Moca Network Unveils MocaPortfolio With $20M in Token Allocations for MOCA and Mocaverse Holders

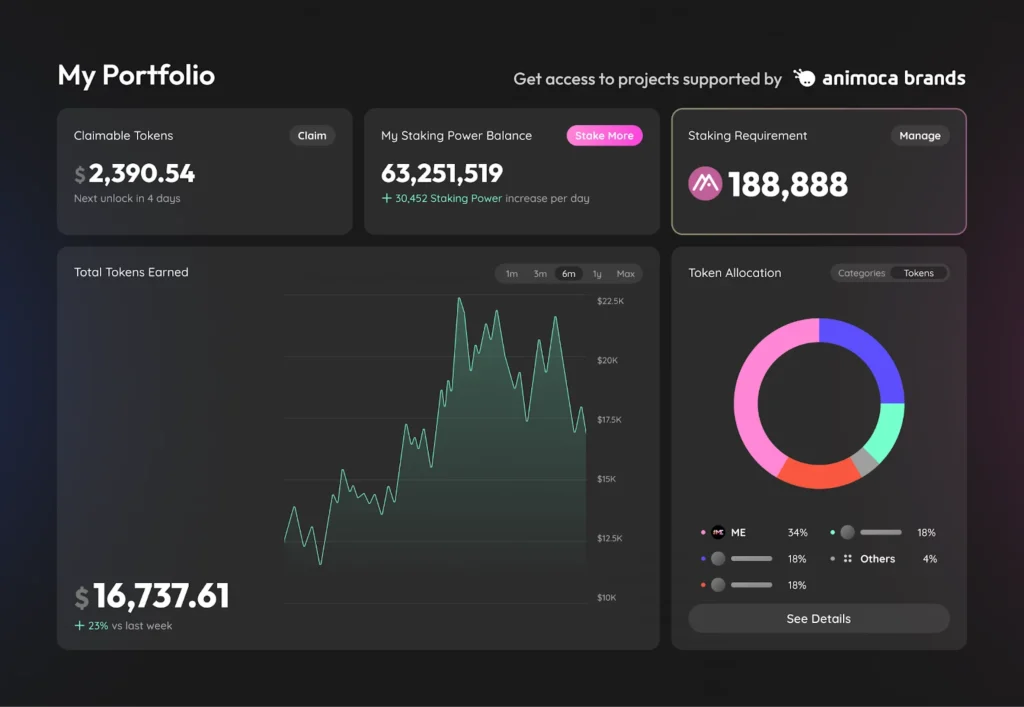

Moca Network, the Animoca Brands–backed project building a chain-agnostic decentralized digital identity ecosystem, today unveiled MocaPortfolio, a new program that will make approximately $20 million worth of token allocations available exclusively to MOCA Coin and Mocaverse NFT holders. The program, the team says, is designed to give the Moca community structured, ongoing exposure to projects across Animoca Brands’ wider portfolio.

It is a shift away from one-off airdrops toward a vesting-based participation model. Participants in MocaPortfolio will be eligible to receive token allocations from projects in Animoca Brands’ investment and partnership portfolio, subject to vesting terms, with the first registration event slated for Q4 2025 and centered on the Magic Eden token (ME). According to the announcement, further project token allocations will be revealed over time as the program rolls out.

Yat Siu, co-founder and executive chairman of Animoca Brands, said: “MocaPortfolio represents an evolution in how we reward and involve our community. Rather than focusing on singular airdrop events, we are offering an ongoing, structured opportunity to share in the growth of promising projects across the Web3 landscape. This approach reflects our commitment to value creation together with the Moca community.”

Kenneth Shek, project lead of Moca Network, said: “MocaPortfolio is about growing together with the projects in Animoca Brands’ portfolio, while empowering our community to build financial literacy and long-term value through active participation. MocaPortfolio serves as a new layer of value accrual for MOCA, complementing what’s to come with Moca Chain’s tokenomics and reinforcing our mission to build a sustainable digital identity ecosystem.”

New and existing community members can accumulate Staking Power by staking MOCA Coin and Mocaverse NFTs on the Mocaverse staking platform. Staking Power can then be burned at the start of the first registration event to claim eligibility in the ME registration, the company said. Mocaverse NFT stakers will enjoy additional benefits, including earning-rate boosts to Staking Power and other perks, intended to reward longer-term engagement.

Why it Matters

MocaPortfolio marks a deliberate pivot from the traditional, one-time airdrop model toward an ongoing, vested rewards framework that ties community incentives to the long-term fortunes of Animoca Brands’ portfolio projects. For MOCA holders, the program could mean recurring, structured access to token allocations rather than one-off windfalls, an arrangement the Moca team says is intended to foster financial literacy and encourage longer-term participation.

The first token in the pipeline, Magic Eden’s ME token, already has a public track record: the ME ecosystem token launched in December 2024 and has since been integrated into marketplace and staking experiences across Magic Eden’s cross-chain product suite. Animoca’s decision to include ME as the inaugural registration token links MocaPortfolio’s debut to an ecosystem token that many in the NFT community already recognize.

Moca Network is positioning itself as a privacy-preserving, chain-agnostic identity layer, offering tools for identity verification, reputation and interoperability across Web3 apps and traditional enterprises. As the identity ecosystem created by Animoca Brands, Moca Network is able to draw on a broad portfolio of Web3 investments and partners.

Animoca’s corporate materials describe the wider group as having over 570 portfolio companies and claim the potential to reach more than 700 million addressable users through integrations and partner platforms, a scale that Moca Network says it will tap into as it rolls out identity infrastructure and token utility. Here is what to watch next:

- Q4 2025 — First registration event for ME via MocaPortfolio (participants will burn Staking Power to gain eligibility).

- Future rounds — Animoca Brands says additional token allocations from its portfolio will be announced; MocaPortfolio is described as an ongoing conduit rather than a single campaign.

- Moca Chain developments — MocaPortfolio is explicitly positioned to complement Moca Chain’s forthcoming tokenomics and the broader identity infrastructure that the project is rolling out.

MocaPortfolio is Animoca Brands’ attempt to convert community loyalty and on-chain identity engagement into structured, vested upside across its investment portfolio. For MOCA Coin holders and Mocaverse NFT owners, the program promises a new, ongoing channel of participation, one that ties staking, utility and community membership to curated token allocations rather than isolated giveaways.

You May Also Like

FullProgramlarIndir.app | Download Free Full Programs (2026)

XRP at a Crucial Turning Point: Where Will It Go Next?