Bitcoin Tops $125K as ETFs Surge — Why Bitcoin Hyper ($HYPER) Could Ride the Rally

Of the $4.5B, about $3.2B went into Bitcoin ETFs — marking the second-largest weekly inflow for $BTC ETFs since November 2024’s $3.37B peak.

Furthermore, ETF trading volumes surged to approximately $26B during the trading period. BlackRock’s iShares Bitcoin Trust is top of the league with a single-fund inflow figure of roughly $1.78B, followed by Fidelity’s FBTC with $692M, Ark 21Shares with $254M, and Bitwise with $212M.

These massive ETF inflows, associated with shifting institutional strategies, signal a new phase of Bitcoin adoption – one that strengthens the entire ecosystem.

Billions Flood into Bitcoin ETFs: The Institutional Liquidity Shock Powering BTC’s $125K Breakout

So why do ETF inflows move the price more than ordinary trading flows?

Well, ETFs convert institutional and retail capital into regulated, pooled investment vehicles that acquire and hold spot $BTC/$ETH, creating steady and measurable demand for the underlying assets.

Secondly, large ETF creation/redemption flows reduce the amount of Bitcoin available to sell through exchanges and OTC desks, which helps tighten the market and push up prices, even with modest buying activity.

Finally, traders and algos watch ETF inflows – significant inflows trigger momentum strategies, options hedging, and market-making flows that amplify the move.

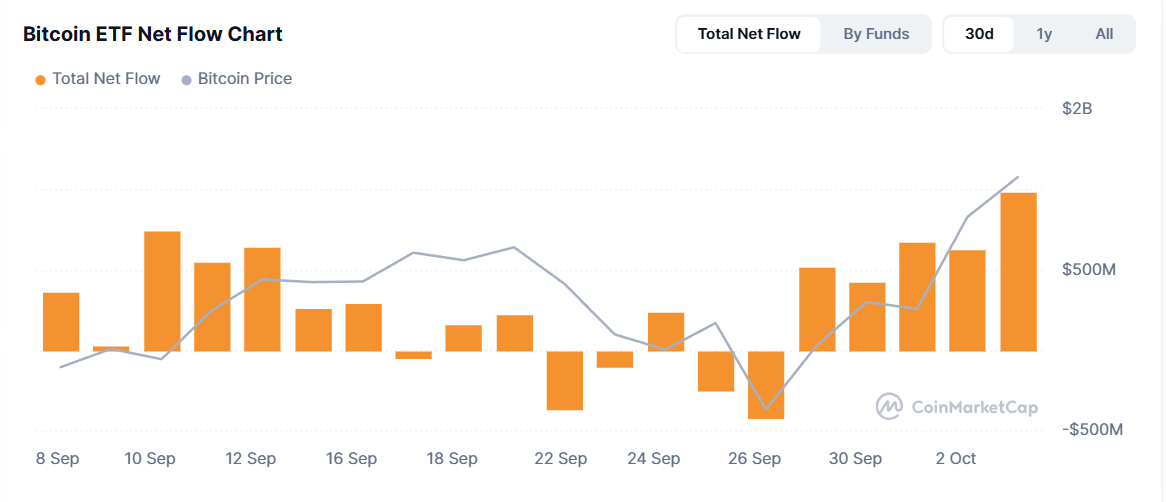

In late September, multiple ETF-flow trackers noted a V-shaped return of inflows into spot ETFs, marking a shift from outflows to sustained buying. This rotation helped tighten supply and fueled the momentum into October (the so-called ‘Uptober’ effect).

Source: CoinMarketCap

Indeed, as we have seen, corporate treasuries, asset managers, and wealthy family offices are increasingly turning to exchange-traded funds (ETFs) as a more accessible way to invest in cryptocurrency.

In addition, the recent tax/treatment clarifications released in early October have also led companies toward on-balance-sheet holdings.

Psychologically, a new ATH ($125K on October 5) draws attention and capital, legitimizes allocation decisions, and often fuels further inflows and price gains.

Together, this momentum has energized the entire crypto landscape, with Bitcoin Hyper ($HYPER) emerging as one of the prime beneficiaries to ride this rally.

Bitcoin Hyper ($HYPER): The High-Speed Layer-2 Poised to Dominate the Post-ETF Era

Bitcoin still rules the cryptocurrency market with a 58.5% share, but its slow transaction speeds, high fees, and 1 MB block limit restrict its scalability.

