A quick look at Loud: An experiment in a decentralized attention market that rewards voices with transaction fees

Original author: @0x_ultra

Compiled by: Zen, PANews

TL;DR

Loud is an experiment in the relationship between attention and value. $LOUD tokens have no intrinsic value, and every transaction generates a fee, which is used as a marketing budget every week to reward the top 25 users who can increase Loud's mindshare the most. The allocation is done using @KaitoAI's mindshare data, which is one of the most efficient incentive mechanisms currently available.

This is not a revolutionary paper on attention mechanisms in neural networks; it is an experiment in the purest form of attention market, one that will run forever, without human intervention.

Inspiration

We often talk about the attention economy in Web3, and the platform built by Kaito AI is essentially a system that allows everyone to participate in the attention transaction, thereby accelerating the development of the entire industry. In the process, it also created one of the best proof-of-work incentive mechanisms in history: a reward mechanism based on "mindshare". This Web3 primitive allows project parties to get the highest output possible for every dollar invested: creating a reward pool that is fought over by those who are willing to work. This is the first piece of the puzzle.

The second part is inspired by the successful practice of Believe, a Web3 startup platform: through transaction volume and fees, a long-term model of binding the interests of speculators and creators is established, thereby feeding back to the creators' continued creation. In fact, the attention of a project is completely dependent on the output and maintenance of the creators, so the creators are the key driving force to maintain attention.

So what would happen if we could combine the best of both models and create a new incentive mechanism that aligned the motivations of all participants around the goal of maximizing mind share?

What is Loud?

Loud is an experiment in distilling cryptographic primitives to their purest form, removing the intermediate product forms.

It's time for the "3,3 game theory" to return.

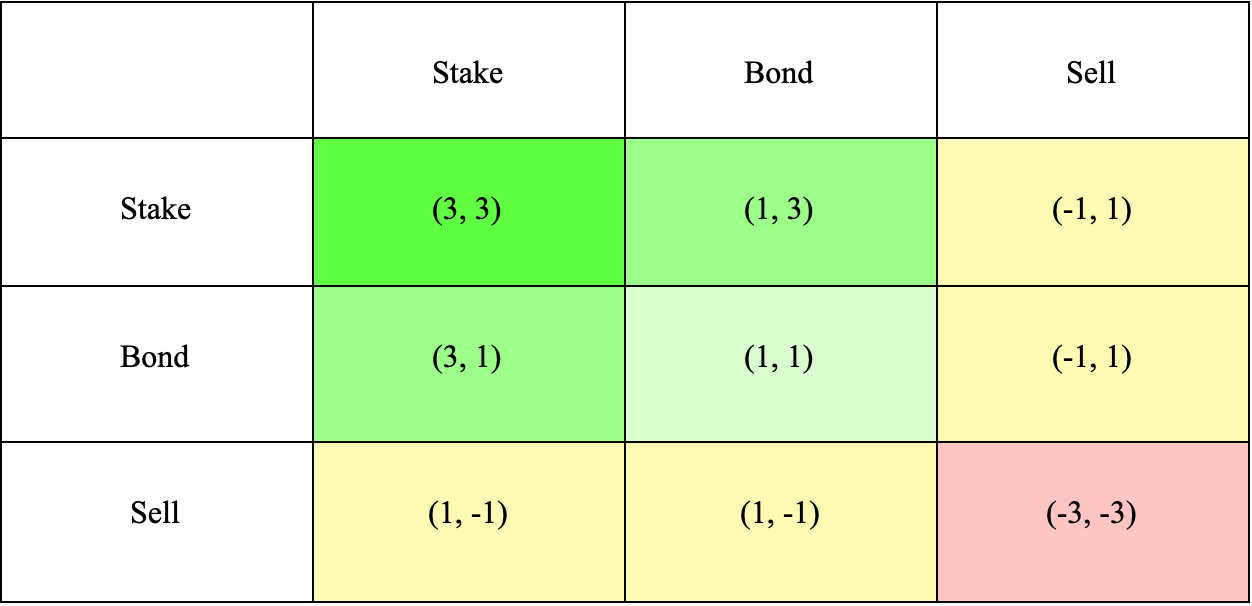

(3,3) Game theory is a concept proposed by Olympus DAO. It originates from the collaborative thinking in game theory and expresses that a "win-win" situation can be achieved when participants cooperate with each other. Its essence is an optimized version of the prisoner's dilemma. Combined with the token economic model of Web3, it conveys the concept of "we win together" to the community in an easy-to-understand way.

In the game matrix, "3" means that the operation has a positive effect on both the protocol and the participants; "-3" means it is harmful. Therefore:

-

(3,3): You stake, I stake, we all support the protocol, the protocol grows, and we all benefit the most → win-win

-

(-3,-3): You sell, I sell too, the agreement collapses, we all lose → lose together

-

(3,-1): You pledge, I sell, you take the risk and I profit → One-sided game

Experimental setup

We combine the best of the “attention proof of work” model with a mechanism that allows creators to earn long-term commissions. What would happen if we provided continuous rewards for those who spread a topic?

We will get the purest "3,3": a direct link between speculators and opinion leaders (KOLs) - no need for intermediaries at all. A continuous attention engine subsidized by speculators and driven by KOLs.

The fees paid by traders will be directly transferred to a bonus pool, which will be divided among the "topic makers" who rank at the top of the attention rankings, incentivizing them to continue to create greater publicity and trading volume. You should have seen the prototype of this flywheel mechanism.

-

The goal of a topic maker: to stimulate higher trading volume

-

Trader’s goal: Buy attention through fee subsidies

This is an experiment in whether attention is enough to confer value. If something gets enough attention, does its price go up? Or vice versa?

Actual operating mechanism

-

$LOUD tokens will be traded on the Solana chain through the liquidity pool of the liquidity platform Meteora. A handling fee will be charged for each exchange, denominated in SOL.

-

Users can gain "mind share" by posting content about Loud

-

The mindshare ranking mechanism provided by Kaito AI will objectively quantify contributions

-

Users can go to stayloud.io to view the leaderboard and register their wallet to receive rewards

-

Once a week, the transaction fee (in SOL) will be distributed to the top 25 users in the leaderboard according to their mindshare contribution ratio.

-

20% of the handling fee will be awarded to $KAITO stakers to promote the ecological flywheel and achieve interest binding

-

The flywheel mechanism will continue forever without intervention

Loud is the purest symbiotic model of speculators subsidizing KOLs.

About the Top 25 ranking mechanism

Why set the top 25 limit? Because as mentioned above, every fee paid by traders is essentially to "buy attention". Setting a smaller reward pool can motivate participants to work harder to gain voice for token holders and traders. Even if you enter the top 25, you can't rest easy - the reward distribution will be entirely based on the mindshare contribution ratio, and participants must continue to maximize their communication efficiency and influence.

Note: Loud is an experimental project. The mechanism will be continuously optimized and adjusted based on community feedback, but it will always adhere to the principle of minimal intervention. It aims to conduct the first large-scale experiment of "decentralized attention-value system".

What happens next?

$LOUD tokens will be launched soon, and the specific release time and distribution method will be announced in subsequent announcements. The experiment is about to begin, with technical support provided by Holoworld AI.

This is an experimental project that belongs entirely to the community: no team reserves tokens, no hidden interests, a completely fair launch, and 100% transparency. How it will develop next depends entirely on the community.

You May Also Like

Building a DEXScreener Clone: A Step-by-Step Guide

Which DOGE? Musk's Cryptic Post Explodes Confusion