Sui Crypto Joins Google’s AP2 Launch, Putting Crypto Payments Into the AI Era

Sui Crypto is about to have a major breakout in Q4. The L1 blockchain created by former Facebook devs has been thrust into the spotlight with Google’s launch of the Agentic Payments Protocol (AP2), a framework built for AI-driven payments.

Backed by PayPal, Salesforce, and dozens of others, AP2 aims to let autonomous agents manage direct purchases and recurring transactions with little to no human input.

According to analyst MartyParty, AP2 “creates a traceable audit trail, making automated purchases safer,” while setting the stage for broader Web3 applications in subscriptions and digital content monetization. Here’s what else you need to know about Sui crypto heading into Q4.

Sui Crypto Price Action: Could Tight Bollinger Bands Hint at Breakout?

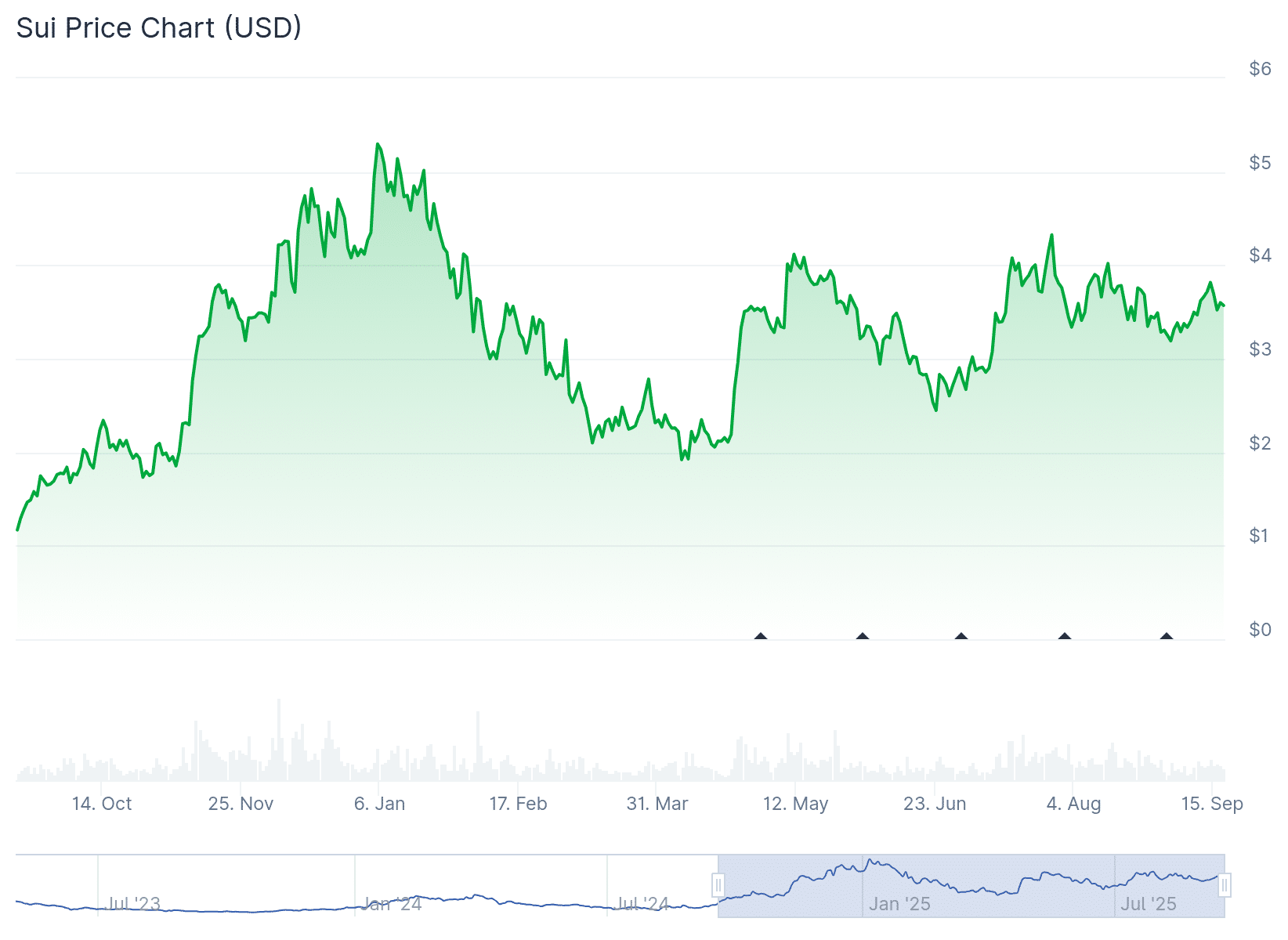

(Source: CoinGecko)