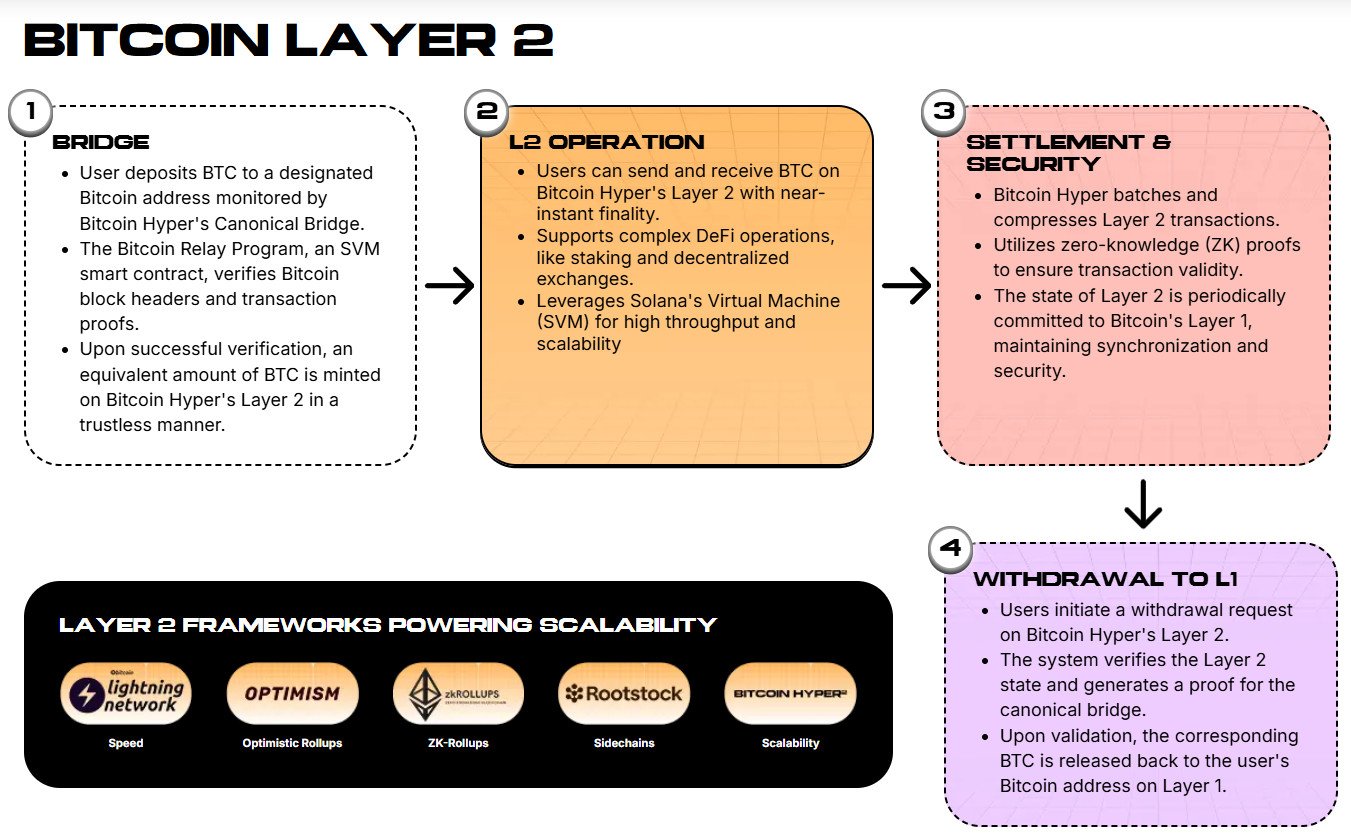

That’s where Bitcoin Hyper ($HYPER) steps in — a unique Layer-2 solution built directly on Bitcoin, powered by the Solana Virtual Machine (SVM). This keeps Bitcoin as the monetary base layer while Hyper becomes its high-speed execution layer.

By bridging Bitcoin onto Hyper, you can send, stake, or trade instantly with near-zero fees. Using zero-knowledge proofs, transactions are settled back on Bitcoin’s main chain, maintaining Bitcoin’s unmatched security.

With SVM integration delivering Solana-level performance and cross-chain support for $BTC, $ETH, and $SOL, Bitcoin Hyper unlocks real DeFi, DAOs, and micro-payments on Bitcoin.

The project is already turning heads, having raised $21.6M in its presale so far. Whale activity is heating up too — with major buys of $196.6K, $145K, $56.9K, $29.8K, $11.8K, and $10.4K, totaling $450.5K just this week.

The current price of 1 $HYPER is $0.013065, and staking rewards yield a 55% APY. These rewards will gradually taper as more participants join the pool, so it’s best to get in soon.

Secure your tokens today from the $HYPER presale website before this ship sails.

You May Also Like

Gold continues to hit new highs. How to invest in gold in the crypto market?

DOGE ETF News & Could Layer Brett See an ETF Approval in Years to come?