Crypto crash: Why are altcoins like Avalanche, Aster, and Dogecoin going down?

This week’s crypto crash continued today, Sept. 25, with Bitcoin plunging to $110,000 and the market capitalization of all coins falling to $3.81 trillion.

- The crypto crash is happening amid fears that the Fed may not cut rates as many times as expected.

- It also accelerated amid rising liquidations in the crypto market.

- The Crypto Fear and Greed Index has fallen this week.

Only five top-100 coins were in the green today, with popular tokens like Avalanche (AVAX), Aster (ASTER), and Dogecoin (DOGE) falling by over 10%.

Avalanche has plunged by 16% from its highest point this month, while Aster and Dogecoin have fallen by over 15% in the same period.

Crypto crash triggered by hawkish Fed officials’ statement

One major reason for the crypto crash is the fear that the Federal Reserve may not cut interest rates as many times as it hinted in its meeting last week.

In a statement this week, Jerome Powell suggested that the Fed was still concerned about inflation. Other Fed officials, including Beth Hammack and Austan Goolsbee, urged the bank to exercise caution when cutting rates.

Their message was that U.S. inflation remains high and that the labor market is still tight, with the unemployment rate hovering at 4.3%.

Cryptocurrencies do well when the Fed is cutting interest rates, as that leads to a risk-on sentiment.

Falling Crypto Fear and Greed Index

Bitcoin and altcoins like Avalanche, Aster, and Dogecoin also plunged as sentiment in the industry worsened. This situation is demonstrated by the Crypto Fear and Greed Index, which has dived from this month’s high of 73 to 41. It is at risk of plunging to the fear area.

In most cases, cryptocurrencies drop when the index moves to the fear zone. In contrast, most coins rally when there is greed, as this stimulates fear of missing out among investors.

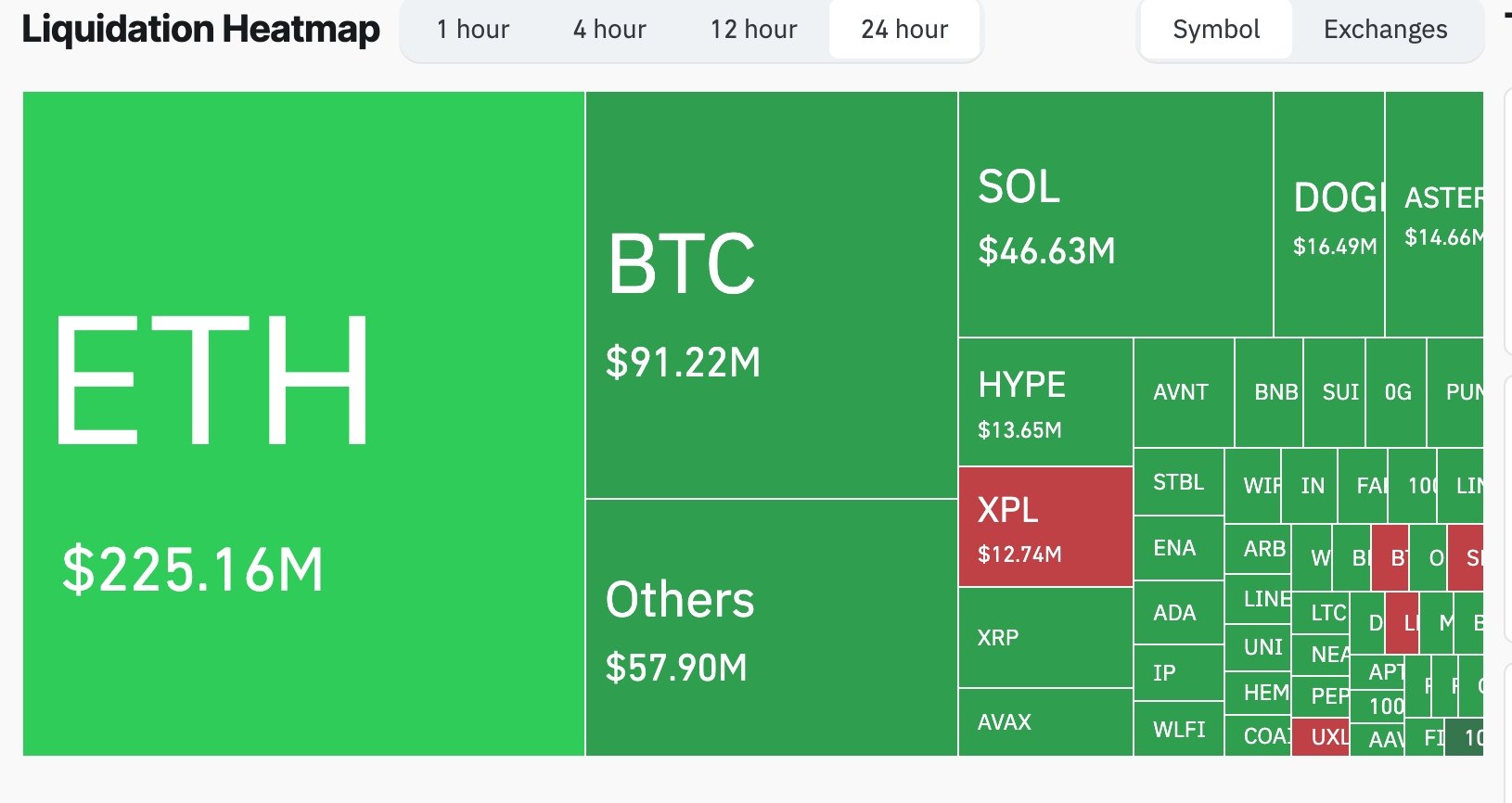

Crypto market falling amid strong liquidations

The other reason why the crypto market is going down is that liquidations have jumped this week. Crypto liquidations jumped by 100% on Thursday to $585 million.

Liquidations also jumped by over 800% on Monday to more than $1.65 billion. Avalanche had liquidations worth over $9.4 million on Monday and $5.5 million on Thursday.

Similarly, Dogecoin liquidations jumped to $58.6 million and $11.8 million on the two days, respectively.

Soaring liquidations are bearish for the crypto market, as they mean that long positions are being closed. Also, traders often stay on the sidelines when this happens. Data shows that the futures open interest of all coins fell by 2% on Thursday to $203 billion.

You May Also Like

Lucid to begin full Saudi manufacturing in 2026

Exploring Market Buzz: Unique Opportunities in Cryptocurrencies