Bitcoin’s $6 Trillion Endgame: Why the Latest Crash Could Start a Massive Bull Run

The post Bitcoin’s $6 Trillion Endgame: Why the Latest Crash Could Start a Massive Bull Run appeared first on Coinpedia Fintech News

The crypto market just faced one of its sharpest shocks in months. Bitcoin briefly fell below $100,000, erasing nearly $2 billion in market value within hours. The sudden drop sent fear rippling through the community.

But according to financial analyst Shanaka Anslem Perera, this panic might be the final shakeout before Bitcoin began its bull run, a setup he calls the $6 trillion endgame.

A Reset, Not a Collapse

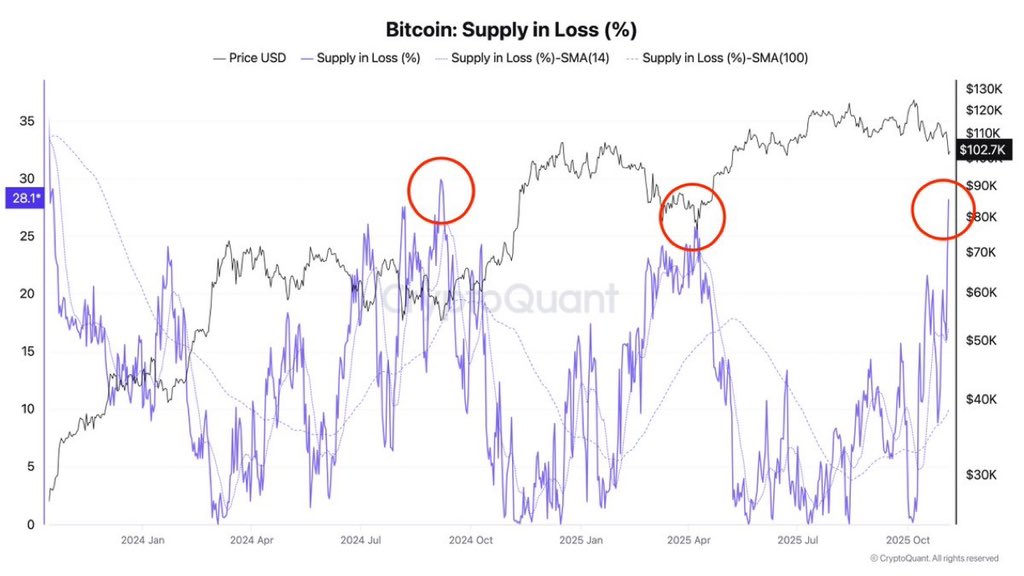

According to on-chain data, nearly 29% of Bitcoin’s supply is now in loss, meaning those coins were purchased at higher prices. While that might sound bearish, Perera explains it’s actually the same signal that appeared before every major Bitcoin rally in history, including 2017, 2021, and 2024.

Each time, Bitcoin followed with 150% to 400% gains within six months. This percentage represents what analysts call a “mid-cycle reset.” It’s the point where newer investors sell in fear while long-term holders quietly accumulate. It’s not a collapse, it’s a clean-up before the next leg higher.

Further the analyst explains that even though some platforms show over 97% of wallets in profit, it doesn’t tell the full story.

Many of those wallets belong to early buyers who purchased Bitcoin at much lower prices. This makes the number look higher than it really is, while many new investors are actually at a loss, a setup often seen before big rallies.

The “$6 Trillion Endgame”

Perera suggests that the global financial system, with over $100 trillion in circulating fiat money (M2), is gradually shifting toward scarce, hard assets like Bitcoin.

He calls this shift the “$6 trillion endgame” because he believes that eventually, trillions of dollars from traditional markets, bonds, and cash reserves will move into Bitcoin and crypto, potentially creating a multi-trillion-dollar market cap for Bitcoin alone.

Market Flush The Panic Seller

Over $19 billion in leveraged positions have recently been wiped out, pushing open interest down by 42%. With funding rates now at near-zero, the overheated derivatives market has cooled completely.

This matters because it removes the “forced sellers,” the traders whose liquidations often trigger chain reactions. The market is now what Perera describes as “sterilized and stable,” giving Bitcoin a solid foundation for organic growth.

Whales and Institutions Are Quietly Buying

While retail traders panic, long-term holders now control about 70% of Bitcoin’s circulating supply, showing no signs of selling. Meanwhile, institutions have been quietly accumulating through ETFs, with inflows topping $149 billion.

Even stablecoin supply, often seen as “dry powder” for buying, has expanded by $50 billion since July, all indicating strong liquidity waiting to re-enter.

Once the pattern plays out, Perera believes the next 180 days could mark the start of Bitcoin’s next bull run.

You May Also Like

CME Group to Launch Solana and XRP Futures Options

XCN Rallies 116% — Can Price Hold as New Holders Gain?