(Source: CoinGecko)

At the time of writing, SUI trades at $3.57, up +2.29% in 24 hours and logging a +1% weekly gain. While modest on the surface, traders are watching a bigger technical story unfold.

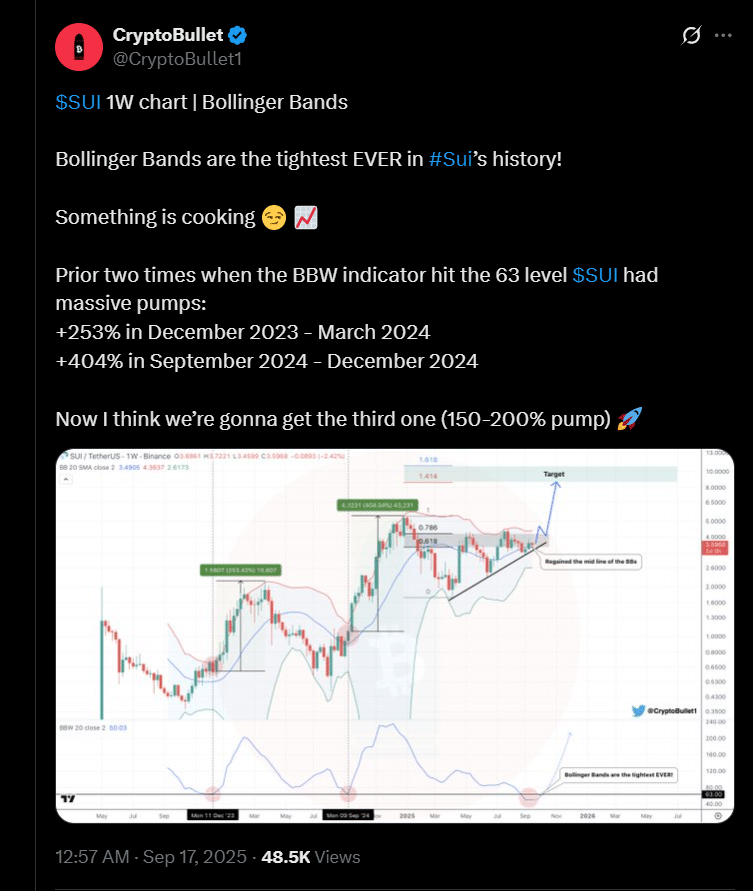

Past setups of this SUI price action echo similar squeezes in Dec. 2023 and Sept. 2024, which triggered 250% and 404% rallies. It also helps that the Bollinger bands are at their tightest levels in SUI’s history, suggesting volatility is about to expand.

(Source: X)

(Source: X)

Analyst CryptoBullet expects a 150–200% move if history repeats, with $5–$6 as early targets. That technical setup, layered on top of Sui’s AP2 partnership, has made it one of the most closely tracked altcoins this week.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Why Google’s AP2 Could Be a Catalyst for Sui’s Next Rally

For investors, the key is whether agent-led commerce becomes more than a buzzword. I mean, would anyone you talk to on the street know what “agent-led” commerce was?

No. But if AI-driven agents gain traction in industries like subscriptions, enterprise licensing, or automated trading, Sui’s architecture is well-positioned to capture demand. Its Move-based design allows fast, asset-oriented execution and it is exactly what’s needed for microtransactions at scale.

