These 2 Growth Engines Are Driving Billions Into US Crypto Adoption: Chainalysis

There has been an “explosion” of tokenized treasuries, while Bitcoin ETFs are seeing a rapid rise in the US.

Chainalysis found that these two segments reshape the intersection of traditional finance and crypto markets in the country.

Merging TradFi and Crypto

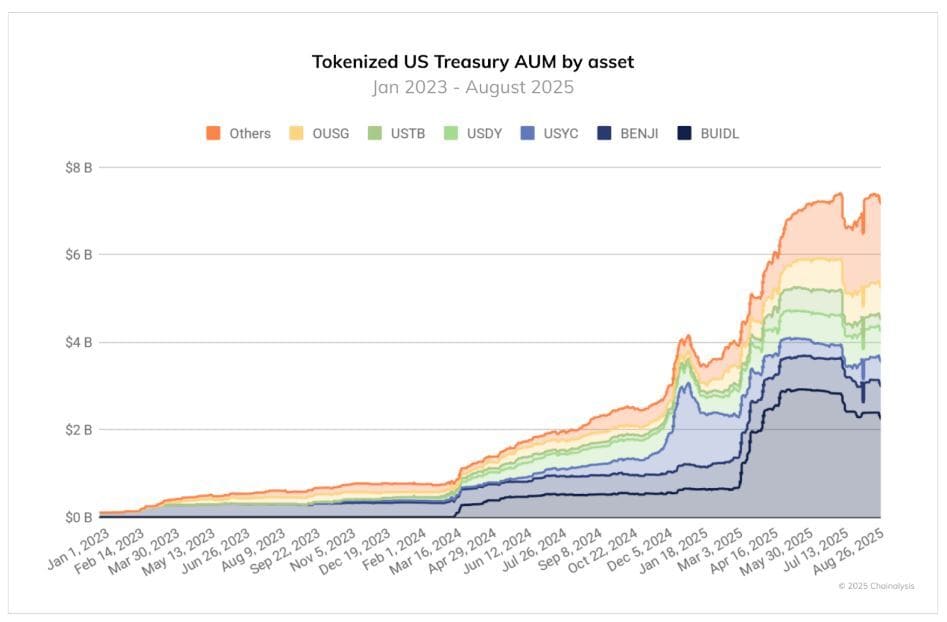

Tokenized real-world assets, particularly money market funds backed by US Treasuries, have emerged as one of the fastest-growing segments in the past year. According to Chainalysis’ data shared with CryptoPotato, assets under management (AUM) in tokenized money market funds nearly quadrupled, after climbing from around $2 billion in August 2024 to over $7 billion in August 2025.

While this figure remains small compared to the $27 trillion-plus US Treasury market, the sharp growth points to investor appetite for regulated, on-chain, yield-bearing products that combine the liquidity of crypto with the safety of government-backed debt.

These tokenized assets have become especially compelling in a high-interest-rate environment, as they offer crypto-native investors and institutions stable returns and provide collateral for DeFi protocols and fintech platforms.

Tokenized US Treasury AUM

Tokenized US Treasury AUM

Additionally, Bitcoin ETFs have also established themselves as the leading gateway for institutional exposure to digital assets. By mid-July 2025, global AUM for Bitcoin ETFs surged to roughly $179.5 billion, and the US-listed products accounted for more than $120 billion. This is a clear demonstration of the United States’ outsized role in driving this trend.

The appeal lies in providing mainstream investors with BTC price exposure without requiring them to manage private keys or hold the asset directly, which lowers entry barriers while boosting liquidity. At the same time, the growth of Bitcoin ETFs ties demand more closely to US monetary policy and equity market cycles, thereby intensifying correlations with broader risk assets.

Meanwhile, Ethereum ETFs, though smaller at $24 billion in AUM, are also gaining traction, and potential approval of Solana ETFs could expand this momentum further.

Beyond institutional adoption, retail participation also remains strong. In fact, centralized exchanges saw $2.7 trillion worth of Bitcoin purchases in USD, followed by $1.5 trillion in ETH and $454 billion in USDT. To top that, Bitcoin’s dominance in fiat trading has been remarkably steady at around 42% since 2022.

North America – World’s Most Volatile Crypto Market

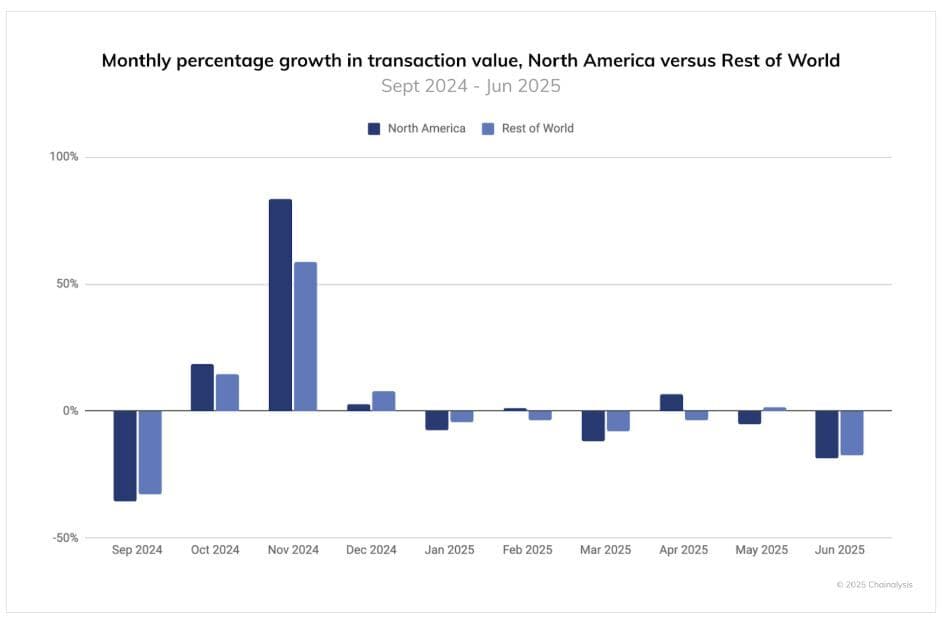

The United States has secured the number two spot in the Chainalysis 2025 Adoption Index, catapulting North America as a crucial aspect in global crypto markets. The region accounted for 26% of all transaction activity between July 2024 and June 2025, and total inflows reached $2.3 trillion.

Monthly Percentage Growth in Transaction Value

Monthly Percentage Growth in Transaction Value

December 2024 saw a historic peak, as $244 billion was received in a single month, driven by record-breaking stablecoin transfers. The blockchain data platform explained that the US presidential election in November 2024 was a catalyst for this surge.

North America stands out not only for scale but also for volatility, with transaction growth swinging from a 35% drop in September to an 84% jump in November. Much of this is attributed to institutional strategies and trading patterns that amplify market movements.

The post These 2 Growth Engines Are Driving Billions Into US Crypto Adoption: Chainalysis appeared first on CryptoPotato.

You May Also Like

Born Again’ Season 3 Way Before Season 2

Fed forecasts only one rate cut in 2026, a more conservative outlook than expected