How ETF Flows Became the New Driving Force for Bitcoin

- Institutional Bitcoin flows through ETFs now dominate price movements, with normalized data offering consistent insights into market sentiment and positioning.

- EFIS reveals how sustained ETF inflows or outflows forecast accumulation or distribution phases among large institutional investors.

Since early 2024, capital flows from spot Bitcoin ETFs in the United States have taken over the market. This isn’t just a new story in the crypto industry, but a reality that’s increasingly difficult to ignore.

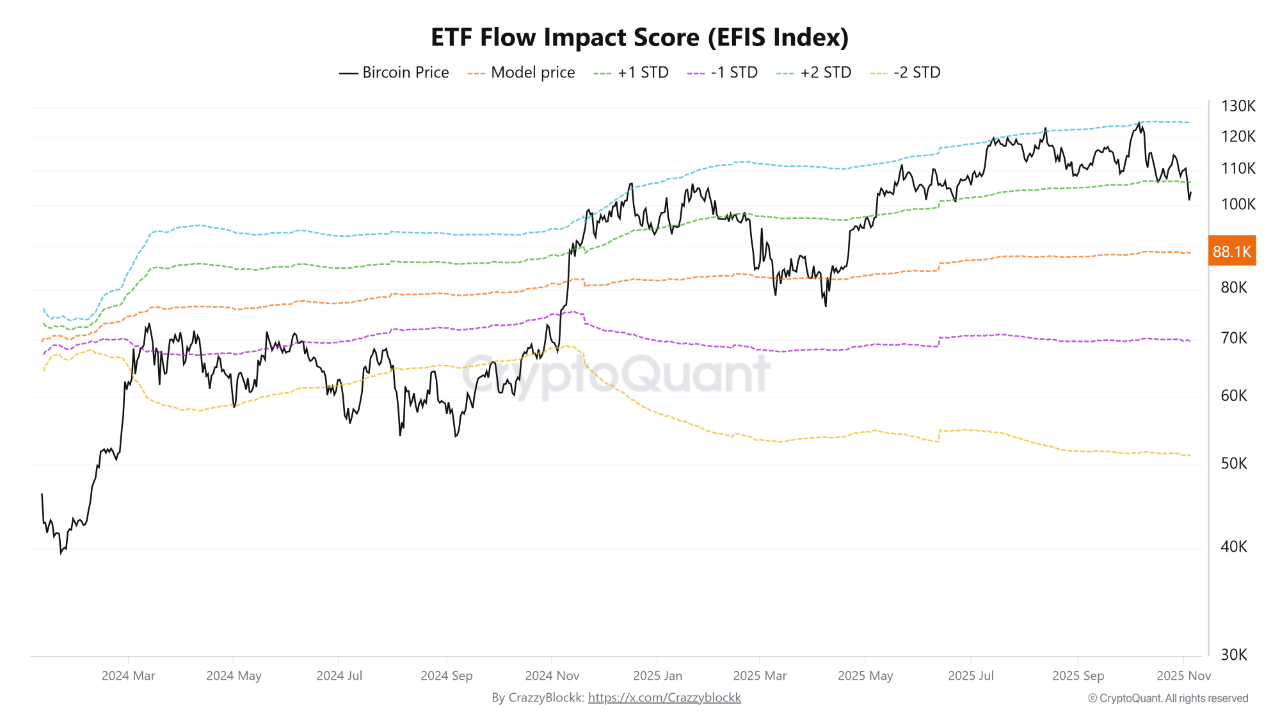

Observing this trend, on-chain analyst Crazzyblockk on CryptoQuant highlighted a particularly interesting metric: the ETF Flow Impact Score (EFIS).

This model is designed to measure the extent to which institutional funds from ETFs can move the Bitcoin price, with surprisingly high accuracy.

Source: CryptoQuant

Source: CryptoQuant

The EFIS is built from 663 days of inflow and outflow data on 11 active spot Bitcoin ETFs in the US. However, Crazzyblockk doesn’t simply count dollar inflows and outflows. He realized one crucial thing: a $200 million investment might have had a significant impact earlier in the year when AUM was still small, but now its impact is much smaller.

Therefore, the EFIS normalizes fund flows based on total assets under management (AUM), creating a consistent measure over time. This is where an interesting correlation arises: if fund flows exceed 1% of daily AUM, Bitcoin can move up 2% to 3% within a week.

EFIS Model Points to $88K, But Market Seems Unconvinced

Now, let’s look at some more alarming numbers. Total ETF holdings currently stand at 1,047,000 BTC. Based on current inflow patterns, EFIS estimates Bitcoin’s fair price should be around $88,000.

But the reality? It’s still far above that. This gap raises an intriguing question: is the market still unaware, or are ETFs simply being too aggressive?

Not only that, EFIS also has another feature that makes investors more alert. It can detect correction signals quite accurately. Whenever a daily outflow exceeds 0.5% of AUM, a major correction soon follows.

Conversely, if for five consecutive days there are positive inflows but the price is still 10% behind the model’s prediction, it’s a sign that institutions are secretly buying.

On the other hand, a previous report from CNF indicated increasingly tense conditions in the on-chain space. Market liquidity is under pressure due to political uncertainty in the US—especially as the looming government shutdown slows capital flows.

Bitcoin reserves on exchanges are rising again, while miners’ balances continue to shrink. This could be interpreted as a defensive move, not an offensive one.

Bitcoin’s Active Addresses Plunge, Signaling Institutional Control

Furthermore, in early November, we highlighted that the number of active Bitcoin addresses had dropped by 26% in a year. This reflects a decline in real activity on the Bitcoin network.

Retail investors are starting to withdraw, leaving institutions and long-term holders in the spotlight.

This situation further underscores the role of EFIS as a tool to detect invisible institutional flows. Because, as Crazzyblockk revealed, the only way to directly measure institutional positions is through ETF data.

Meanwhile, as of the writing time, BTC is changing hands at about $102,889. up 1.04% over the last 24 hours, with $7.19 billion in daily trading volume.

]]>You May Also Like

Hadron Labs Launches Bitcoin Summer on Neutron, Offering 5–10% BTC Yield

South Korea Launches First Won-Backed Stablecoin KRW1 on Avalanche