Cardano (ADA) Price: Whales Buy the Dip While Retail Takes Profits

TLDR

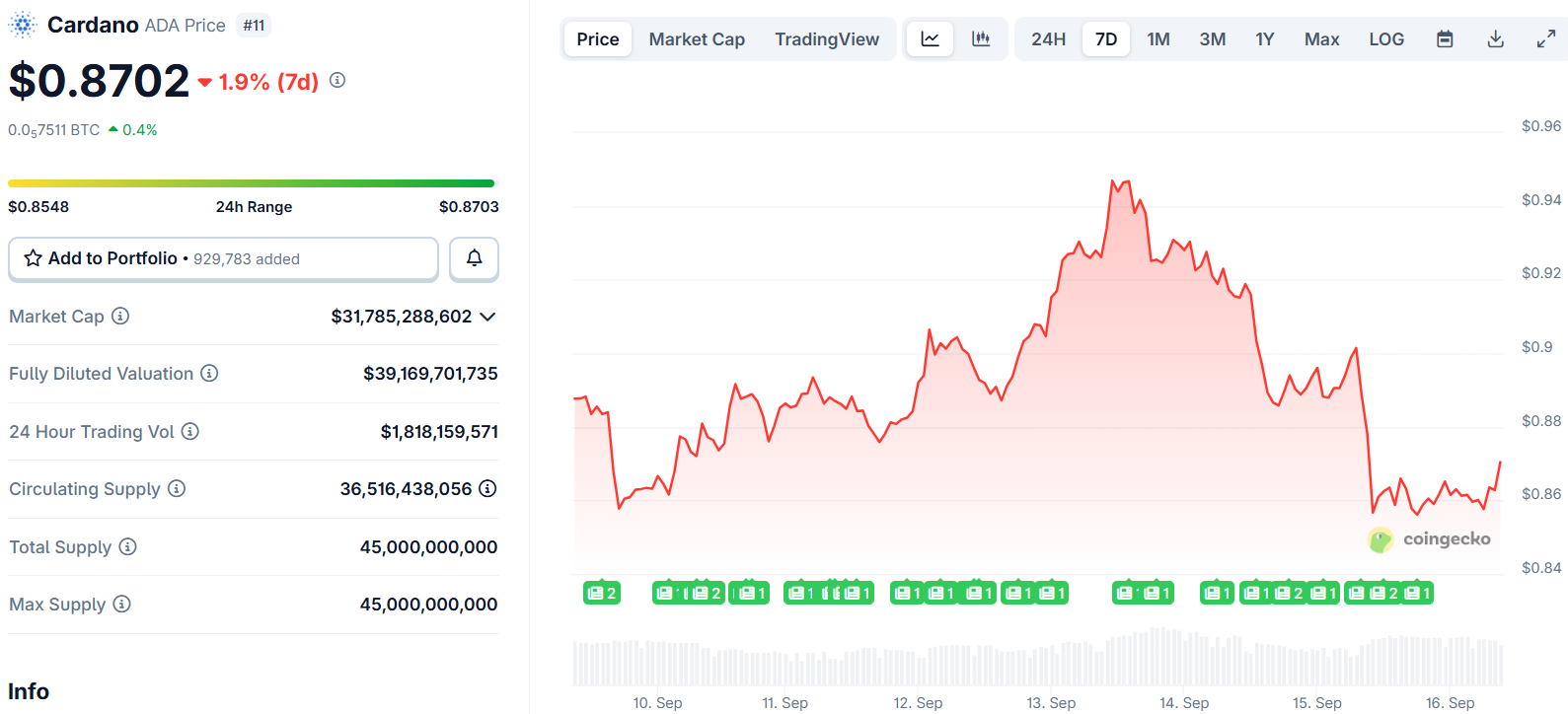

- Cardano price trades around $0.85-$0.90 with recent 7% correction over two days due to profit-taking

- Whales accumulated over 20 million ADA tokens in 24 hours on September 13th

- Technical analysis shows key support at $0.82 and resistance at $0.95-$0.97

- Price targets of $1.15 and $1.25 identified if ADA breaks above $0.95

- Long-to-short ratio dropped to 0.87, indicating bearish sentiment among traders

Cardano price has shown mixed signals this week, with the cryptocurrency currently trading near $0.85 after experiencing a correction of more than 7% over the past two days. The recent pullback comes as holders realize profits, creating short-term selling pressure.

Cardano (ADA) Price

Cardano (ADA) Price

Despite the current downturn, market structure analysis reveals that ADA has been building a solid foundation around the $0.86 to $0.90 range. This base has been tested multiple times, with buyers consistently stepping in during dips.

The cryptocurrency maintains a market cap of nearly $33 billion. Over the past week, ADA climbed from $0.86 to $0.93 before the recent pullback, demonstrating that buying interest remains active at lower levels.

On-chain data from September 13th shows whales accumulated over 20 million ADA tokens in just 24 hours. This represents one of the strongest single-day accumulations in recent weeks and suggests growing confidence among large holders.

The whale activity occurred near the $0.86-$0.90 support zone, reinforcing the technical base that has been forming. Large holder positioning often aligns with price turning points and provides both liquidity support and reduced selling pressure.

Profit-Taking Creates Selling Pressure

Santiment’s Network Realized Profit/Loss metric indicates that Cardano holders are booking profits. The metric experienced its highest spike since late July on Monday, showing holders are selling at profits and increasing downward pressure on price.

Source: SantimentTrading sentiment has turned bearish in the short term. Coinglass data shows the long-to-short ratio dropped to 0.87 on Tuesday, the lowest level in over a month.A ratio below one indicates traders are betting on price declines. This bearish positioning contrasts with the whale accumulation data, creating conflicting signals for ADA’s direction.

The Relative Strength Index currently reads 49, slipping below the neutral level of 50. This indicates early signs of bearish momentum developing.

Technical Levels Define Next Move

Technical analysis reveals a buy wall around $0.88 acting as solid support. This level aligns with the broader base ADA has established in recent weeks.

Source: TradingView

Source: TradingView

On the resistance side, a sell wall extends up to $0.97, marking the key barrier price needs to overcome. Volume data shows active interest around these levels, with liquidity clusters concentrated in this range.

Analysts identify $1.15 and $1.25 as next resistance targets if ADA can break above $0.95. These levels correspond with previous supply areas on the chart.

The 61.8% Fibonacci retracement level sits at $0.82, representing critical support. A close below this level could trigger further declines toward $0.76.

If ADA maintains support around $0.84, it could recover toward the August 14 high of $1.02. The Moving Average Convergence Divergence lines are converging toward a potential bearish crossover.

Current price action shows ADA broke above $0.84 support on September 8 and rallied 9% over five days before the recent correction. Volume over recent sessions shows improving participation, suggesting dips are being bought.

The post Cardano (ADA) Price: Whales Buy the Dip While Retail Takes Profits appeared first on CoinCentral.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Nvidia Invests $5 Billion in Intel for Chip Development