Did One Entity Kill PEPE’s Fair Launch? Bubblemaps Flags 30% Genesis Hoard, $2M Dump

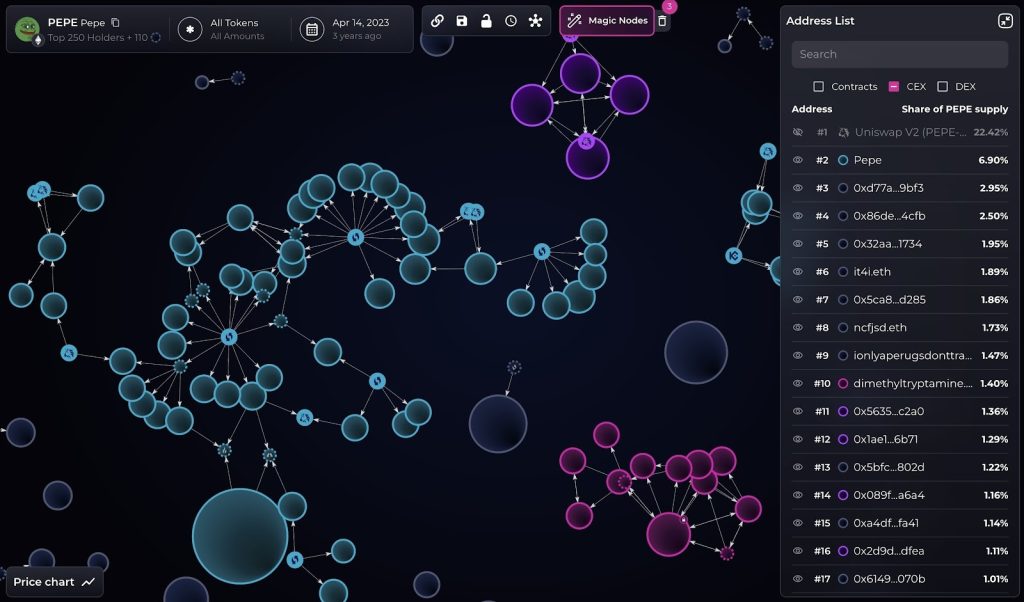

New blockchain analysis is raising questions about the long-promoted “fair launch” of the PEPE meme coin, after fresh data suggested that almost one-third of the token’s initial supply may have been controlled by a single entity.

The findings come from blockchain visualization platform Bubblemaps, which published its latest breakdown on Wednesday, alleging that the project’s early messaging may have misled investors.

Bubblemaps Flags Concentrated PEPE Holdings at Launch

According to the data, roughly 30% of PEPE’s genesis supply was bundled into a cluster of wallets connected to one entity at the time of the token’s April 2023 launch.

Bubblemaps said this concentration contradicts PEPE’s branding as a token created “for the people” and its stated approach of launching in stealth with no presale allocations.

Source: Bubblemaps

Source: Bubblemaps

The firm added that the same cluster sold about $2 million worth of tokens just one day after launch. The move, it believes, added enough early sell pressure to prevent the meme coin from crossing the $12 billion market-cap threshold during its first major surge.

The claims surfaced during a difficult period for the token. PEPE’s price dropped 5.7% in the past 24 hours and is down more than 81% over the past year, according to CoinMarketCap.

The project also dealt with an unrelated security scare last December, when its website was briefly compromised and redirected users to a malicious “inferno drainer,” a tool associated with wallet theft, phishing, and other social-engineering scams.

Still, PEPE’s performance has not been uniformly negative. The token has delivered dramatic rallies at various points over the last two months.

On October 8, PEPE also outperformed the broader meme coin market amid a wave of accumulation from large holders.

Data from Nansen showed that the top 100 wallets increased their collective holdings by 4.18% over a month, bringing their total to more than 307 trillion tokens.

Analysts at the time pointed to a bullish pennant formation and noted that PEPE was testing a historically strong demand zone, fueling speculation of an impending breakout.

On October 25, it rebounded 156% from a weekly low, attracting dip buyers and putting short sellers under pressure as trading volumes pushed toward $1 billion.

Bubblemaps Identifies Large-Scale Wallet Coordination Across Major Meme Tokens

The new Bubblemaps findings are part of a broader series of investigations by the firm into hidden accumulation patterns, insider launches, and potential manipulation across the meme coin sector.

Its “Time Travel” analytics tool, introduced in May, reconstructs historical token distributions to highlight wallets that may have coordinated holdings ahead of launch.

The goal, according to the firm, is to help traders detect risks such as rug pulls, concentrated supply, and rapid liquidity removal.

Bubblemaps has already been involved in uncovering questionable activity behind several high-profile meme tokens this year.

In February, the company linked the MELANIA and LIBRA tokens to the same wallet, alleging that the entity behind the launches had used insider tactics to snipe early liquidity and extract millions in profits before both tokens collapsed.

LIBRA’s implosion triggered political fallout in Argentina after insiders allegedly withdrew more than $100 million, causing the token to lose nearly all its value within hours.

Similar patterns have emerged in other cases. Investigators reported that more than 70% of Kanye West’s YZY token holders suffered losses shortly after its launch, while 11 wallets captured nearly a third of all profits.

Bubblemaps also raised alarms in September about what it described as one of the largest Sybil attacks ever recorded, linking around 100 wallets to a coordinated effort that claimed $170 million worth of MYX airdrop tokens.

And in early December, the firm tied over 1,000 wallets to a single actor who allegedly captured most of the WET token presale on Solana within seconds.

Ayrıca Şunları da Beğenebilirsiniz

Now You Don’t’ New On Streaming This Week, Report Says

Pakistan’s Bitcoin Pivot Sparks Momentum for DeepSnitch AI, Up 80% In Presale