Epoch Protocol’s Successful Raise for Composable Solver Networks to Improve DeFi

The post Epoch Protocol’s Successful Raise for Composable Solver Networks to Improve DeFi appeared first on Coinpedia Fintech News

The decentralized finance landscape has reached an inflection point. With total value locked approaching $100 billion across dozens of chains, DeFi’s success has paradoxically created its greatest challenge: a fragmented ecosystem where optimal execution requires navigating an increasingly complex maze of protocols, bridges, and liquidity pools.

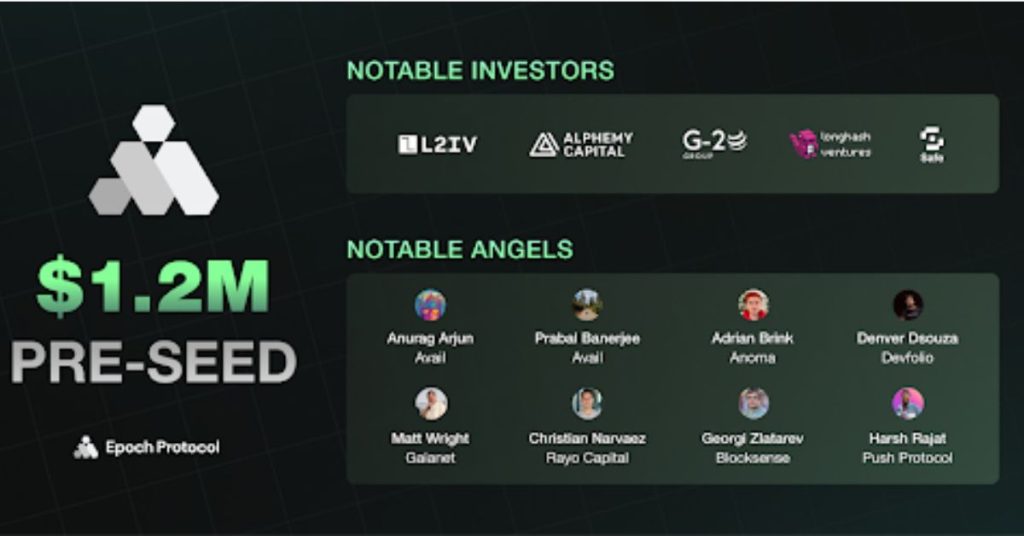

Epoch Protocol, positioning itself as the Universal Coordination Layer for Agents, Solvers, and more, has quietly secured $1.2 million in funding to address this systemic inefficiency through what may be DeFi’s most ambitious infrastructure play yet, composable solver networks that don’t just route transactions, but orchestrate them.

The funding, raised across rounds with backing from institutional players, arrives as the protocol prepares to transition from private testing to public testnet.

But this isn’t just another DeFi raise; it’s a bet on fundamentally reimagining how decentralized markets coordinate value.

Beyond Aggregation: The Specialized Solver Thesis

Traditional DEX aggregators operate on a simple premise: scan available liquidity, find the best price, execute.

It’s a model that served DeFi well when the ecosystem consisted of a handful of protocols on the Ethereum mainnet.

Epoch’s innovation lies in recognizing that modern DeFi requires orchestration, not just aggregation.

Epoch’s solver networks incorporate specialized optimization across multiple dimensions:

- MEV Protection at the Infrastructure Level:

While traditional aggregators leave users vulnerable to sandwich attacks and front-running, Epoch’s specialized MEV protection solvers shield transactions at the network level.

- Cross-Chain Coordination Without Compromise:

Rather than forcing users through bridge interfaces with their inherent risks and delays, Epoch’s liquidity pool architecture enables near-instantaneous cross-chain execution.

Solvers front liquidity to provide immediate settlement, then handle bridge coordination asynchronously, while taking reorg risks

- Conditional and Batched Execution:

Through its Hyperion observer network, Epoch enables solvers to execute based on complex on-chain conditions while batching transactions to reduce gas costs.

Recent data from Ethereum gas trackers shows median transaction fees fluctuating between $8-$25 during peak periods, costs that effective batching can reduce by 40-60% through transaction consolidation.

The Composable Advantage: Competition Meets Cooperation

In Epoch’s ecosystem, different solvers can plug in modularly, competing where it drives efficiency but cooperating where it delivers superior outcomes.

Consider a complex user intent:

swapping ETH for USDC, bridging to Polygon, then depositing into a yield farming position when gas fees drop below a certain threshold.

