Motif AI Enters Phase Two of Its Growth Cycle

[PRESS RELEASE – Zurich, Switzerland, September 17th, 2025, Chainwire]

Motif is expanding its closed beta. Opening access to more users ready to experience the next generation of AI-powered wealth management.

Motif, the AI wealth management app for the future, has entered the second phase of its growth cycle, expanding its beta platform. Now, more users than ever can participate in Motif’s growth.

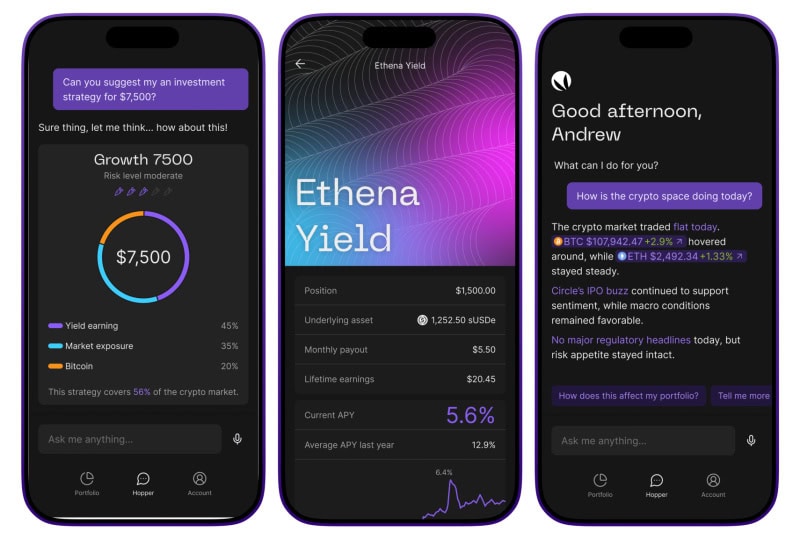

This expansion offers firsthand experience of what makes Motif different. Motif makes digital wealth management personal and interactive, giving users an AI wealth manager that builds hyper-personalized, diversified, and yield-bearing portfolios. By combining stable products like Ethena with market insight, risk management, and seamless execution, Motif helps users grow and protect their wealth in one place. With 24/7 autonomous execution on the horizon.

In addition to this milestone, Motif has made strides in regulatory compliance by incorporating its business in Switzerland. This move ensures adherence to stringent financial regulations, providing users with a secure and compliant environment that fosters trust and validation for those managing their assets on the platform. This incorporation also paves the way for a VASP with an application already in progress.

In another boost of confidence for the start-up, Motif has been accepted into Ignition Season Four by Superteam SG, a Solana initiative that welcomes only eight crypto startups into its selective cohort. This milestone reinforces Motif’s momentum within the blockchain ecosystem and provides access to strategic mentorship, hands-on resources, and high-signal connections to further accelerate growth.

Motif has also been named a finalist for the Startup Battle at the 11th European Blockchain Convention in Barcelona this October. Selected from over 500 applicants, Motif will pitch live on stage in front of more than 300 investors, putting its vision for AI-powered wealth management in the spotlight at one of Europe’s leading blockchain events.

Finally, Motif AI can now confirm Menyala, Temasek’s web3 venture builder, as a key funding source in their pre-seed round. This partnership brings significant validation and support, further strengthening Motif’s position and providing the resources necessary for continued innovation and growth.

This recent flurry of activity for the project signifies a strong future and potential opportunity in the AI wealth management space.

For more details, users can visit the motif website https://www.motifapp.ai

About Motif

Motif is a technology company developing AI-powered wealth management solutions for digital assets. Founded by fintech and crypto specialists based in Switzerland, Motif provides tools that help users build and manage diversified, long-term digital asset portfolios. The company’s platform integrates agentic AI technology to assist with allocation decisions, risk management, and portfolio optimization.

Users can join the Closed Beta or join the community on Discord and Telegram.

The post Motif AI Enters Phase Two of Its Growth Cycle appeared first on CryptoPotato.

You May Also Like

Google's AP2 protocol has been released. Does encrypted AI still have a chance?

Zama to Conduct Sealed-Bid Dutch Auction Using Encryption Tech