Amidst the crossroads of waiting for the Monad mainnet launch: Should the ecosystem move forward or remain where it is?

Author:yyy

Introduction:

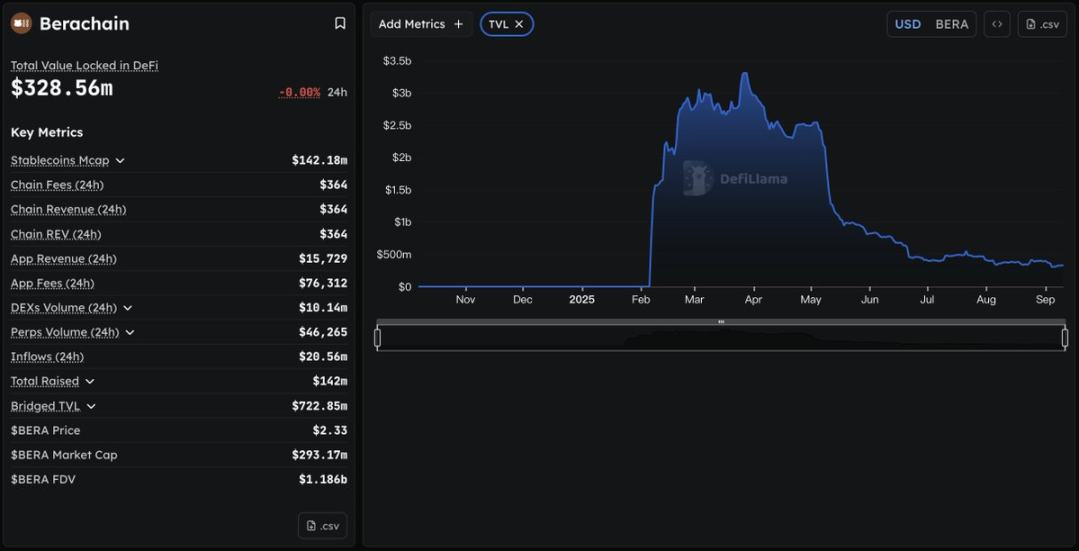

The ecological development of Berachain's mainnet launch was far below expectations, shattering the native ecological protocol TGE plan. The on-chain protocol that has not yet issued a coin became a victim of the Berachain TGE.

Taking BearChain as an example, Monad is at a critical juncture, about to launch its mainnet, so where should the ecosystem protocols go from here? Some project owners have already left, while others are still holding on.

Monad and Berachain can be said to be the two high-performance L1 chains most favored by capital in this bull market. One represents the ultimate Ponzi cultural narrative, and the other leads the direction of change in ultra-high-performance public chains.

Institutional investors are also drawn to the native ecosystem protocols of Berachain and Monad. Berachain's star protocol, @InfraredFinance, has raised nearly $20 million across three rounds; @honeypotfinance, valued at $20 million; and @origami_fi, in which Berachain's founder and several BearChain veterans participated in the funding round.

Berachain launched its mainnet and synchronized TGE as early as February 6, but seven months have passed, and to this day there are still many protocols on Berachain that have not yet conducted TGE.

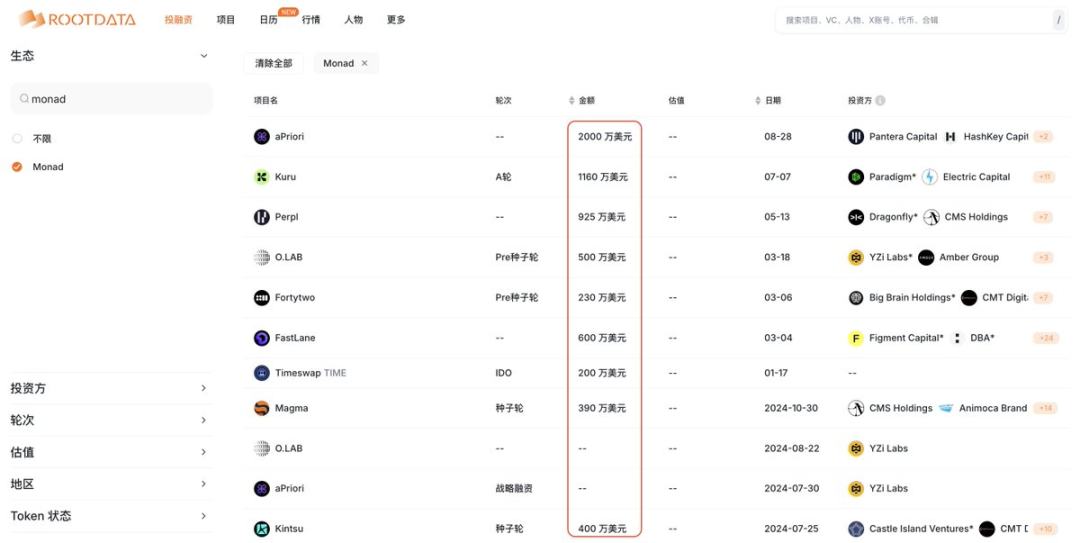

The financing data of @monad's on-chain ecosystem protocols is even more impressive than that of the Berachain ecosystem: MEV and LSD infrastructure layer @apr_labs completed multiple rounds of financing totaling $30.7 million; native CLOB DEX protocol @KuruExchange completed two rounds of financing totaling $13.6 million; native perp DEX @perpltrade completed $9.25 million in financing; prediction market protocol @opinionlabsxyz completed a $5 million Pre-Seed round of financing...

Without exception, all ecological protocols on the Monad chain are waiting for the launch of the Monad mainnet to start tge.

The Big Game of Ecological Protocol TGE Timing

Choosing the right time to launch a major on-chain ecosystem protocol is a game of strategic decision-making. Some projects choose to launch on other chains before the mainnet launch, some immediately after, and some wait and see how the ecosystem heats up and the overall crypto environment develops.

I wouldn't call the project's choice of TGE timing a "big gamble" but rather a "big game." This is because the "gamble" is based on completely asymmetric information, and ecosystem project owners are the most familiar with public chain teams. They have a strong sense of whether public chain teams are committed to concrete actions or just empty talk.

However, the ecosystem development and changes after the public chain mainnet launch are not fully under the team's control and are fraught with uncertainty and unknowns. The room for maneuver for ecosystem projects lies in the public chain team's market-making capabilities, ability to call orders, incentive measures, and most importantly, expectations for future crypto market trends.

During the long wait for @monad's mainnet launch, many projects gave up and chose to move to other chains. Representative projects, such as @Kintsu_xyz, the Monad native LSD protocol, ultimately chose to launch their mainnet on the @HyperliquidX chain.

postscript

According to multiple sources, @monad is expected to launch its mainnet and tge in Q4. Before the mainnet launch, some protocols similar to @Kintsu_xyz may choose to leave.

But I believe more native protocols will remain in place. Betting the survival of the protocol on a single native public chain is a great move, as everyone prospers together.

You May Also Like

Japanese Yen rises on safe-haven demand and intervention concerns

GBP trades firmly against US Dollar