Today, this requires manual coordination across multiple interfaces, protocols, and timing decisions.

In Epoch’s composable model, specialized solvers handle each component, MEV protection, cross-chain routing, yield optimization, and conditional execution, while orchestration layers ensure optimal coordination between them.

Market Timing and Infrastructure Maturity

Recent data from DeFi analytics platforms shows that while trading volumes have surged, with DEX volumes on Ethereum alone increasing 2x in recent months, user retention remains challenged by UX friction.

The numbers tell the story:

DeFi user growth dashboards show that total unique addresses have surpassed 505 million, but engagement patterns reveal that users frequently abandon complex, multi-step operations due to coordination overhead.

Protocols that reduce this friction capture disproportionate value, a dynamic Epoch’s composable solver networks are positioned to capitalize on.

The timing aligns with broader infrastructure maturity signals. Account abstraction standards like ERC-4337, EIP-7702, and ERC-7579 have gained traction.

Funding as Infrastructure Investment

The raise of $1.2 million so far, led by a number of strategic blockchain VCs including L2Iterative Ventures, Alphemy Capital, G20 Group, Longhash Ventures, SAFE and HadronFC and support from angel investors, including Anurag Arjun (Avail), Prabal Banerjee (Avail), Adrian Brink (Anoma), Matt Wright (Gaianet), Christian Narvaez (Rayo Capital), Georgi Zlatarev (Blocksense), Harsh Rajat (Push Protocol), Denver Dsouza (Devfolio) and Shubham Bhandari (Manta Network), accelerates building infrastructure that developers can extend rather than rebuild.

This matters more than the funding amount suggests; by providing composable solver coordination as infrastructure, Epoch enables developers to focus on creating novel financial primitives rather than solving recurring routing and optimization challenges.

The complexity of integrating multiple protocols is reduced from multiple days to multiple hours by using Epoch SDK

This developer productivity multiplier effect could prove more valuable than direct protocol revenue, especially as the ecosystem continues expanding across Layer 2 networks and alternative chains.

The funding also supports critical infrastructure requirements: solver network bootstrapping incentives and liquidity pool capitalization for instant cross-chain execution.

The Emergence of Specialized Solver Markets

As Epoch’s network matures, the funding accelerates the development of specialized solver categories.

New solvers will emerge solving increasingly sophisticated intents, yield optimization across liquid staking derivatives, automated rebalancing strategies, predictive trading integration with AI agents, and complex multi-protocol strategies that span lending, trading, and staking.

This specialization dynamic mirrors successful infrastructure platforms in traditional tech, where ecosystem value compounds as more specialized participants join.

Each new solver category expands the types of intents the network can handle optimally, creating network effects that benefit all participants

Path to Testnet and Beyond

Epoch is taking a methodical, phased approach to deployment that prioritizes stability and performance validation at each stage.

The protocol has progressed through private testing and is currently operating a standalone node on public testnet, the first phase of their comprehensive rollout strategy.

The deployment roadmap follows a carefully structured progression:

- private testing

- standalone node on testnet

- standalone node on mainnet with external solvers

- network of nodes on testnet

- network of nodes on mainnet.

Currently in the standalone testnet phase, Epoch is stress-testing a single node’s ability to handle diverse intent types while measuring performance characteristics against competitive DeFi execution requirements.

The measured progression prioritizes reliability over speed, a crucial consideration given the protocol’s coordination role in handling user funds across multiple chains and protocols.

What’s Next: Intent-Driven DeFi

Epoch Protocol’s successful fundraise validates growing market recognition that DeFi’s next evolution requires new coordination primitives, not just additional protocols.

Users increasingly want to specify desired outcomes rather than execution steps, while sophisticated infrastructure handles optimization.

This mirrors broader technology trends toward abstraction and automation, suggesting strong product-market fit potential for well-executed intent-based platforms.

With $1.2 million in funding secured, private testing demonstrating significant efficiency gains, and the public testnet is live, Epoch Protocol is positioned to capitalize on this transition.

Epoch Protocol’s successful raise positions it as a leading contender in this emerging infrastructure category, with the capital and technical foundation necessary to turn intent-based coordination from concept to market reality.

Try Epoch Protocol Testnet

Join the shift from static aggregation to dynamic coordination. Experience better execution, lower costs, and seamless cross-chain trading today.

To Learn More:

Website

Doc

XTelegram

You May Also Like

Long-Time Investor Sets $1,000,000 XRP Order at $1

Tokyo’s Metaplanet Launches Miami Subsidiary to Amplify Bitcoin Income