BTC Drops as Strategy NAV Falls Below 1 Amidst Ongoing Bearish Rally

Bitcoin’s recent plunge has marked its lowest trading levels since May 2025, signaling increased volatility amid broader market uncertainties. Alongside Bitcoin’s decline, MicroStrategy’s stock (MSTR) has experienced significant pressure, falling to pre-market levels not seen since October 2024. This combination underscores growing apprehension among investors regarding the company’s Bitcoin holdings and market dynamics.

- Strategy appears to have transferred roughly $5.77 billion worth of Bitcoin into new wallets, likely for custody, sparking market speculation.

- MicroStrategy’s Net Asset Value (NAV) multiple falling below 1 signals that the company’s market valuation now undercuts its Bitcoin holdings’ value.

- Despite market stress, analysts suggest a forced liquidation of Strategy’s Bitcoin position remains unlikely in the near term.

- Market sentiment remains fragile as traders scrutinize whether underlying issues could lead to further declines.

- Some experts see the decline as a technical correction rather than a sign of systemic crisis in the crypto space.

Wallet move sparks panic after a $5.7 billion Bitcoin transfer

Market volatility intensified Friday after Strategy transferred 58,915 BTC, worth approximately $5.77 billion, into new wallets. This move quickly fueled speculation on social platforms that the company might be preparing to sell part of its Bitcoin holdings, prompting a flurry of activity from bots and algorithmic traders reacting to the news.

Industry analysts swiftly sought to clarify the move, emphasizing that it appears to be a routine custody restructuring rather than any imminent sale. One crypto expert noted,

Despite reassurances, the overall sentiment in the crypto markets remains cautious as traders and investors analyze whether deeper underlying issues may be causing the recent selloff, adding to the prevailing volatility in cryptocurrency and blockchain assets.

MSTR NAV drops below 1, an unprecedented indicator for Strategy

The more concerning development surrounds Strategy’s valuation metrics. For the first time, the company’s Net Asset Value (NAV) multiple dipped below 1, indicating the market now values MicroStrategy shares at less than the assessed value of its Bitcoin holdings. Currently, the NAV is slightly above at 1.09, but still remains at a historically low level.

Bitcoin Strategy Tracker NAV data. Source: XA NAV below 1 suggests that the market is pricing Strategy’s stock at a discount relative to the underlying Bitcoin assets, reflecting growing investor concerns regarding potential debt risks, liquidity issues, or questions about the sustainability of its aggressive Bitcoin acquisition strategy.

