While “Bitcoin Tumbles Back to $110K Under Fed’s Powell’s Hawkish Comments,” Fed Policy Can’t Stop the Digitap ($TAP) Visa Card from Shipping

Bitcoin briefly dipped below $110K this week as Jerome Powell’s comments suggested that the Federal Reserve may delay interest rate cuts longer than expected. The move triggered caution across the crypto market, with major altcoins also pulling back.

Yet, while the macro narrative remains uncertain, Digitap ($TAP) continues to deliver concrete results. Its Visa card has officially begun shipping, and its presale has now surged by 114% since launch.

This is a clear indication that long-term investors seeking the best cryptocurrency to invest in are shifting their attention toward functional fintech tokens rather than speculative assets.

Powell’s Remarks Cool Market Momentum

Powell’s latest statement reinforced the idea that rates will stay higher for longer, cooling enthusiasm in both equities and digital assets. Bitcoin’s retreat to $110K reflected renewed caution among institutions after weeks of inflows through ETFs. Market liquidity remains tight, and traders are wary of overexposure to volatile assets until clearer signals emerge from the Fed.

The Federal Reserve’s stance is influencing both retail and institutional behavior. Traders are focusing on risk management, adjusting positions across Bitcoin and altcoins, prioritizing tokens with adoption. High volatility and macro uncertainty have increased the demand for assets with measurable transaction volume and repeat usage.

Liquidity flows also influence sentiment. Institutional participants prefer coins with deep markets and reliable trading volumes, which reduces the risk of large swings. Meanwhile, retail investors are closely tracking social sentiment, staking returns, and platform usability. This combination of macro awareness and practical evaluation shapes investment strategies.

Altcoins are showing mixed performance in this environment. While some speculative tokens are losing value rapidly, utility platforms are holding capital more effectively. Analysts are pointing to key adoption metrics, including active wallets, daily transactions, and integrated services.

Digitap’s Fundamentals Defy Market Momentum

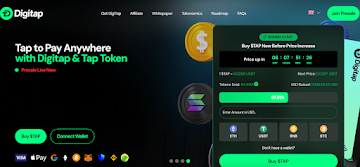

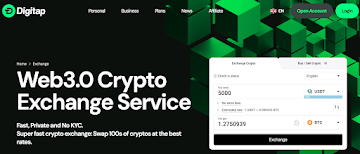

$TAP has remained stable throughout crypto downturns and Fed commentary, even launching its payments app and shipping its Visa-enabled card for users. The omni bank allows for international finance from a smartphone, with easy payments, global IBANs, invoicing, deposits, and withdrawals. The presale has exceeded $1.2 million in funding, selling more than 80 million tokens.

Currently priced at $0.0268, the next presale stage will increase the token price by 11% to $0.0297, following a 114% climb since the first round. The app, which is already available on both the Apple App Store and Google Play Store, enables users to hold both fiat and crypto balances, make payments, and stake assets for yields as high as 124% APY.

This mix of functionality makes Digitap different from speculative presales. The project has integrated stablecoin support alongside its Visa card rollout, bridging the gap between traditional and decentralized finance. Beyond payments, the app supports seamless transfers and multi-currency holdings, giving users practical daily options.

While Bitcoin and major coins struggle under macroeconomic pressure, Digitap is quietly establishing itself as a functioning financial ecosystem that combines liquidity, usability, and staking rewards for holders. Its price remains unaffected by macro commentary until it lists on a major exchange.

A Broader Shift Toward Utility-Driven Growth

The crypto market has seen this pattern before. When major assets stall, early capital flows to projects with real-world traction. Tokens that provide everyday usability — payments, savings, and spending — attract users even during bearish periods. Investors are increasingly looking at adoption metrics to identify tokens that are likely to retain their value.

Digitap’s combination of a live app, scalable tokenomics, and a no-KYC structure opens new adoption pathways, particularly in markets where traditional banking is restrictive. The project also supports stablecoins and staking, allowing users to earn while engaging with the platform.

With 50% of its profits directed toward $TAP burns and staking rewards, the token’s deflationary design strengthens its long-term value proposition. Even after its 114% increase, it remains at an 80% discount from its $0.14 launch price, making it an appealing entry for both retail and institutional participants.

This positions it among the few early-stage tokens that can grow independently of Bitcoin’s volatility. Investors looking for the best cryptocurrency to invest in are increasingly favoring projects that already demonstrate functionality. Digitap’s resilience during one of Bitcoin’s most volatile weeks shows that real adoption can offset macro weakness.

Why Real Products Outperform Hype

Bitcoin remains the benchmark, but its dominance over crypto sentiment is gradually weakening. Investors no longer chase only the top names. They search for credible, functioning ecosystems that can operate under any market condition. $TAP matches that profile.

While the Fed’s policy stance continues to weigh on speculative coins, tokens like $TAP, built for utility, may capture outsized market share. The Visa card launch shows that the project is executing its roadmap, not just promoting it.

Crypto’s next major winners will not be those that talk about disruption. It will be those who deploy, and Digitap has already done so. The app can be used today to pay at any store that accepts Visa, to send money internationally, or to manage a portfolio of assets.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

The post While “Bitcoin Tumbles Back to $110K Under Fed’s Powell’s Hawkish Comments,” Fed Policy Can’t Stop the Digitap ($TAP) Visa Card from Shipping appeared first on Live Bitcoin News.

You May Also Like

First Arrest Made in Hyderabad

Fed Decides On Interest Rates Today—Here’s What To Watch For