3 Bank CEOs to Meet US Senators for Crypto Regulation Talks as Bitcoin Hangs at $90K

Citigroup CEO Jane Fraser, Bank of America CEO Brian Moynihan and Wells Fargo CEO Charlie Scharf are scheduled to meet senators on Thursday for a closed-door discussion on crypto market structure legislation.

Punchbowl News’ The Vault team, which tracks financial policy in Washington, circulated details of the invitation in an X post on Monday. He described the imminent meeting as part of a broader effort for banks, regulators, lawmakers and key stakeholders to deliberate on ongoing regulatory proposals.

On Sunday, Semafor congressional reporter Eleanor Mueller mentioned that the provision for the United States government to launch a Central Bank Digital Currency (CBDC) is no longer in the draft, while responding to the new NDAA package deal published by Politico defense reporter Connor O’Brien.

The absence of the CBDC ban adds further relevance to Thursday’s session, with senators expected to press bank leaders on how traditional financial institutions intend to navigate a regulatory landscape that remains unsettled.

The US enacted landmark GENIUS act in July 2025, creating a framework for stablecoin regulations in the country. However, lawmakers continue to debate how banks should handle digital-asset custody, the supervision of stablecoin reserves and the role the Federal Reserve should play in tokenized-market infrastructure.

Bitcoin Holds $90K as Traders Await Regulatory Clarity

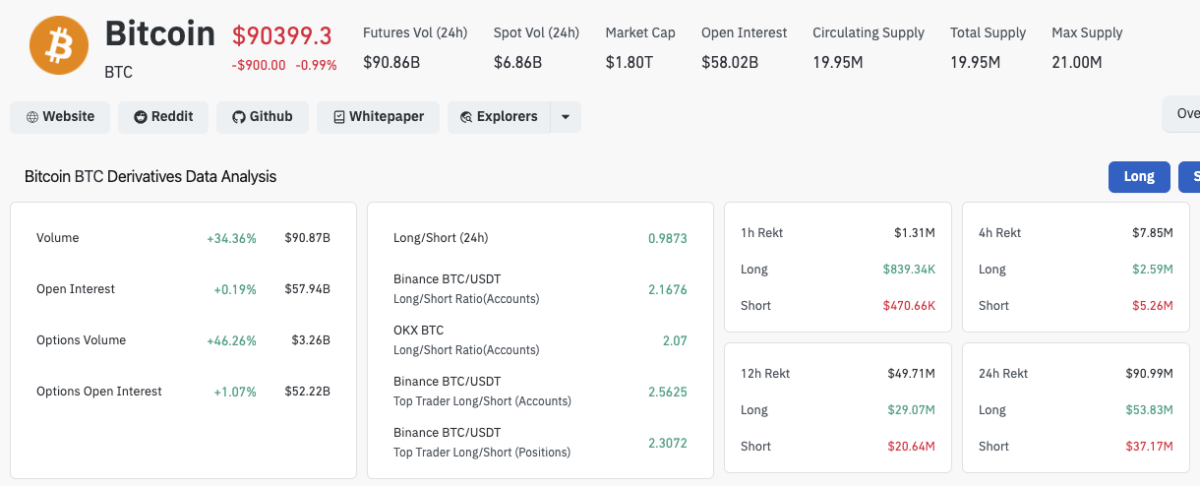

Bitcoin BTC $91 107 24h volatility: 0.6% Market cap: $1.82 T Vol. 24h: $48.40 B held near $90,000 as the policy backdrop developed. Coinglass data shows futures volumes rising 34.36 percent to $90.87 billion while open interest increased just 0.19 percent to $57.94 billion. The long-short ratio eased to 0.9873, reflecting a slight tilt toward short exposure.

Bitcoin (BTC) Derivatives Market Analysis | Source: Coinglass

The imbalance between volume spike and mild increase in open interest indicates that most activity came from intraday rotations rather than conviction-driven positioning, suggesting traders prefer to await clarity from Washington as the week unfolds before placing larger directional bets.

Crypto Traders on Alert As Maxi Doge Presale Approaches $4.5M

Maxi Doge is a meme-based leverage trading ecosystem that combines social entertainment with aggressive yield potential.

The Maxi Doge presale has now exceeded $4.2 million, nearing its $4.5 million target. The project, offering up to 1000x leverage with no stop-loss restrictions. Each MAXI token is currently priced at $0.00027, with the next pricing tier expected to unlock within hours.

Maxi Doge presale

Interested buyers can visit the official Maxi Doge presale website to secure early allocation and access exclusive early-joiner bonuses.

nextThe post 3 Bank CEOs to Meet US Senators for Crypto Regulation Talks as Bitcoin Hangs at $90K appeared first on Coinspeaker.

Ayrıca Şunları da Beğenebilirsiniz

Zero Knowledge Proof’s 200M Daily Presale Auction Is Driving The Rush, While ZCash and Hedera Look Lost

U.S. Court Finds Pastor Found Guilty in $3M Crypto Scam