Best Crypto to Buy Now – Solana Price Prediction

Solana stands out as one of the top gainers this week as steady ETF inflows bring more institutional capital into the ecosystem.

The broader market still experiences sharp volatility, yet Solana continues to build strength. Network activity rises, developers stay active, and buyers show more interest each time new ETF products attract fresh liquidity.

This Solana price prediction update explains the key drivers behind SOL’s momentum and shows how rising ETF inflows tighten its supply.

While SOL continues to dominate the Layer-1 market, the capital entering through institutional channels is also rotating into infrastructure projects built for the future of crypto’s largest ecosystem, which is Bitcoin.

This is where Bitcoin Hyper (HYPER) enters the conversation. It ranks among the best cryptos to buy for high-alpha exposure because it bridges Bitcoin’s security with Solana’s speed in a single scalable network.

Source – Cilinix Crypto YouTube Channel

Solana Price Prediction

Solana has spent several weeks moving inside a clear consolidation zone between $144 and $126, a range that began in mid-November. Two days ago, SOL was firmly testing $139, but weakness took over.

A brief push above the key resistance at $144, the one and a half year point of control, turned into a classic fakeout. Price dropped back below the level almost immediately, confirming a more bearish short-term tone and reaffirming the $144 ceiling.

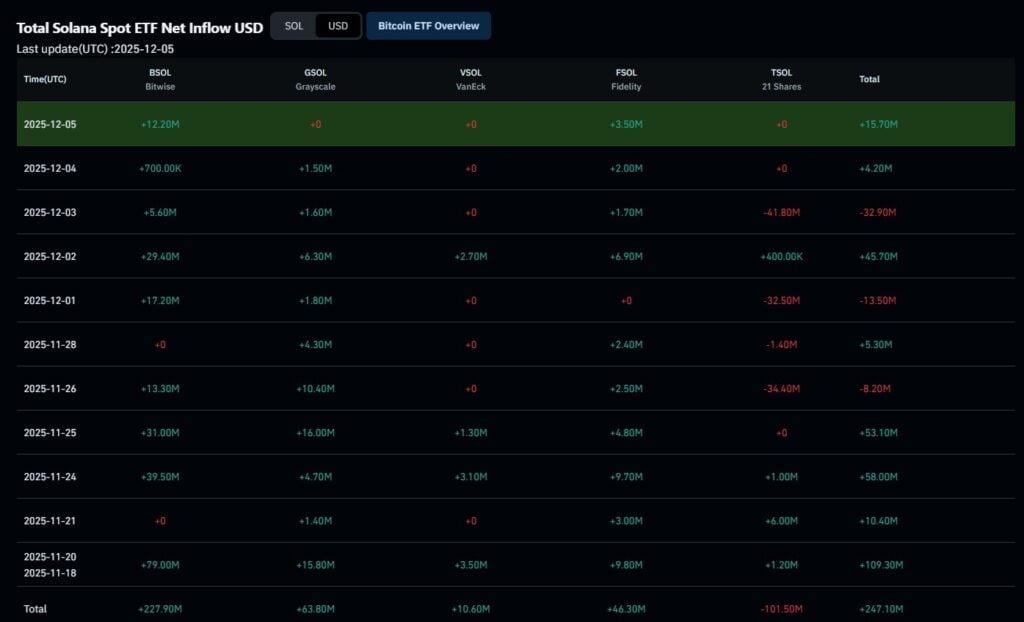

A sustained range like this often continues until major new information enters the market. Last week brought a minor boost from the Solana ETF, which recorded inflows on Tuesday, Thursday, and Friday.

However, with total inflows of roughly $65 million and outflows of roughly $45 million, the net inflow of about $15 million shows interest but not enough strength to break a months-long consolidation by itself.

