Ethereum Price Drops 30% as ETF Outflows and Liquidations Shake the Market

The post Ethereum Price Drops 30% as ETF Outflows and Liquidations Shake the Market appeared first on Coinpedia Fintech News

ETH price has entered a critical phase after sharp ETF outflows and widespread liquidations drove Ethereum into a deeper correction. The asset’s decline of nearly 30% from its yearly peak has put traders on alert, though accumulating whales and on-chain signals suggest potential recovery zones forming ahead.

Major ETH ETF Outflows Add Selling Pressure

Over the past four active ETF days, all nine ETH ETFs have reportedly been responsible for notable capital outflows, which have weighed heavily on sentiment. Per farside, from October 29th to November 3rd, Ethereum ETFs collectively saw continuous withdrawals, with the most latest single-day outflow of $135.7 million recorded on November 3rd. Where BlackRock sold $81.7 million worth of ETH, amplifying selling pressure across institutional desks.

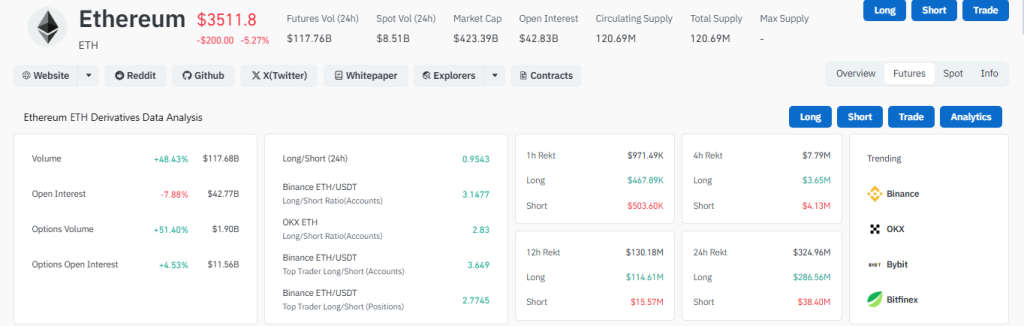

This institutional retreat has coincided with broader crypto market turbulence, leading to $1.33 billion in total liquidations within a single day. Ethereum alone accounted for $324.96 million of those liquidations, a figure that underscores the market’s fragile state. As a result, ETH price today trades around $3,510, down nearly 2.6% intraday.

On the Ethereum price chart, this pullback confirms a technical bear market, with prices now nearly 30% below the 2025 peak of $4,955. Despite this weakness, certain long-term investors appear to be taking advantage of the downturn to accumulate.

- Also Read :

- Crypto Market Meltdown: Over $90 Billion Wiped Out in an Hour as Panic Selling Intensifies—What’s Next?

- ,

BitMine’s Accumulation Highlights Long-Term Optimism

Even as market conditions worsen, large institutional holders have shown confidence in Ethereum’s long-term fundamentals. BitMine, a major ETH holder, has reportedly added $300 million worth of 82,353 ETH to its reserves, raising its total Ethereum holdings to approximately $11.11 billion holding 3.16 million ETH in total.

This accumulation pattern provides a key contrast to recent ETF outflows, suggesting that while some investors are derisking, others view the current ETH price in USD as a discounted accumulation opportunity. Such activity often reflects strategic positioning for future cycles, particularly if ETH crypto continues to expand its role in staking, DeFi, and tokenization.

Technically, Ethereum’s nearest support lies around the $3,300-$3,350 zone. A successful defense of this level could form the base for a reversal, potentially enabling a retest of the $4,955 yearly high if momentum strengthens in November. However, failure to hold support could extend the slide toward $2,890, marking deeper retracement levels.

On-Chain Indicators Show a Potential “Opportunity Zone”

According to on-chain data shared via Santiment insights, Ethereum’s 30-day MVRV ratio has dropped to -10.5%, entering what’s described as an “opportunity zone.” Historically, when this metric falls below -10%, ETH price forecast trends suggest accumulation opportunities, often preceding short-term recoveries.

In addition, whale accumulation and retail capitulation remain crucial for triggering the next leg higher. The pattern seen in past cycles reveals that when retail traders panic-sell and whales accumulate, it often sets the stage for a strong rebound.

Thus, while short-term volatility persists, the combination of technical support, institutional accumulation, and favorable on-chain metrics keeps optimism alive for a potential rebound in ETH price in the near term.

FAQs

As per our Ethereum price forecast 2025, the ETH price could reach a maximum of $9,428.11.

According to our Ethereum Price Prediction 2030, the ETH coin price could reach a maximum of $71,594.69 by 2030.

While Ethereum is trusted for its stout fundamentals, Bitcoin continues to dominate with its widespread adoption.

As per our Ethereum price prediction 2040, Ethereum could reach a maximum price of $4,128,680.

By 2050, a single Ethereum price could go as high as $238,189,500.

You May Also Like

WhiteWhale Meme Coin Crashes 60% in Minutes After Major Token Dump

Will Elon Musk buy this company next?