Token vs The Market Giant

Solana may be edging closer to new all-time highs, but traders are starting to compare its potential returns with emerging projects like Rollblock (RBLK). Both tokens are gaining attention, yet their entry points and growth outlooks paint two very different pictures.

Here’s a table on how they compare:

| Feature | Solana (SOL) | Rollblock (RBLK) |

| Current Price | $247 | $0.068 (under 7 cents) |

| ATH | $294 | Not yet listed on exchanges |

| Institutional Backing | $700M Galaxy Digital, $1.65B Ford | $11.7M raised in presale |

| Utility | DeFi, NFTs, scalable blockchain | 12,000+ games, sports betting, staking, buyback & burn |

| Growth Potential | Near ATH, slower upside | Early stage, 500% presale gains |

Why Rollblock Could Deliver Bigger Returns Than Solana

Despite Solana nearing a new ATH, its high price tag of around $247 makes it less accessible for smaller holders and new investors. Rollblock, on the other hand, offers entry at under 7 cents per token, with proven traction and a rapidly expanding ecosystem. For those chasing outsized gains, RBLK’s combination of adoption, affordability, and growth potential sets it apart.

Discover the Exciting Opportunities of the Rollblock (RBLK) Presale Today!

Website: https://presale.rollblock.io/

Socials: https://linktr.ee/rollblockcasino

The post Solana Edges Nearer To All-Time Highs As Traders Talk About Rollblock Becoming The Cycle’s Viral Breakout Star appeared first on Blockonomi.

You May Also Like

United States Building Permits Change dipped from previous -2.8% to -3.7% in August

Payward Revenue Hits $2.2 Billion as Kraken Exchange Reports Strong 2025 Growth