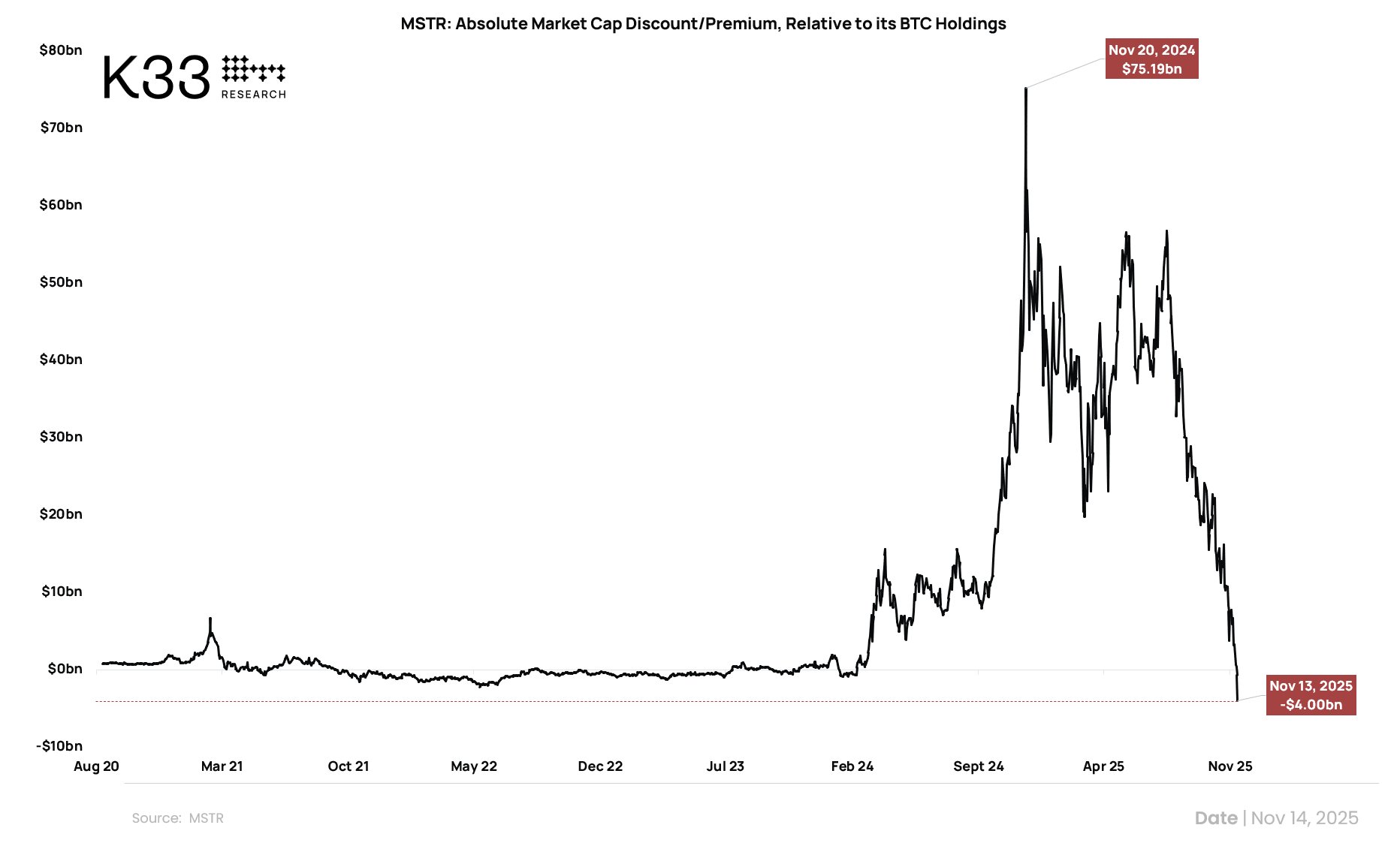

Vetle Lunde, head of research at K33, highlighted that Strategy’s equity premium has dropped by approximately $79.2 billion since November 2024. He pointed out that although the firm raised $31.1 billion through dilution, nearly $48.1 billion of implied Bitcoin demand never actualized into real BTC purchases. This indicates a decline in investor appetite for direct Bitcoin exposure via MicroStrategy.

MSTR market cap discount/premium relative to BTC holdings. Source: Vetle Lunde/X

MSTR market cap discount/premium relative to BTC holdings. Source: Vetle Lunde/X

However, Bitcoin advocate Willy Woo downplays fears of forced liquidation, suggesting that as long as MSTR’s stock remains above $183.19 by 2027—roughly aligning with Bitcoin’s $91,500 price assuming a 1x NAV multiple—there’s unlikely to be a need for strategic asset sales. Woo warned that partial liquidation could occur during the 2028 bull run if Bitcoin’s performance falters.

For more insights on macro trends affecting crypto markets, see: 3 Reasons Why Bitcoin and Risk Markets Sold Off: Is a Recovery on the Horizon?

This article is for informational purposes only and not financial advice. Cryptocurrency investments carry risks; thorough research is essential before making trading decisions.

This article was originally published as BTC Drops as Strategy NAV Falls Below 1 Amidst Ongoing Bearish Rally on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Why Bitcoin’s Bear Case Is Suddenly Back on the Table

USD/JPY drops to near 157.80 as US-EU disputes batter US Dollar