Best Presales News Live Today: Latest Updates on Early Crypto Projects with 10x Potential (October 17)

Stay Ahead with the Latest Insights of Today’s Best Presales News

Check out our Live Best Presales Updates for October 17, 2025!

Of all the crypto opportunities out there, presales are often the most promising and potentially the most profitable. These early-stage projects raise funds to launch community-driven meme coins, utility-heavy projects, and even degen shitcoins.

What defines crypto presales is the opportunity to join stage zero at the lowest possible price point. It can only go up from there, which it often does.

Pepe Unchained soared 550% post-presale, to name one presale. The potential is there, and if you’re looking for the latest crypto presale updates to get in early, you’ve come to the to right place.

We update this page regularly throughout the day with the latest insights on presales. Keep refreshing to stay ahead of the pack!

Disclaimer: No crypto investment comes without risk. Our content is for informational purposes, not financial advice. We may earn affiliate commissions at no extra cost to you.

Bitcoin Fear Index Plunges to Yearly Low — Bitwise Sees Opportunity as $HYPER Emerges Among the Best PresalesOctober 17, 2025 • 10:00 UTC

On October 10th, a violent market crash sent $BTC tumbling to $103,133, only for the coin to rebound to $116,044 by October 13th before cooling off at $108,138 at the time of writing.

The Bitcoin Fear Index dropped to 22 from last week’s 71, its lowest in a year, reflecting the widespread risk aversion among investors.

However, Bitwise interprets this as a contrarian signal, arguing that it’s the ideal phase for accumulation. The historical pattern from April this year supports Bitwise’s theory, as $BTC dipped below $74K only to rally above $100K the following month.

On the other hand, Glassnode data suggest that small holders are accumulating Bitcoin, a sign of rising retail confidence.

Amid high market volatility, promising presale opportunities like Bitcoin Hyper ($HYPER) are gaining strong traction from savvy investors. Bitcoin Hyper is a scalability solution that aims to deliver Solana-level speed, ultra-low fees, near-instant finality, and support for dApps, DeFi, and NFTs.

Discover how to purchase Bitcoin Hyper ($HYPER) in our comprehensive guide.

$1.8B in Bitcoin Profits Hit the Market — Is Bitcoin Hyper ($HYPER) Poised to Shine Among the Best Presales?October 17, 2025 • 10:00 UTC

$BTC is exhibiting signs of exhaustion, dipping below its key psychological zone of $110K-$112K and is now trading at $108,572, signalling low investor confidence.

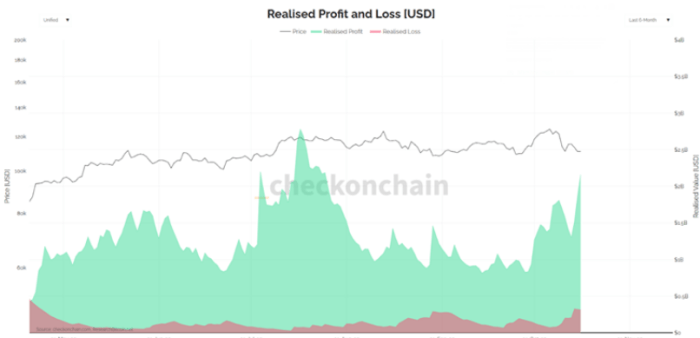

On October 15, traders locked in $1.8B in profits during which long-term holders took advantage of 6X gains and small-time holders sidelined with smaller returns. The same day saw $319M in realized losses, suggesting market instability and a sentiment shift among profit-takers and loss-sellers.

Analysts cite this pattern as healthy derisking – one that resets the market’s overbought conditions before its next leg up.

Checkonchain Data shows Bitcoin stuck between its 128 and 200 DMAs, signalling fading momentum and a potential directional shift ahead.

As $BTC consolidates near $110K, savvy traders are rotating capital into emerging presales like Bitcoin Hyper ($HYPER). A recent whale purchase $28,230 just last week shows that the project’s momentum is heating up.

Take a look at our expert $HYPER price prediction path.

Authored by Ben Wallis, Bitcoinist — https://bitcoinist.com/best-presales-news-live-today-october-17

You May Also Like

UK Looks to US to Adopt More Crypto-Friendly Approach

Crucial Fed Rate Cut: October Probability Surges to 94%