Stablecoins Are Quietly Winning Real-World Adoption. YouTube Just Showed Why.

The post Stablecoins Are Quietly Winning Real-World Adoption. YouTube Just Showed Why. appeared first on Coinpedia Fintech News

YouTube’s recent move highlights a bigger trend: mainstream platforms are choosing stablecoins, not Bitcoin or Ethereum, for real-world payments. When money actually needs to move, volatility isn’t an option—speed and predictability are. Stablecoins, which were once backend tools for traders, now process trillions and increasingly power creator payouts, gig work and cross-border commerce. YouTube isn’t the story; it’s the latest signal that stablecoins are becoming crypto’s first true mass-market utility.

YouTube’s New Payout Option Signals a Bigger Shift

As per the latest reports, YouTube has introduced stablecoin payouts—allowing U.S. creators to receive revenue in PayPal’s PYUSD via PayPal’s rails. This update is seen as a headline-worthy update this week. But the story isn’t really about YouTube. It’s about a macro trend hiding in plain sight: the largest platforms are integrating stablecoins, not Bitcoin or Ethereum, into their payment infrastructure.

And that’s not a coincidence. Functionally, stablecoins solve problems BTC and ETH were never designed to fix: volatility, settlement speed, and global accessibility. YouTube is simply the latest proof.

Stablecoins Process More Value Than Most Blockchains Combined

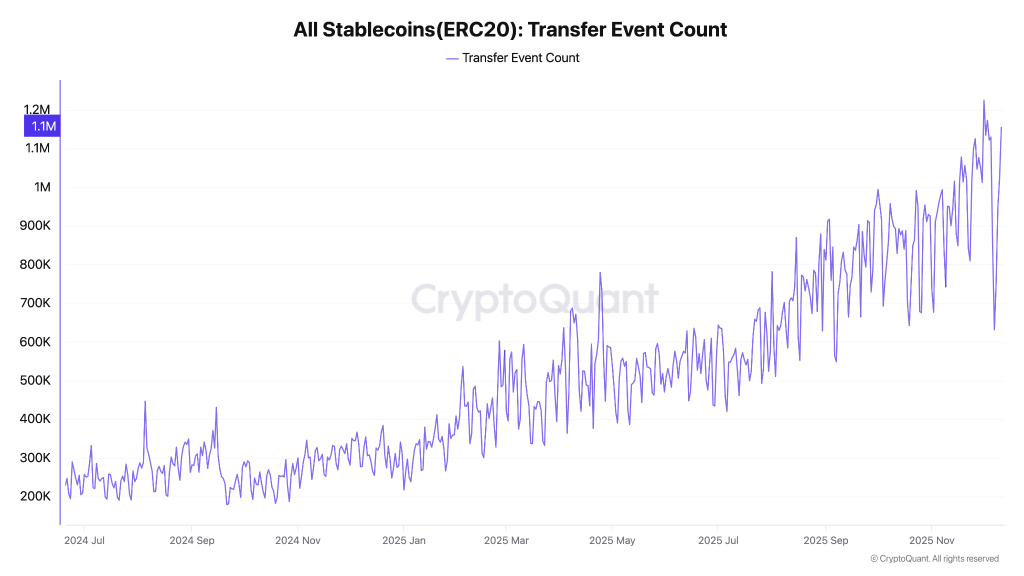

Stablecoins have become the dominant form of on-chain money movement. The market cap of stablecoins has seen a drastic rise since Q4 2024, elevating the levels from around $170 billion to as high as $308 billion. At the same time, the event of a non-zero transfer of Stablecoin has been maintaining a steep ascending trend, reaching levels over a million per day.

Alongside, over $8.9 trillion in stablecoin volume flowed across blockchains in the first half of 2025 — already outpacing many traditional settlement networks. Stablecoins accounted for around 30% of all crypto transaction volume between January and July 2025, according to TRM Labs. This isn’t speculation-driven liquidity—it’s transactional liquidity. And that distinction explains why large companies are choosing tokens like USDC and PYUSD as settlement tools.

Global Payments Networks Are Quietly Going On-Chain

The US GENIUS Act has been one of the major bullish factors for stablecoins, strengthening them and bringing them under regulation. Visa and Mastercard, two of the world’s largest payment networks, have both moved aggressively toward stablecoin integrations.

- Visa has launched stablecoin payout pilots targeting creators, gig workers, and freelancers—the same user demographic YouTube serves.

- Mastercard is building stablecoin rails into its Global Dollar Network, enabling cross-border settlement using USDC and PYUSD.

- OKX recently enabled USDC and USDT payments at GrabPay merchants in Singapore, bringing stablecoins to everyday retail.

What crypto exchanges did for traders, these companies are now doing for mainstream users. On the other hand, the corporations and the institutions are also preparing for a major shift. A JPMorgan note estimates stablecoins could generate $1.4 trillion in new USD demand by 2027, largely driven by global settlement and treasury flows. An EY-Parthenon survey shows 54% of corporates expect to adopt stablecoins within 6–12 months for cross-border payouts and treasury management.

Bitcoin Stores Value, Stablecoins Move It

Bitcoin may store value, and Ethereum may enable innovation, but neither is built for everyday payments. Stablecoins are. They’re becoming the settlement layer for creators, businesses and institutions that need instant, borderless dollars without price swings. YouTube adopting PYUSD is one more data point in a structural shift: stablecoins are quietly becoming the rails of global money movement. The next phase of crypto adoption won’t be led by price action—it will be led by stablecoins powering real economic activity behind the scenes.

Ayrıca Şunları da Beğenebilirsiniz

Historic Debut: U.S. Sees Launch of Spot ETFs for DOGE and XRP

Now You Don’t’ New On Streaming This Week, Report Says