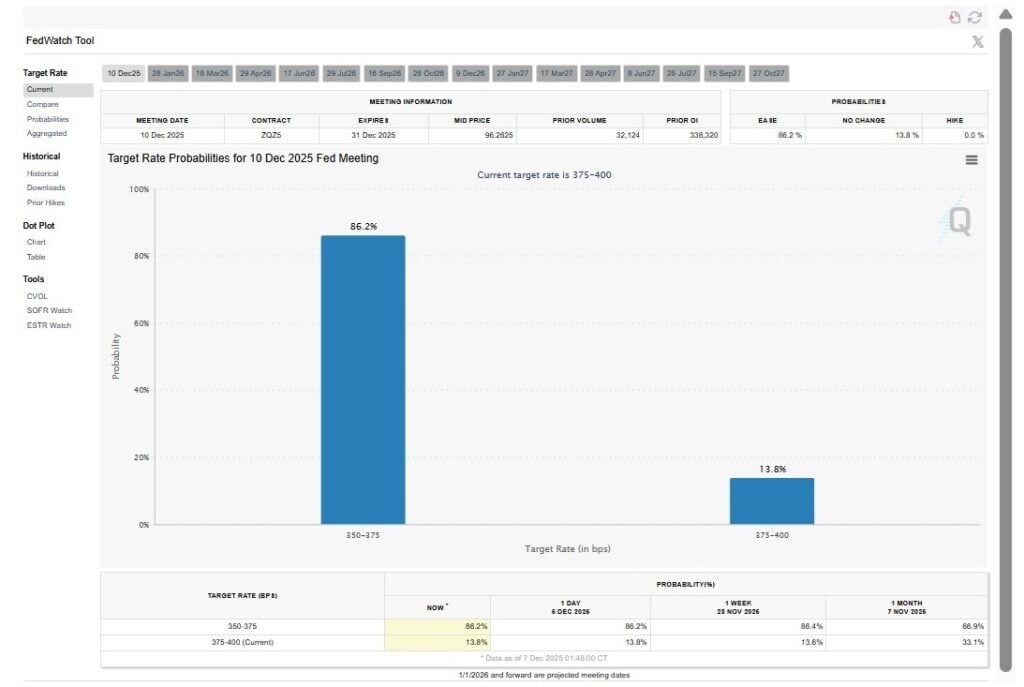

The major volatility catalyst arrives this Wednesday with the interest rate decision. The market currently expects a rate cut with an 86% probability, leaving 14% uncertainty that is enough to push traders to de-risk ahead of the announcement.

This macro pressure suggests that while the $126 to $144 range will likely hold, traders should prepare for a quick move lower before any recovery.

The most probable short-term scenario includes a dip into support near $126 and the trend line around $129, followed by a strong reaction upward and a move back toward the mid-range.

A clean reclaim of $129 would show firm buyer conviction and could drive price toward the $138 to $139 value area.

This setup does not justify a short position. Instead, it highlights the dip as a potential long opportunity, especially since Bitcoin and Ethereum charts also hint at a deeper flush before a broader recovery.

Solana Integration Boosts Bitcoin Hyper Presale Past $29 Million

The crypto market has cooled over the last few days after a strong rebound earlier in the week, but Bitcoin Hyper keeps gaining momentum. More money flows in every day, and several analysts now expect the kind of growth that usually appears only a few times in a full market cycle.

No one can say for sure whether Bitcoin Hyper will reach those expectations, but the mix of rapid presale growth and a clear real-world use case already makes $HYPER one of the most interesting projects on the market.

The presale continues to impress. It has raised around $29 million so far, putting it among the strongest ICOs of the year. Whales joined early as well, with several six-figure buys showing strong confidence in the project.

Bitcoin Hyper aims to keep Bitcoin’s well-known security while solving the network’s biggest limits. It runs on the Solana Virtual Machine (SVM), giving it Solana-level speed and full smart contract support.

The SVM also lets the network connect easily with Solana, allowing developers to move apps over with only a few lines of code. This creates a clear path for a highly active ecosystem.

If Bitcoin continues to recover in the coming weeks, $HYPER could emerge as one of the standout performers in the market. Prominent YouTuber Borch Crypto even said Bitcoin Hyper could be the best crypto to buy now.

Another key advantage is the staking system. Holders can already stake during the presale and earn up to 40% APY while also gaining exposure to any price growth.

Visit Bitcoin Hyper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

Ayrıca Şunları da Beğenebilirsiniz

Historic Debut: U.S. Sees Launch of Spot ETFs for DOGE and XRP

Now You Don’t’ New On Streaming This Week, Report Says