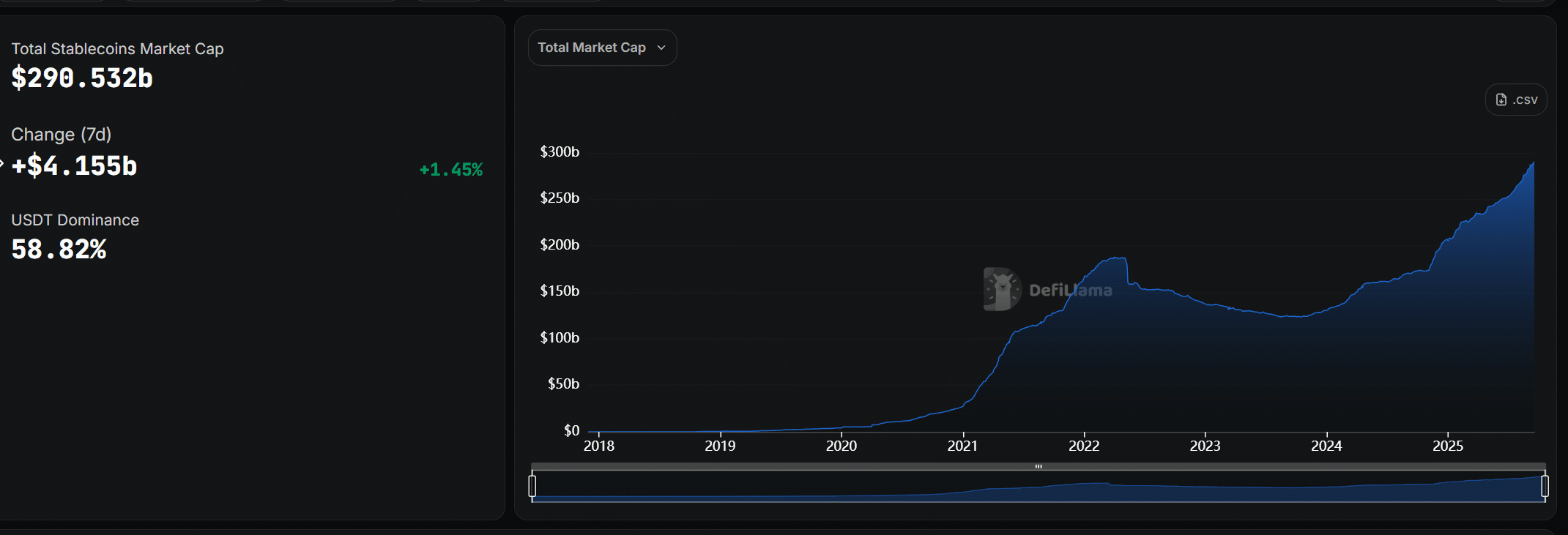

(Source: DeFiLlama)

(Source: DeFiLlama)

DeFiLlama reports $290B in stablecoin liquidity across the market, capital that could rotate quickly if AP2 adoption picks up.

DISCOVER: 20+ Next Crypto to Explode in 2025

Sui ETF Filings Add Fuel to the Fire: Is SUI The Breakout Star For Q4?

The news comes as US regulators face a flood of new crypto ETF filings. Among them is Bitwise’s spot Avalanche ETF, Tuttle’s “Income Blast” funds covering Sui (SUI) and Bonk, and a leveraged Orbs ETF. While analysts see AVAX and tokenization funds as likeliest to win approval, the presence of Sui in ETF filings adds another institutional angle.

Whether SUI rallies 150% as traders predict will depend on adoption and broader market risk appetite, yet it is clear that Sui is now part of Google’s vision for AI-powered finance.

EXPLORE: Singapore Denies Do Kwon’s $14M Refund Demand For ‘Stolen’ Penthouse

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Sui Crypto is about to have a major breakout in Q4. The L1 blockchain created by former Facebook devs just partnered with Google.

- Whether SUI rallies 150% as traders predict will depend on adoption and broader market risk appetite.

The post Sui Crypto Joins Google’s AP2 Launch, Putting Crypto Payments Into the AI Era appeared first on 99Bitcoins.

You May Also Like

Crucial Fed Rate Cut: October Probability Surges to 94%

Pump Fun Fund Launches $3M Hackathon: Market-Driven Startups